Blue Chip Stocks In Focus: Cincinnati Financial Corp.

There is no exact definition for blue chip stocks. We define it as a stock with at least 10 consecutive years of dividend increases. We believe an established track record of annual dividend increases going back at least a decade, shows a company’s ability to generate steady growth and raise its dividend, even in a recession.

As a result, we feel that blue chip stocks are among the safest dividend stocks that investors can buy.

This installment of the 2022 Blue Chip Stocks in Focus series will analyze the property & casualty insurance company Cincinnati Financial Corp. (CINF) in greater detail.

Business Overview

Cincinnati Financial is an insurance company founded in 1950. It offers business, home, and auto insurance, as well as financial products including life insurance, annuities, and property and casualty insurance.

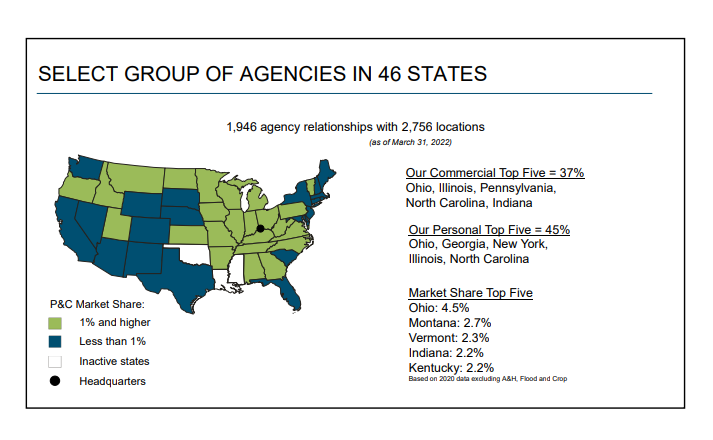

The company has operations in 46 states. The company also has more than 1,945 agency relationships with 2,756 locations as of March 31st, 2022.

Source: Investor Presentation

As an insurance company, Cincinnati Financial makes money in two ways. It earns income from premiums on policies written, and also by investing its float, the large sum of premium income not paid out in claims.

On July 27th, 2022, Cincinnati Financial reported second-quarter earnings. Total revenues were $820 million for the quarter compared to $2,295 million in 2Q 2021, a 64% year-over-year decrease.

Earned premiums were up 11% year-over-year. CINF generated a net income loss of $(808) million, or $(5.06) per share, compared to a profit of $703 million, or $4.31 per share, in the second quarter of 2021. The loss was primarily due to recognizing a $1.32 billion decrease in net investment gains.

On a non-GAAP operating income basis, the company made $100 million for the quarter, still down 64% compared to the second quarter of 2021. For the quarter, non-GAAP operating income was $0.65, down from $1.79 in the prior-year quarter.

The company book value decreased 9% year-over-year to $66.30.

We estimate earnings-per-share for 2022 to be $4.74.

Growth Prospects

Cincinnati Financial has a successful history of growing profits through new policies written, outperforming the industry benchmark, and taking market share as a result.

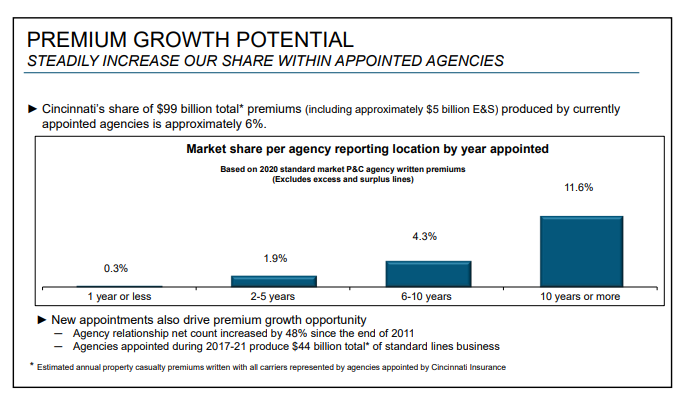

Source: Investor Presentation

Cincinnati Financial has progressively increased its market share in its agencies over time. While the market share stays low from years one through five of the appointment of the agency, and then rises considerably and contributes to strong premium growth.

Interest rates have been a headwind in the past several years, but a rising rate environment in 2022 could be a positive catalyst. Like other insurers that rely upon investment income, Cincinnati Financial would prefer higher rates, all else equal. Generally, insurers have large amounts of bonds and fixed income, which generate higher yields at higher rates.

However, Cincinnati Financial can be considered an aggressive investor, with 44.4% of its investment portfolio invested in common equities.. This presents a risk because a market downturn, which can be caused by increasing interest rates, would have a considerable impact on the company’s book value.

With new policies written and long-term growth in the equity markets, we see Cincinnati Financial producing 6% annual growth in earnings-per-share.

Competitive Advantages & Recession Performance

Cincinnati Financial does not possess a durable competitive advantage in its field.

This is because there are generally low barriers to entry in insurance, which leads to intense competition. One lever Cincinnati Financial can pull is to offer lower prices than competitors, but this isn’t always optimal.

Since Cincinnati Financial has been in the business for decades, it has built close relationships with its customers. This has led to some brand recognition.

Insurance companies are not immune from economic downturns. Cincinnati Financial, in particular, does not have a highly recession-resistant business model.

Earnings-per-share declined significantly from 2008 – 2010. Insurers like Cincinnati Financial typically sell fewer policies during recessions and suffer from the poor performance of their investment portfolios when markets decline.

In fact, Cincinnati Financial is vulnerable to recessions due to its large exposure to the stock market and its sensitivity to interest rates.

Still, Cincinnati Financial remained profitable during economic downturns, an important factor in enabling the company to increase its dividend for over six decades.

Valuation & Expected Returns

Shares of Cincinnati Financial have traded for an average price-to-earnings multiple of around 20.6. Shares are now trading in line with this average, which indicates that shares could be trading at fair value at the current 20.7 times earnings.

Our fair value estimate for Cincinnati Financial stock is 20.0 times earnings. If this proves correct, the stock will incur losses of -0.7% annually in its returns through 2027.

Shares of Cincinnati Financial currently yield 2.8%, which is below its average yield of 3.2%. On a dividend yield basis, CINF shares seem to be trading above fair value.

Putting it all together, the combination of valuation changes, EPS growth, and dividends produces a total expected return of 7.8% per year over the next five years. This makes Cincinnati Financial a hold.

The current dividend payout is adequately covered by earnings, with room to grow. Based on expected fiscal 2022 earnings, CINF has a payout ratio of 58%. We anticipate continued mid-single-digit dividend increases in the years to come.

Final Thoughts

Cincinnati Financial is a Dividend King in the insurance sector. The company has increased its dividend for 62 consecutive years, through multiple economic downturns.

Total estimated returns are decent in the intermediate term, but shares appear to be trading just slightly above our estimate of fair value. At the current price, Cincinnati Financial earns a hold rating.

More By This Author:

Warren Buffett Stocks: T-Mobile US Inc.

Blue Chip Stocks In Focus: MDU Resources Group

Blue Chip Stocks In Focus: Matthews International Corp.