Yesterday's Relief Bounce Negated In One Day

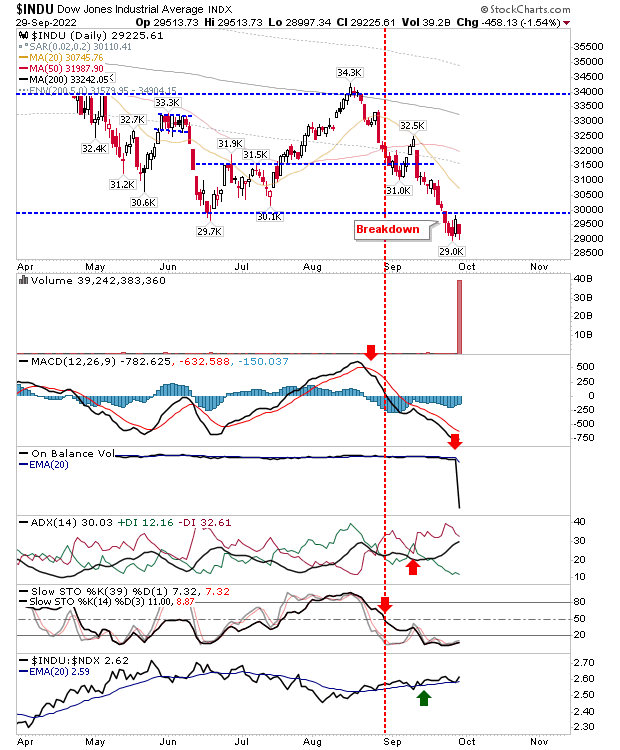

It was always going to be a tough sell given the speed at which markets pushed down into a retest of June lows last week, but I would have thought a bounce would have lasted longer than a day.

The Nasdaq hasn't violated the June low yet but with Friday's end-of-week print likely to see additional pressure into the over-weekend-hold price, it's not looking great for tomorrow.

The S&P edged with a (real-body) close below support, but at least there is no confirmed distribution. On the flip side, the relative performance advantage against the Russell 2000 was quickly erased on today's selling.

The Russell 2000 has managed to hold on to June low support, although as with the S&P there wasn't a whole lot of selling volume. One big swing has come with a relative performance advantage over peer indices has been gobbled up after today.

We got a good idea of the continued strength in bears, such that we only really saw one day of gains for a support test that really should have offered more for bulls than a single day. We need to see what happens from here, but given the Dow Industrials has already undercut the June low we would have to assume the same will happen in the Nasdaq, S&P, and Russell 2000 too.

More By This Author:

Look For A Bounce Monday, But Don't Expect It To Last

Bulls' Last Chance To Bounce The Decline

Russell 2000 Suffers Heaviest Loss As Selling Continues

Disclaimer: Investors should not act on any information in this article without obtaining specific advice from their financial advisors and should not rely on information herein as the primary ...

more