Blue Chip Stocks In Focus: Illinois Tool Works

When filtering through our coverage universe to compile a list of blue chip stocks, our key condition was that the set would be comprised of those companies that featured at least 10 consecutive years of dividend hikes.

Of course, some companies exhibit different qualities than others. One company that stands out among the 350+ blue chip stocks we have gathered is Illinois Tool Works (ITW). This is due to its outstanding dividend growth track record, which spans nearly six decades.

Specifically, Illinois Tool Works has grown that dividend for a phenomenal 58 consecutive years. Therefore, besides classifying Illinois Tool Works as a blue chip stock, the company is also a constituent of the Dividend Kings. That group includes all companies with at least 50 years of consecutive dividend increases.

It’s also worth noting that while we have identified 45 companies that we categorize as Dividend Kings, only 14 other companies feature a similar or longer dividend growth track record. This demonstrates Illinois Tool Works’ proven ability to grow its dividend even in the harshest market environments.

This installment of the 2022 Blue Chip Stocks In Focus series will analyze Illinois Tool Works in greater detail.

Business Overview

Illinois Tool Works is a diversified multi-industrial manufacturer with seven unique operating segments: Automotive, Food Equipment, Test & Measurement, Welding, Polymers & Fluids, Construction Products, and Specialty Products.

Last year the company generated $14.5 billion in revenue. The $65.8 billion market cap company is geographically diversified, with more than half of its revenue generated outside of the United States.

Illinois Tool Works is a member of the Dividend Aristocrats Index and is a Dividend King.

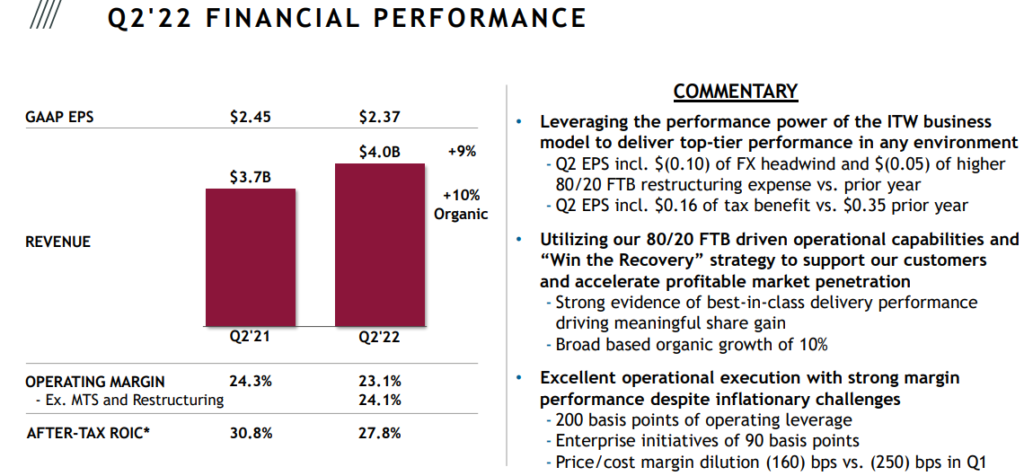

Early in August, Illinois Tool Works reported its second quarter 2022 results for the period ending June 30th, 2022. For the quarter, revenue came in at $4.0 billion, up 9% year-over-year. Sales were up 1% in the Automotive OEM segment, the largest out of the company’s seven segments.

(Click on image to enlarge)

Source: Investor Presentation

However, the Food Equipment, Test & Measurement, Welding, Polymers & Fluids, and Construction Products segments grew sales by 20%, 15%,21%, 7%, and 9%, boosting the company’s top line. Only Specialty Products’ sales declined by 5%.

Net income equaled $738 million or $2.37 per share compared to $775 million or $2.45 per share in Q2 2021. Illinois Tool Works also reiterated its 2022 earnings guidance and sees a record $9.00 to $9.40 in earnings-per-share for the full year.

Simultaneously, the company expects organic revenue growth of 7% to 10% and also plans to repurchase $1.5 billion of its own shares through fiscal 2022.

Growth Prospects

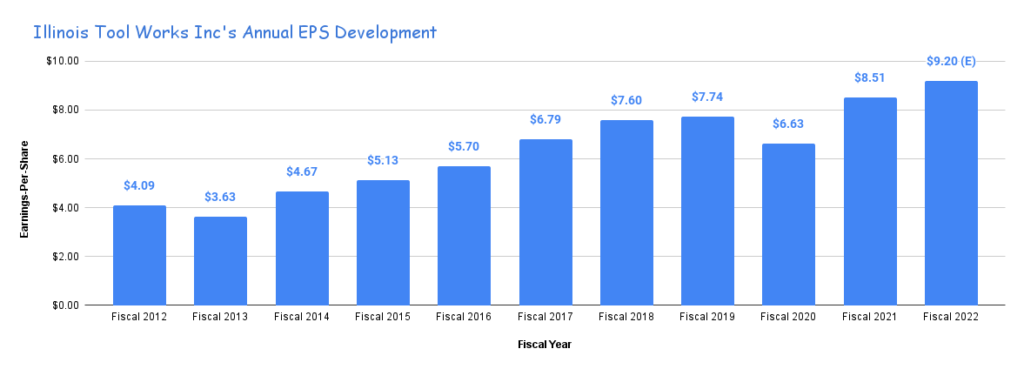

Over the past decade, Illinois Tool Works has increased its earnings-per-share by an average compound rate of roughly 9% per year. While there was cyclicality during the last recession, including a -40% drop in earnings from 2007 to 2009, generally, the company has exhibited consistent progress.

In the past, Illinois Tool Works was able to grow via mild top-line growth that was aided greatly by margin expansion and continuous share repurchases. Results for 2020 dipped -by 14% amid the pandemic but bounced back materially in 2021. Moving forward, growth becomes a bit more difficult as the company gets larger. Still, the balance sheet is in good health, permitting some flexibility from a capital allocation standpoint.

Further, attractive returns can be accomplished without venturing outside Illinois Tool Works’ existing core competencies. Illinois Tool Works can continue to invest in its sales networks, R&D, and production capacity, and the company’s cost-cutting efforts could continue to buoy margins.

(Click on image to enlarge)

Source: SEC filings, Author

In our estimates, we are employing the midpoint of management’s guidance, $9.20, along with a 7% expected annual growth rate over the intermediate term.

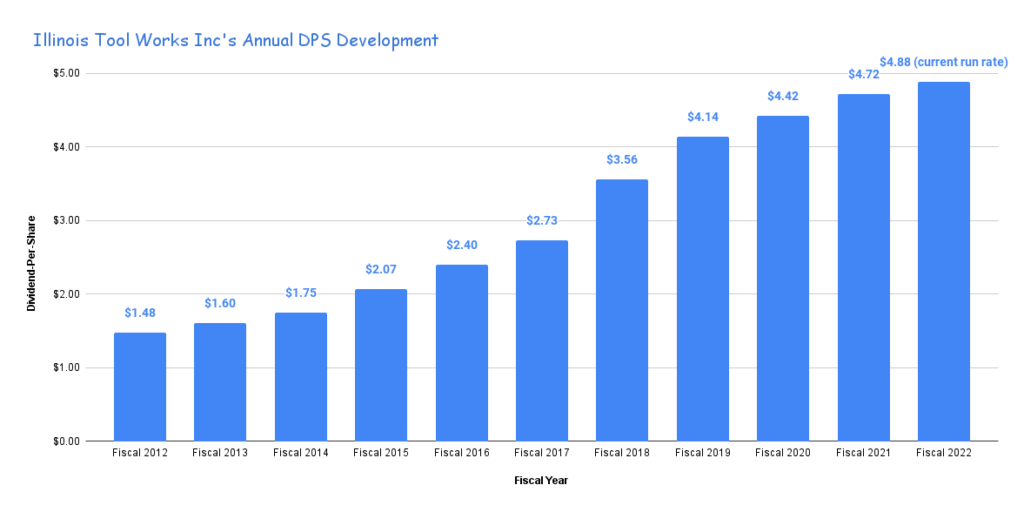

The dividend-per-share has grown by an average compound annual rate of roughly 13%. The latest dividend increase was by 7% to a quarterly rate of $1.22.

(Click on image to enlarge)

Source: SEC filings, Author

Competitive Advantages & Recession Performance

Illinois Tool Works has an excellent dividend growth history. Its payout ratio was relatively high during the last financial crisis, but the company was not forced to cut the payout. Today the dividend payout ratio sits at 53% of expected earnings, above the company’s long-term target, meaning that future dividend growth may trail earnings growth.

Illinois Tool Works’ industry is not glamorous or one with outstanding growth rates, but the company has established itself as a major player that continues to grow profitably. Its experienced management and strong fundamentals, such as an above-average return on capital, function as competitive advantages.

You can see a rundown of Illinois Tool Works earnings-per-share from 2007 to 2011 below:

- 2007 earnings-per-share of $3.31

- 2008 earnings-per-share of $2.26

- 2009 earnings-per-share of $1.94

- 2010 earnings-per-share of $2.90

- 2011 earnings-per-share of $3.61

Thus, despite profitability temporarily suffering during the Great Recession, it quickly rebounded. The company’s bottom line was tested in 2020 as well, as previously mentioned, but also recovered rapidly.

Valuation & Expected Returns

Over the past decade, shares of Illinois Tool Works have traded hands with an average P/E ratio of about 20 times earnings. We believe that a P/E ratio of 19 is a fair starting point, considering the quality of the business and growth prospects. With shares currently trading near 23 times the midpoint of management’s guidance, this implies the potential for a valuation headwind.

If the price-to-earnings multiple expands from 22.8 to 19, future returns would be weighted down by 3.6% per year over the next five years. Combined with our EPS & DPS growth rates, as well as the current dividend yield, we project annualized returns could amount to 5.4% through 2027.

Accordingly, we rate Illinois Tool Works a hold.

Final Thoughts

Illinois Tool Works has several admirable features, including remarkable earnings and dividend growth track records, among other qualities.

Total return potential comes in at just 5.4% per year, as returns stemmed from a 7% earnings growth, and the 2.3% dividend yield could be offset by the possibility of a valuation headwind.

We are enthused about the business, but we are less keen on the valuation. Shares earn a hold rating.

More By This Author:

Blue Chip Stocks In Focus: Johnson & Johnson

Blue Chip Stocks In Focus: Medtronic plc

Blue Chip Stocks In Focus: Cincinnati Financial Corp.