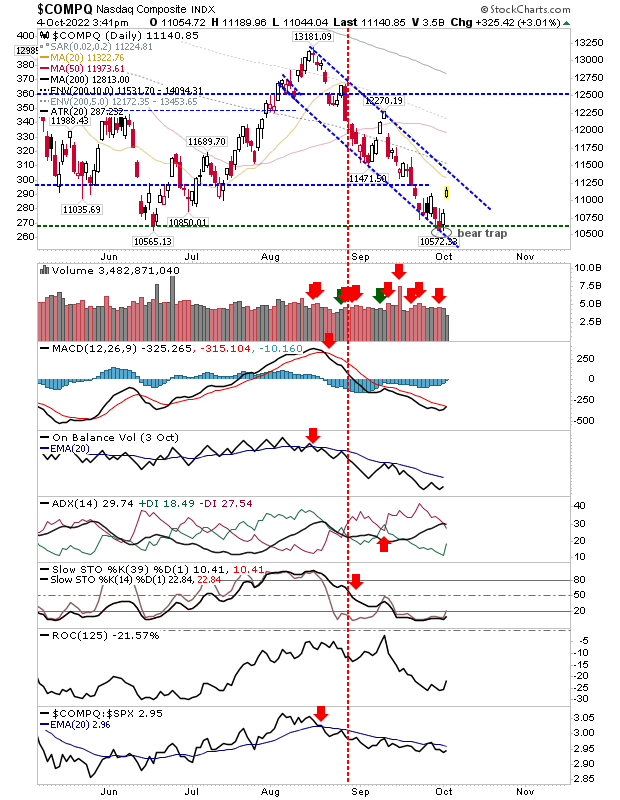

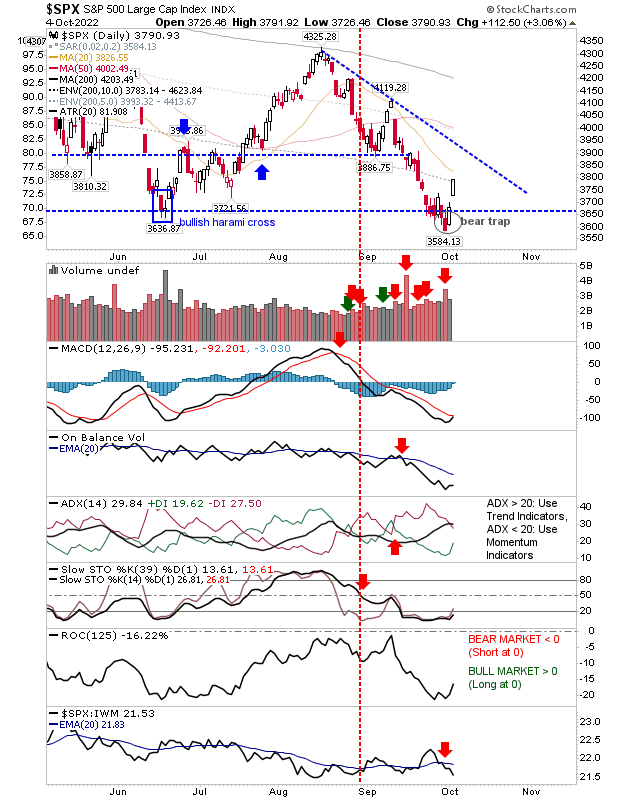

'Bear Traps' For The Nasdaq And S&P As Russell 2000 Holds Above Support

Buying in the Nasdaq and S&P delivered important 'bear traps' which in part, probably fueled today's gap higher in these indices. There is still a lot of work for bulls to do, not least drive breaks of downward channels - not to mention, clear the first of the key moving averages in the 20-day. But it does give indices some respite from the grinding selling of the last couple of months.

The buying in the Nasdaq didn't register as accumulation, but there is a slow improvement in the technical picture with an upcoming 'buy' in the MACD.

Buying in the S&P is also close to a MACD trigger 'buy' (and didn't register as accumulation). There was an acceleration in the underperformance relative to the Russell 2000.

The Russell 2000 ($IWM) is the first index to challenge its 20-day MA with a sharp advance in relative performance against the Nasdaq and S&P. But despite these relative gains, there was no confirmed accumulation.

Given the generally light volume, we may look for some easing over the next couple of days. If the Russell 2000 is able to finish the week above its 20-day MA it will set a positive precedent for the Nasdaq and S&P.Watch for fresh MACD 'buy' triggers as indices put in the groundwork to build longer rallies.

More By This Author:

Yesterday's Relief Bounce Negated In One Day

Look For A Bounce Monday, But Don't Expect It To Last

Bulls' Last Chance To Bounce The Decline

Disclaimer: Investors should not act on any information in this article without obtaining specific advice from their financial advisors and should not rely on information herein as the primary ...

more