Bulls' Last Chance To Bounce The Decline

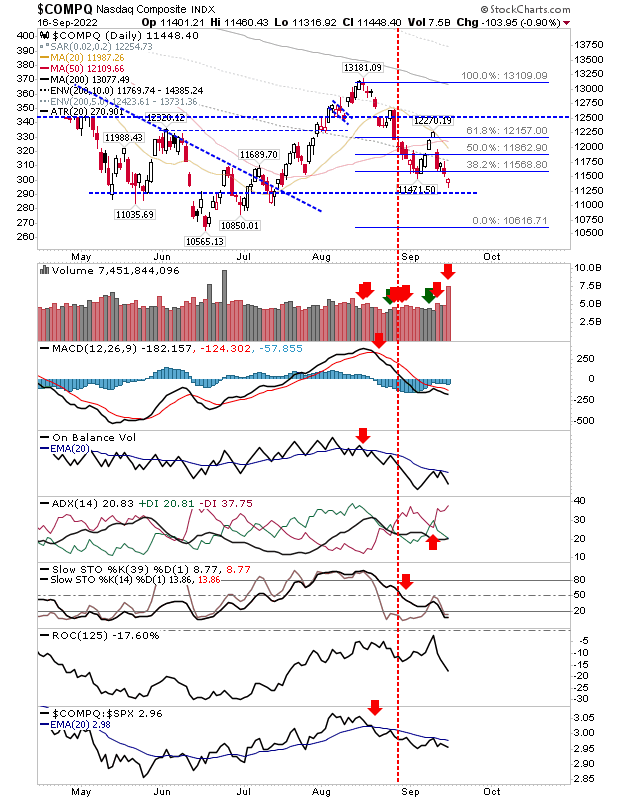

Markets are running out of opportunities to stall the decline from August's swing highs. Friday's options expiration will have clouded the volume picture, so we don't necessarily have a clear capitulation but there could be some cause for optimism. Indices have gone beyond the standard Fibonacci retracement and there isn't a whole lot of room for bulls to come in without a full retracement of the rally to become the most likely outcome to emerge here.

The Nasdaq closed with a gap down bullish 'hammer', which leaves it open for a gap higher and potential bullish morning star set up; but for that to happen we have to start with a opening gap higher and there can't be a close below Friday's open (and ideally, no intraday violation of Friday's low). Technicals are oversold, which does favor some form of bounce - but such a bounce is not necessarily one to start a new long term rally - as a trader, we can only use the information we have. If looking to trade this, then place a stop on a loss of Friday's low. The question is how much risk to use, the tighter the stop the greater the chance for a stop hit, so it's a question of a balance. In terms of a bounce, I would be looking to hold for a period of months - so a 2.5x ATR (Average True Range) stop would be my go to for a reasonable risk:reward.

The S&P is lurking a little closer to Fibonacci levels so it's not as vulnerable to the Nasdaq in it could take a loss without totally ruling out the reversal opportunity, but ideally, it should gap higher and not look back. Technicals are net negative, no suprise, but momentum on short and intermediate term time frames is oversold - a good setup for a doji to play as a reversal.

The Russell 2000 is a more interesting example. It too gapped down on Friday, but it's hanging on to Fibonacci support and may have the best chance for a rally on Monday. Technicals are net bearish and short and long term momentum is oversold. The other advantage, is that the index is outperforming its peer indices - so it should attract buyers, but take nothing for granted.

For tomorrow, buyers have to make a better attempt at acting on a bullish 'hammer' than they did a couple of weeks ago. If sellers manage to close below Friday's low then it's hard to see indices not making a full retracement of June-August rallies across markets.

I should add, if you are an investor (i.e. someone with a timeframe of holding for 5 years or more), then Friday is yet another opportunity to add to your position. As an investor, you can't be second guessing what the market may or may not do. Yes, we may see further losses. Yes, we are likely to get a recession. But when it's a good time to buy the news will always be bleak. Embrace the negativity.

More By This Author:

Russell 2000 Suffers Heaviest Loss As Selling ContinuesBulls Fluff Their Lines Into The Labor Weekend

Silver Lining? Bullish Hammers At Fib Retracements For Lead Indices

Disclaimer: Investors should not act on any information in this article without obtaining specific advice from their financial advisors and should not rely on information herein as the primary ...

more