Blue Chip Stocks In Focus: Medtronic Plc

Often, when scanning lists of stocks with great dividend longevity, one will find healthcare companies feature heavily. In general, healthcare companies offer inherent defensiveness, and therefore earnings stability, a combination that makes for the capability to be a great dividend stock. Healthcare companies tend to be more recession-resilient than many other sectors simply because the goods and services they sell are non-discretionary. This means they can weather economic stores more so than consumer discretionary companies.

One such company is Medtronic plc (MDT), which offers investors a staggering 45-year streak of consecutive dividend increases. Medtronic is one of more than 350 companies on the list of Blue Chip stocks, which are companies with at least 10 consecutive years of dividend raises. We see this list as a good starting point for finding great dividend stocks because these companies have proven their ability to stand the test of time when it comes to dividend longevity.

We see such stocks that satisfy the 10-year payout growth streak criterion among the safest dividend stocks that investors can buy, with built-in recession resistance, and management teams that are willing and able to return capital to shareholders.

This installment of the 2022 Blue Chip Stocks In Focus series will analyze Medtronic in more detail.

Business Overview

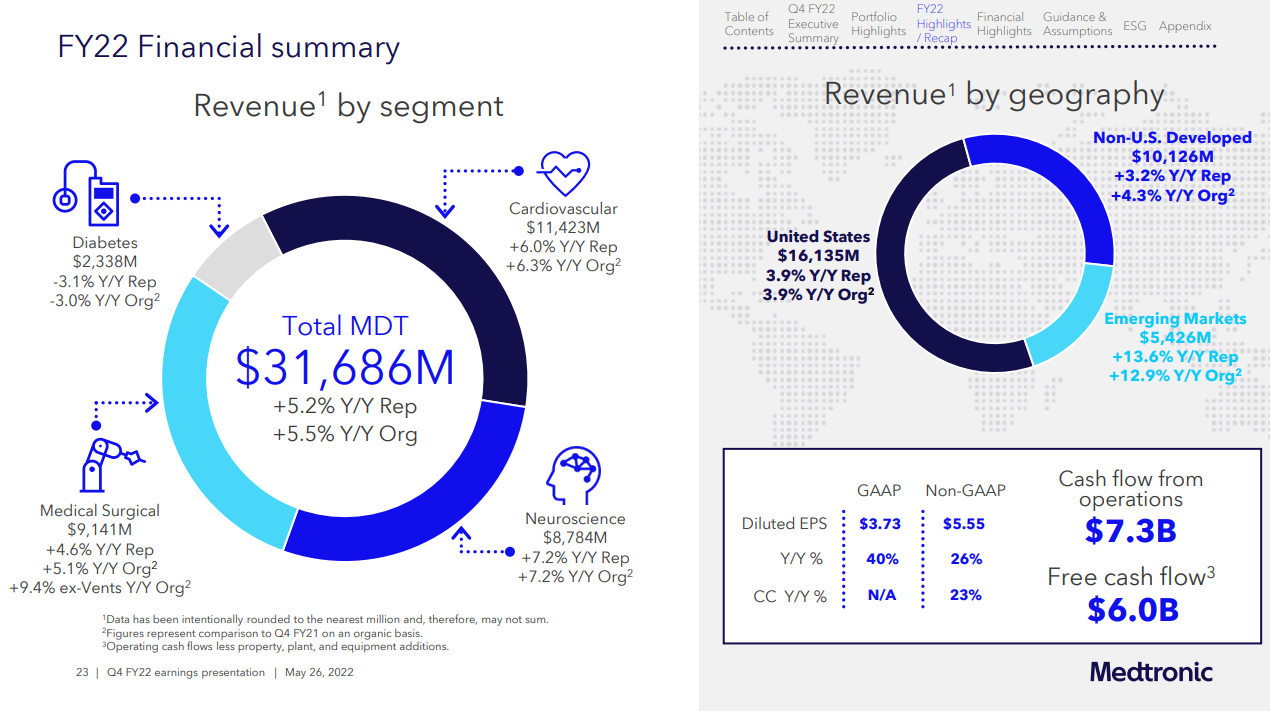

Medtronic is a medical therapies company that operates in four segments and sells its products globally. The Cardiovascular Portfolio offers implantable pacemakers, defibrillators, monitoring systems, valves, and related products. The Medical Surgical Portfolio offers stapling devices, sealing instruments, robotic-assisted surgery products, mesh implants, and more. The Neuroscience Portfolio sells surgical products to a variety of practitioners, including spinal surgeons neurosurgeons, neurologists, pain management specialists. This segment produces robotic guidance systems as well. Finally, the Diabetes Operating Unit sells insulin pumps and consumables, glucose monitoring systems, and related products.

Medtronic was founded in 1949, employs about 95,000 people globally, generates $32 billion in annual revenue, and trades with a market cap of $124 billion.

Medtronic reported fourth quarter and full-year earnings on May 26th, 2022, and results were weaker than expected. Adjusted earnings-per-share for the quarter came to $1.52, which was four cents light against expectations. Revenue was off fractionally year-over-year at $8.09 billion and missed estimates by $340 million.

The company reported a $215 million headwind from forex translation during the quarter, as well as what it called temporary supply chain issues, particularly in China.

US revenue was down 2% year-over-year and was 51% of total revenue in the quarter. Emerging Markets revenue was up 7%, but was just 17% of total revenue.

Medical Surgical revenue was off 5%, while Surgical Innovations revenue was down 3%, on supply chain constraints. Diabetes revenue was down 8% year-over-year, including a 20%+ decline in the US on lack of new product approvals. Cardiovascular revenue was up 2%, while Neuroscience was essentially unchanged.

Source: Q4 earnings presentation, page 23

Full-year earnings were up 26% on an adjusted basis at $5.55, as revenue for the year rose just over 5%. The company’s Diabetes segment stood out as the weakest business, but the other three were able to grow decently and bring the company’s top line – and earnings – higher for the full year.

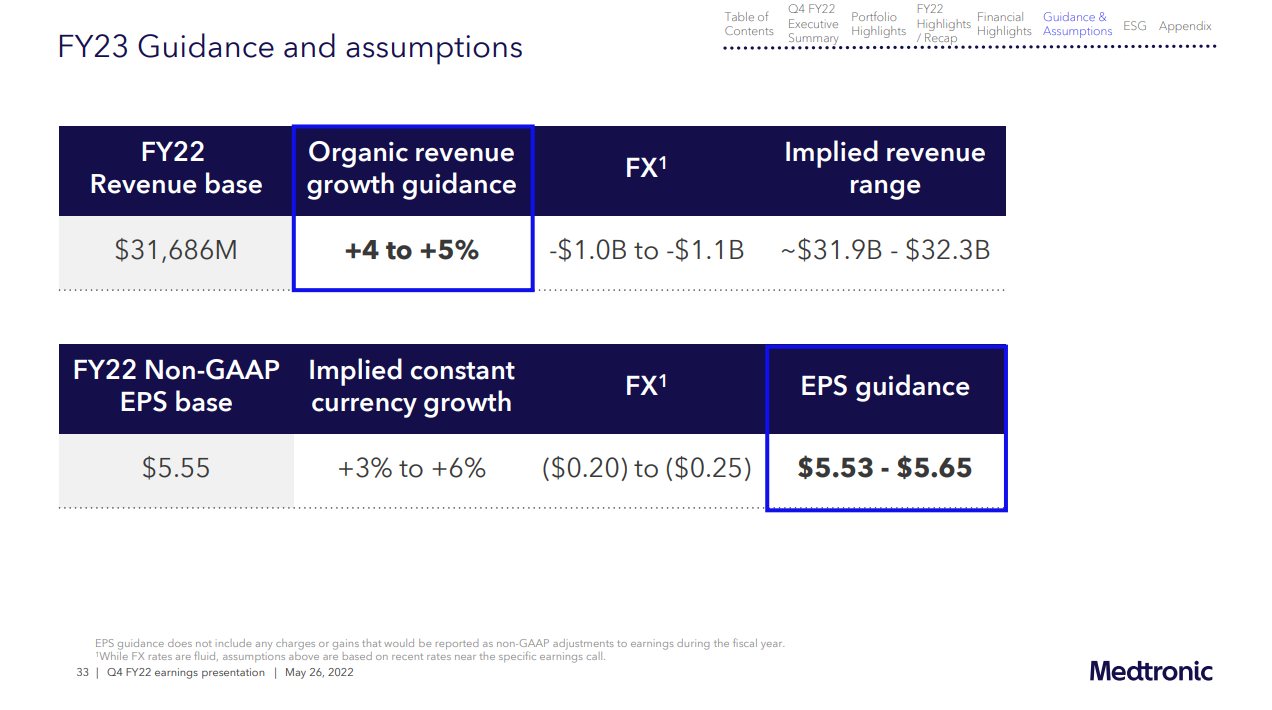

Source: Q4 earnings presentation, page 33

Medtronic offered up guidance of organic revenue growth of between 4% and 5%, and adjusted earnings-per-share of $5.53 to $5.65 for fiscal 2023. That was below consensus earnings estimates of $5.75, and would represent very modest growth year-over-year should it come to fruition. Our initial estimate is for $5.60 in fiscal 2023 earnings-per-share.

Growth Prospects

Medtronic’s average earnings-per-share growth in the past decade has been just 4%, including some years with earnings declines. In addition to some volatility in the company’s revenue and earnings, it has issued a huge number of new shares in the past decade to fund acquisitions. That dilution makes it more challenging to grow on a per-share basis, and Medtronic’s results have suffered for it.

Looking forward, we expect to see 6% annual earnings-per-share growth off of 2023 earnings estimates, which we believe will be driven primarily by revenue gains in the mid-single digits. The company makes sizable acquisitions from time to time, which adds to the top line. In addition, it is buying back a small number of shares, so the combination of these factors could lead to ~6% earnings-per-share growth over time.

Dividend growth has been more than double that of earnings growth, with the former averaging a 10% annual gain in the past decade.

Because the dividend has outpaced earnings in terms of growth, the payout ratio has risen significantly, rising from less than 30% of earnings a decade ago to almost 50% today. We see more measured dividend growth going forward as a result, but also believe the company will remain a strong dividend stock for years to come.

Competitive Advantages & Recession Performance

Medtronic’s competitive advantage is its wide and deep portfolio of intellectual property. Given there are many medical device and supply makers, Medtronic must stand out with its unique applications, with products such as its robotic surgery aids. The company has a very long history of remaining competitive through technological changes, and we don’t believe that is at risk in any way.

Medtronic has some components of its portfolio that are discretionary, but on the whole, its portfolio should continue to stand up well to recessions. With the payout ratio at less than 50%, we don’t see any meaningful risk to the dividend in the years to come.

Valuation & Expected Returns

Shares have traded in a valuation range of between 11 and 24 times earnings in the past decade, and we assess fair value in the middle of that range at 17. The stock is essentially in line with fair value today, going for 16.7 times our 2023 earnings estimate, so we see virtually no impact to total returns from the valuation.

We noted 6% expected growth above, and the current dividend yield is 2.9%, which is about double that of the S&P 500. All told, between the valuation, expected growth, and the current yield, we expect 9% total annual returns in the years to come, which is good enough for a solid hold rating on the stock.

Final Thoughts

While Medtronic has faced years where it has struggled to grow earnings in the past, it also sports a nearly half-century streak of raising the dividend. We believe the dividend will be raised indefinitely, and that the stock’s earnings prospects are good.

The yield is about twice that of the broader market, and shareholders get 9% estimated total annual returns, so we rate the stock a hold for income-focused investors, and those looking for dividend growth.

More By This Author:

Blue Chip Stocks In Focus: Cincinnati Financial Corp.Warren Buffett Stocks: T-Mobile US Inc.

Blue Chip Stocks In Focus: MDU Resources Group