Black Friday Sales Results

Based solely on Black Friday sales data, the holiday shopping season may be decent despite poor consumer sentiment. According to Adobe Analytics, which draws data from over one trillion retail site visits, Black Friday online sales hit a record $11.8 billion, up 9.1% from last year. Per MasterCard’s SpendingPulse, retail sales, including online and in-store transactions, rose 4.1% year-over-year. Such outpaces 2024’s Black Friday’s 3.4% growth. Approximately 87.3 million Americans shopped online, and 81.7 million visited physical stores; however, as we share below, online sales continue to grow versus those made in physical stores. Bear in mind that the growth figures don’t consider inflation. When adjusting for inflation, which sits around 3%, the aggregate spending growth reported by SpendingPulse is minimal.

Looking deeper into the data, we find that Mobile devices drove 55-70% of online purchases globally, contributing $6.5 billion in the U.S. alone. Buy Now, Pay Later options rose by nearly 10% year over year. Lastly, AI is increasingly playing a role in retail sales. Estimates are that AI-influenced US online sales hit $3 billion. More significantly, AI-driven traffic to retail sites spiked 800% year-over-year, per Salesforce and Adobe.

Retailers’ comments suggested that many purchases were driven by value amid economic concerns such as inflation and employment. There is no single definitive source of data on holiday sales, except for what retailers share as we get closer to the holidays. Furthermore, bargain hunting may drive strong sales on Black Friday and Cyber Monday, but satisfy most purchasers’ needs, resulting in weaker sales later in the month. The commentary below is courtesy of MasterCard’s SpendingPulse.

What To Watch Today

Earnings

Economy

(Click on image to enlarge)

Market Trading Update

Yesterday, we discussed the Zweig Breadth Thrust, which in April of 2025 signaled the beginning of the monster rally. After the recent correction, as discussed yesterday, the sharp recovery of the indicator over the last 10 days is a bullish sign. As noted by Sentiment Trader yesterday:

“Recently, as shown in the chart, the indicator has quickly recovered from below 0.4 to above 0.59 within 10 trading days. Although it has not reached the ZBT signal (i.e., recovery to 0.62 or above), as a slightly weakened signal, we can still observe how the market performs amid such a rapid recovery. The chart below shows the Zweig indicator quickly recovering from below 0.4 to above 0.59 within 10 trading days.”

As they conclude:

“The table of maximum profits and losses over various time periods for the 16 signals in the chart demonstrates the bullish impact of these signals on the S&P 500 Index. Even after one year, the average maximum drawdown is only -1.6%, with a win rate as high as 93%. However, cases from 1974 and 2008 in historical data remind us that such recoveries can sometimes evolve into cruel ‘bull traps.'”

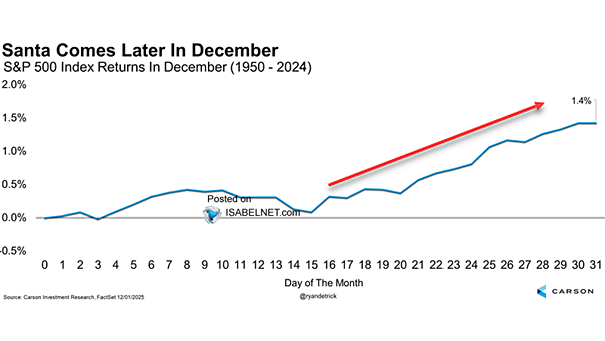

The signal is early, but historically tends to support further bullish advances. As we previously discussed, you can expect some irregular trading activity over the next two weeks as mutual funds distribute their annual gains and income. However, after that, with retail buyers continuing to “buy dips,” professional managers underperforming, and year-end performance chasing coming into view, the market should perform better.

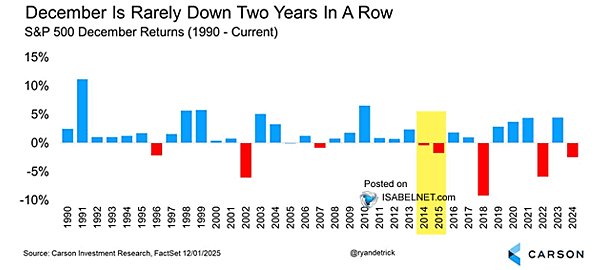

However, as Sentiment Trader noted, not every year will turn out to be bullish. That is just a statistic from market history. However, given that last December was a “dud,” that also adds to the bullish ledger for investors as two consecutive negative Decembers are rare. But even that can happen.

While there are numerous reasons to remain tactically long in equities currently, it is also prudent to continue managing risk accordingly. Just because something rarely happens doesn’t mean it can’t happen. As such, continue to take profits, rebalance risks, and manage exposures accordingly.

The Stagnant Labor Market

Next week, the Fed will try to assess the labor market to determine the proper path for its monetary policy. One key component of the hawkish-dovish debate will be a focus on the labor markets. The hawks will argue that the unemployment rate is low, albeit upticking, and weekly jobless claims are subdued. The dovish Fed members will also highlight the jobless claims data, but instead point to continued jobless claims. As we share in the first graph below, the number of people receiving jobless claims and unable to find new employment continues to rise. The current level, just under 2 million, is about 200k more than where it stood the year before the pandemic. The second graphic further underscores that jobs are increasingly becoming harder to get. Furthermore, the widening gap between the two figures suggests that while many employees are not being fired, the labor market is weakening.

If Fed members think that inflation is transitory due to tariffs, the employment data below and other warnings that the labor market is stagnant should be enough to warrant a cut in the Fed Funds rate.

MicroStrategy Math

Strategy, formerly known as MicroStrategy, is a software company that holds significant Bitcoin holdings. In fact, the company would likely be bankrupt due to continued losses on its software products if not for Bitcoin. About six months ago, shareholders greatly rewarded the company for holding Bitcoin. Its market cap was about 1.5 times the value of its Bitcoin holdings. That premium has since collapsed. In fact, it is now negative. The negative premium might entice some investors as they can effectively buy Bitcoin at a discount. However, with Bitcoin comes corporate risk. The Kobeissi Letter (@KobeissiLetter) helps us break down the company’s balance sheet to assess its situation. Their take, which mirrors ours, is that the current discount reflects the market assigning a probability of default or other hardships to its shareholders.

Tweet of the Day

More By This Author:

How To Reduce Taxes On Investment Gains: Advanced Strategies For High Net Worth InvestorsOverheating Financial Markets Highlight Data Centers Handicap

A Bear Market Is A Good Thing

Disclaimer: Click here to read the full disclaimer.