Finding The Best Value Stocks To Buy To Start 2024

The Nasdaq tumbled through early afternoon trading on Tuesday following the New Year’s Day holiday. Big moves lower from Apple and other big tech names drove the downbeat start to 2024 trading as investors take some profits following the fierce early December rally.

The selling on Tuesday and the relatively sideways movement in the back half of last month showcase that investors are acting rationally since stocks cannot go straight up. Stocks and indexes always slide down to key moving averages before they can return on their upward journey.

Thankfully, the dips might be bought up quickly as more investors big and small chase returns in 2024 as rates fall. No matter what, many investors likely want to find strong value this year following the tech-heavy 2023 rebound.

Today we show investors how to screen for stocks that offer a great combination of enticing valuation levels and improving earnings outlooks to consider buying to kick off 2024.

NRG Energy, Inc. (NRG)

NRG Energy is a utilities powerhouse that generates electricity and provides energy solutions and natural gas to millions of business and residential customers. The Houston, Texas-based company is rolling out more digital-focused efforts as electric grids, homes, and businesses grow more high-tech.

These tech-focused efforts include NRG’s acquisition of Vivint Smart Home in March 2023. The beefed-up and diversified NRG boasts a network of approximately 7.3 million customers.

(Click on image to enlarge)

Image Source: Zacks Investment Research

NRG can bundle offerings for utilities, home security, automation, and more to thrive in a smart home/building world. The completion of the deal did, however, help spur an activist investor to push to force NRG to focus on returning more value to shareholders.

NRG on November 20 said that it was replacing its CEO and shaking up the board. NRG also announced a new $950 million accelerated share repurchase deal in November.

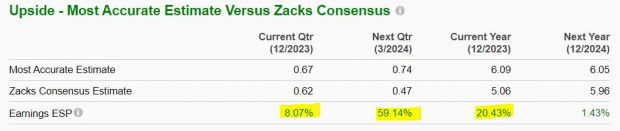

NRG’s adjusted earnings are projected to climb by 93% in FY23 and 18% higher next year. Plus, its earnings outlook has improved significantly recently, with its most accurate/most recent EPS estimates coming in solidly above consensus to help it land a Zacks Rank #1 (Strong Buy). Its dividend yields 2.9% at the moment vs. the Utilities sector’s 3.5%.

(Click on image to enlarge)

Image Source: Zacks Investment Research

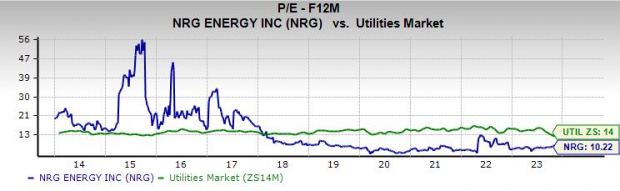

NRG shares have soared 60% over the last 12 months to trade right near fresh all-time highs and blow away the Utilities sector’s -7% dip. NRG has also climbed by 80% in the past decade vs. its sector’s 11% run.

Utilities appear poised for a comeback after a rough stretch, with the sector up 12% during the past three months. Despite its outperformance and its recent surge to new highs, NRG trades at a 27% discount to the Utilities sector and right near its 10-year median at 10.2X forward 12-month earnings.

More By This Author:

3 Top-Ranked Growth Tech Stocks To Buy In 20242 Top S&P 500 Stocks To Buy On The Dip For Big 2024 Gains

2 Great Value Stocks To Buy For 2024

Disclaimer: Neither Zacks Investment Research, Inc. nor its Information Providers can guarantee the accuracy, completeness, timeliness, or correct sequencing of any of the Information on the Web ...

more