Best And Worst Stocks Since The COVID Crash Low

We are now three years out from the COVID Crash low, and even with the past year’s weakness, most assets continue to sit on solid gains. For major US index ETFs, the S&P Midcap 400 (IJH) is up the most having slightly more than doubled while the S&P Smallcap 600 (IJR) is not far behind having rallied 95.9%. Value has generally outperformed growth, especially for mid and small-caps although that has shifted somewhat this year. For example, while its gains have been more middling since the COVID crash, the Nasdaq 100 (QQQ) has been the strongest area of the equity market in 2023 thanks to the strength of sectors like Tech (XLK) and Communication Services (XLC). Although those sectors have posted strong gains this year, they have been the weakest over the past three years while Energy (XLE) far and away has been the strongest asset class. Paired with the strength of energy stocks has been solid runs in commodities (DBC)more broadly with the notable exception being Natural Gas (UNG) which has lost over 40%. Bond ETFs are similarly sitting on losses since the COVID Crash lows. As for international markets, Mexico (EWW) and India (PIN) have outpaced the rest of the world although Emerging Markets (EEM) as a whole have not been particularly strong; likely being dragged on by the weaker performance of China (ASHR) which holds a large weight on EEM.

Taking a look at current S&P 500 members, nearly half of the index has more than doubled over the past three years. As for the absolute best performers, Energy stocks dominate the list with four of the top five best-performing S&P 500 stocks coming from that sector. Targa Resources (TRGP) has been the absolute best performer with a nearly 900% total return. Other notables include a couple of heavy-weight stocks: Tesla (TSLA) and NVIDIA (NVDA) with gains of 563.9% and 412.9%, respectively.

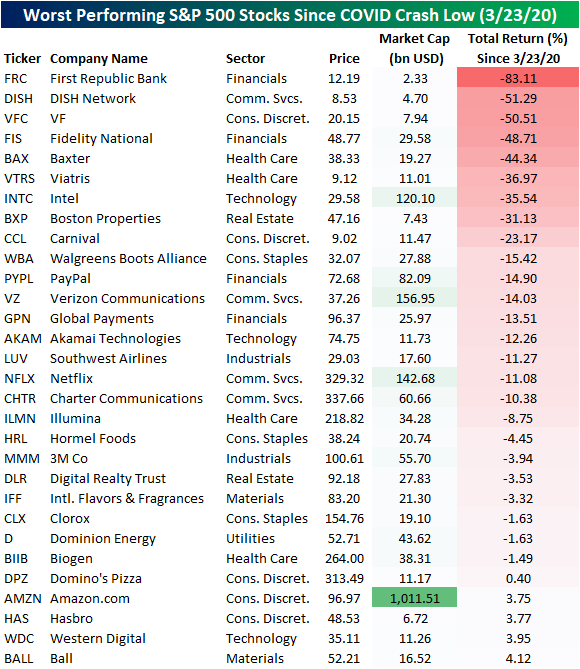

On the other end of the spectrum, there are currently 25 stocks that have posted a negative return since the COVID Crash low. The worst has been First Republic Bank (FRC) which has been more of a recent development. Whereas today the stock has posted an 83.1% loss, at the start of this month it would have been a 65% gain. Another standout on the list of worst performers has been Amazon (AMZN). Most other mega caps have more than doubled since the March 2020 S&P 500 low, however, the e-commerce giant has hardly offered a positive return.

More By This Author:

Sector Performance Experiences A Historical Divergence

Seasonality Keeps Claims Below 200K?

A Fed Day Like Most Others

Disclaimer: Bespoke Investment Group, LLC believes all information contained in this report to be accurate, but we do not guarantee its accuracy. None of the information in this report or any ...

more