3 Top-Ranked Growth Tech Stocks To Buy In 2024

Image: Bigstock

The S&P 500 inched slightly higher last week to hover just below its all-time highs. The bulls appeared set to send the benchmark index to new highs during the Santa Claus rally period. That said, stocks will likely face selling pressure at some point in the coming weeks after the market-wide December surge capped off a fantastic 2023.

Stocks and indexes always come back down to key moving averages. Thankfully, the dips might be scooped up quickly as more investors, big and small, chase returns in 2024 as rates fall.

The three top-ranked growth tech stocks we explore today have recently been seen trading at least 50% below their all-time highs heading into 2024. Investors might want to consider these three stocks, as many big tech stocks have been sitting near fresh records.

Upwork (UPWK - Free Report)

Upwork is a standout in the world of freelance work, connecting businesses of all shapes and sizes with people around the world. Upwork is a former remote-work and COVID-19 rally superstar that’s slowly making a comeback as the economy and interest rate environment normalize.

Despite a return to a more regular, pre-pandemic working environment, office building occupancy rates remain at a fraction of what they once were. A massive chunk of the economy and workforce function in a mostly digital world. Upwork helps freelancers and clients connect for jobs across development and IT, finance and accounting, design and creative, and beyond.

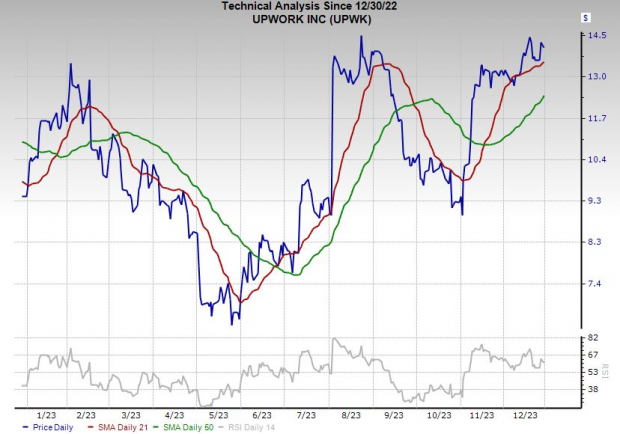

Image Source: Zacks Investment Research

Upwork, like many former growth-at-all-cost firms, is focusing more on the bottom line. The firm has topped our adjusted earnings estimates in the trailing four quarters, including a 91% Q3 beat. Upwork is projected to swing from an adjusted loss of -$0.06 per share last year to +$0.48 a share FY23, and then to surge 39% higher in FY24. The company is projected to grow its revenue by 11% in 2023 and 12% in 2024, following 23% sales expansion from 2022.

The firm’s total marketplace take rate in the third quarter climbed to 17.1%, up from 15.4% in the year-ago period and 14.2% in Q3 FY21, driven by the simplification of its freelancer pricing structure and ads products. UPWK’s positive earnings revisions activity helps it land a Zacks Rank #1 (Strong Buy) right now. Upwork’s EPS outlook began trending higher in the early part of 2023 for FY23 and FY24.

Image Source: Zacks Investment Research

Upwork stock climbed 45% in 2023, including some huge swings. UPWK was recently seen trading above its 21-day, 50-day, and 200-day moving averages. Yet it has pulled back from overbought RSI levels, and it trades roughly 75% below its record highs at around $15 per share. Upwork’s Internet – Services unit lands in the top 14% of over 250 Zacks industries, and its balance sheet is strong.

Shopify (SHOP - Free Report)

Shopify provides what it has dubbed the “essential internet infrastructure for commerce.” The firm helps companies with everything from site design and sales to marketing, payments, shipping, and more.

Shopify makes money from recurring subscription fees and various add-ons. Shopify grew its revenue by an average of 65% between FY17 and FY21 as companies, small businesses, entrepreneurs, and other entities clamored to catch up to the new age of retail.

Shopify’s days of 60% growth are over, which makes sense because those figures are unsustainable, as its yearly revenue starts inching toward $10 billion and its customer acquisitions slow in a more saturated market. Shopify made up for slowing expansion by raising its prices in 2023 for the first time in over a decade.

Image Source: Zacks Investment Research

Shopify’s sales climbed 21% in FY22, and its revenue is projected to jump 25% higher in FY23 from $5.60 billion to $6.98 billion and then post 19% growth next year to pull in $8.31 billion. As is the case with Amazon (AMZN - Free Report) and most of tech, Shopify is committed to boosting its bottom line. SHOP’s adjusted earnings are projected to climb from $0.04 a share in 2022 to $0.70 in 2023, and then to surge another nearly 50% next year.

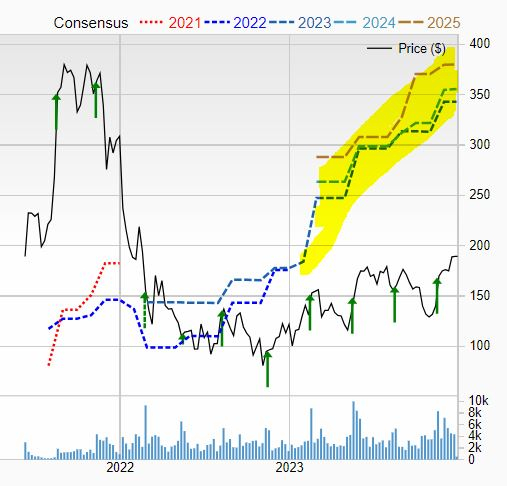

Shopify’s earnings revisions have soared in the back half of 2023 for FY23, FY24, and FY25 to help it capture that Zacks Rank #1 (Strong Buy). SHOP shares have skyrocketed 200% off their October 2022 lows, including a 125% run in 2023.

Image Source: Zacks Investment Research

Despite the huge comeback, Shopify still trades over 50% below its all-time highs. The stock recently traded above its 21-day, 50-day, and 200-day moving averages. SHOP is on the cusp of retaking its 200-week moving average, having found support near its 50-week level in late October.

Shopify’s valuation levels are still sky-high compared to the broader tech sector. But SHOP’s balance sheet is stellar, with nearly $5 billion in cash and equivalents and $10.5 billion in total assets vs. $852 million in current liabilities and $2.2 billion in total. And its outlook is impressive in an essential area of the economy.

Monday.com (MNDY - Free Report)

Monday.com’s core work operating system, or Work OS, is a “low code-no code” platform that helps its customers build work management tools and software applications across various industries. On top of that, Monday.com operates a sales CRM segment and a Dev unit.

Monday.com has amassed around 190,000 global customers, most of which are smaller businesses. The firm operates in a key growth segment of the economy since every business needs to digitalize their workflows to succeed.

MNDY posted a big beat-and-raise Q3 in November, helping boost its consensus earnings estimate by 64% for FY23 and 62% for FY24. Monday.com’s recent upward earnings revisions prolong an impressive streak of improving earnings that lands it a Zacks Rank #1 (Strong Buy).

Image Source: Zacks Investment Research

Monday.com is projected to post 40% revenue growth in 2023 and 28% higher sales in 2024 to climb from $519 million in FY22 to $925 million in FY24. It is also projected to swing from an adjusted loss of -$0.73 per share to +$1.49 FY23, and then reach $1.73 a share in 2024. Plus, MNDY has topped our quarterly EPS estimates by an average of 200% in the trailing four quarters, including a 256% Q3 beat.

MNDY shares have climbed 57% in 2023 vs. the Zacks Tech sector’s 53%. Yet it recently traded 55% below its 2021 peaks and 12% under its average Zacks price target. On the technical front, Monday.com trades above its 21-day and 50-day moving averages and below overbought RSI levels.

Image Source: Zacks Investment Research

As is the case with Shopify and Upwork, Monday.com’s valuation levels are high. Thankfully, MNDY is improving its bottom line, and 10 of the 15 brokerage recommendations Zacks has are “Strong Buys.” On top of that, its balance sheet is in great shape.

More By This Author:

2 Top S&P 500 Stocks To Buy On The Dip For Big 2024 Gains2 Great Value Stocks To Buy For 2024

Looking For Stocks To Buy In 2024? Here Are 3 Strong Picks

Disclaimer: Neither Zacks Investment Research, Inc. nor its Information Providers can guarantee the accuracy, completeness, timeliness, or correct sequencing of any of the Information on the Web ...

more