Bear Of The Day: Westlake Corporation

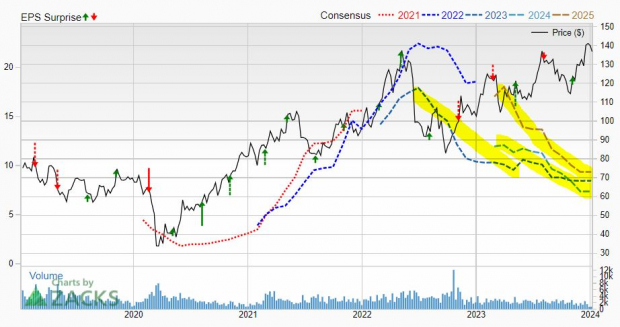

Westlake Corporation (WLK) shares have climbed to fresh highs even as its earnings outlook tumbles. WLK’s Chemical – Plastic segment also currently lands in the bottom 18% of over 250 Zacks industries.

The WLK Basics

Westlake Corporation is a manufacturer and supplier of essential materials and products. WLK’s offerings include ethylene, polyethylene, styrene, vinyl intermediates, PVC, fence, decking components, and more.

Westlake utilizes internally-produced basic chemicals to make higher value-added chemicals and building products. The firm’s two reportable segments include Performance and Essential Materials as well as Housing and Infrastructure Products.

The slowing housing market and declining industrial and construction activities are weighing on Westlake’s growth prospects. Westlake also faces a difficult to contend with stretch of growth. WLK’s revenue is projected to fall 20% in fiscal 2023 and another 2% next year, based on Zacks estimates.

On the bottom line, Westlake’s adjusted earnings are projected to tumble 51% in FY23 and then slide another 13% next year. The company’s EPS outlook began fading around the middle of 2022 and it keeps getting worse.

(Click on image to enlarge)

Image Source: Zacks Investment Research

WLK’s consensus Q4 earnings estimate is down 35% in the last two months, with its most accurate/most recent estimate for the fourth quarter coming in below the already beaten-down consensus. “As we enter the fourth quarter of 2023, weak macroeconomic conditions, including elevated inflation and high interest rates, remain in place driving softer demand for all of our products and low sales prices in our PEM segment,” CEO Albert Chao said in prepared Q3 remarks.

Despite Westlake’s falling earnings outlooking and downbeat near-term projections, WLK shares have climbed over 30% in the last year vs. the Zacks Basic Materials sector’s 7% climb. The stock is also up roughly 100% in the last five years to outpace the S&P 500 and it hit new highs right after Christmas.

Westlake stock is trading well above its 50-day and 50-week moving averages right now, which signals that a pullback could be due.

Bottom Line

Westlake’s downward earnings revisions help it land a Zacks Rank #5 (Strong Sell). Therefore, investors might want to stay away from the stock for now. That said, some might want to keep WLK on their long-term watchlists.

More By This Author:

2 Large-Cap Tech Stocks To Buy In 2024 For Surprising Value

Finding The Best Value Stocks To Buy To Start 2024

3 Top-Ranked Growth Tech Stocks To Buy In 2024

Disclaimer: Neither Zacks Investment Research, Inc. nor its Information Providers can guarantee the accuracy, completeness, timeliness, or correct sequencing of any of the Information on the Web ...

more