Sector Performance Experiences A Historical Divergence

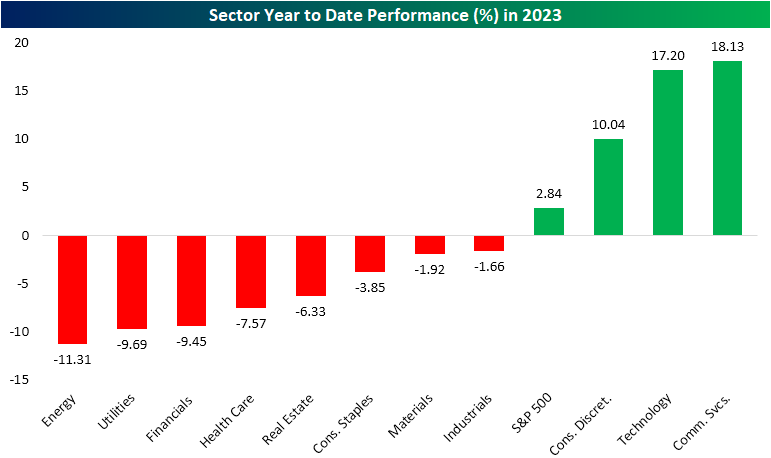

The first quarter of 2023 is coming to a close next week, and checking in on year-to-date performance, there has been a big divergence between the winners and losers. Although the S&P 500 is up 2.84% on the year as of yesterday’s close, only three of the eleven sectors are higher. Not only are those three sectors up on the year, but they have posted impressive double-digit gains only three months into the year. Of those three, Consumer Discretionary has posted the smallest gain of 10% whereas Technology and Communication Services have risen 17.2% and 18.1%, respectively. The fact that these sectors are home to the main mega cap stocks — like Apple (AAPL), Amazon (AMZN), and Alphabet (GOOGL), which have been on an impressive run of late — helps to explain how the market cap weighted S&P 500 is up on the year without much in the way of healthy breadth on a sector level.

One thing that is particularly remarkable about this year’s sector performance is just how rare it is for a sector to be up 10%+ (let alone 3) while all other sectors are lower. And that is for any point of the year let alone in the first quarter. As we mentioned in yesterday’s Sector Snapshot and show in the charts below, going back to 1990, there have only been two other periods in which a sector has risen at least 10% YTD while all other sectors were lower YTD. The first of those was in May 2009. In a similar instance to now, Consumer Discretionary, Tech, and Materials were the three sectors with double-digit gains back then. With those sectors up solidly, the S&P 500 was little changed on the year with a less than 1% gain. As you can see below, though, by the end of 2009, every sector had pushed into positive territory as the new bull market coming out of the global financial crisis was well underway.

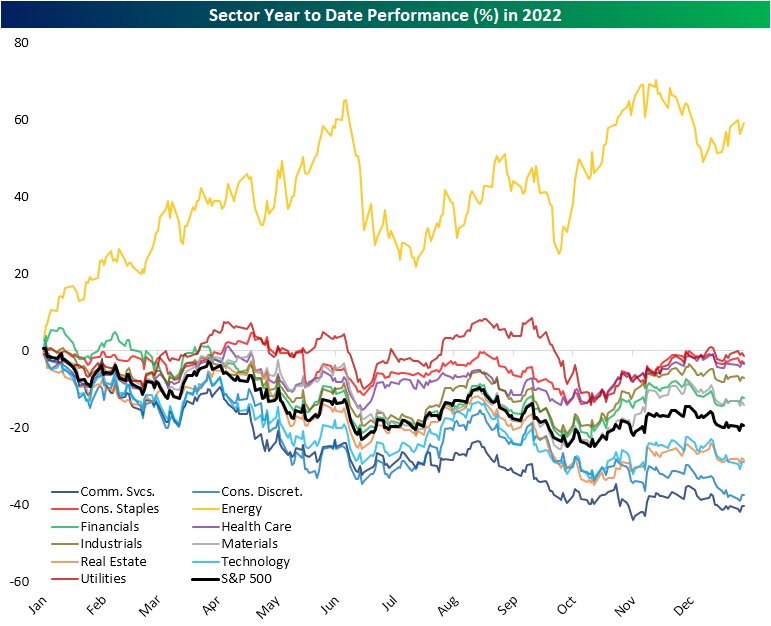

The next occurrence was much more recent: 2022. Obviously, it was a tough year for equities except for the Energy sector which had a banner year. Throughout most of the year, the sector traded up by well over 20% year to date even while the rest of the equity market was battered.

More By This Author:

Seasonality Keeps Claims Below 200K?

A Fed Day Like Most Others

FANG+ Flying

Disclaimer: Bespoke Investment Group, LLC believes all information contained in this report to be accurate, but we do not guarantee its accuracy. None of the information in this report or any ...

more