Bear Of The Day: Nike, Inc.

Nike, Inc. (NKE - Free Report) tumbled after it released its quarterly results on September 29 as it warned Wall Street that soaring inventory would eat away at its profit margins. The sportswear titan, like many others, is struggling to stay ahead of the curve when it comes to consumer demand amid ongoing supply chain bottlenecks.

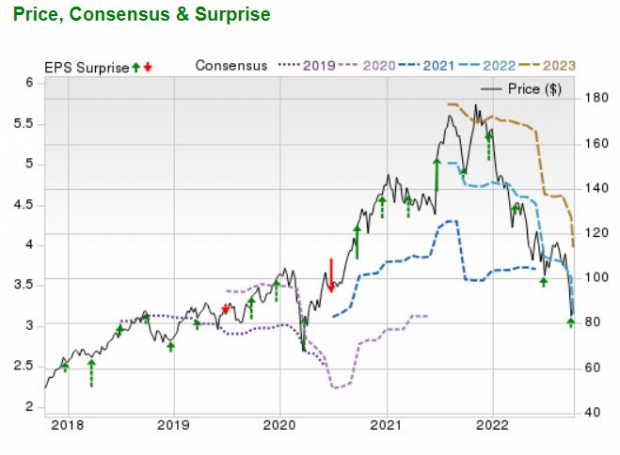

Nike’s post-earnings release drop is part of a much longer downturn that’s seen NKE shares sink 44% in the past 12 months alongside many other consumer discretionary stocks.

Nike’s Story

Nike remains one of the heavyweight champions of sportswear. The company has continued to adapt and create trends to help fend off improved challenges from Adidas, Lululemon (LULU - Free Report), and many smaller digital-native brands.

The iconic Swoosh is attached to many of the most popular sports, athletes, and cultural icons on the planet. This helps Nike stand out as one of the most valuable brands, alongside the likes of Coca-Cola and Apple.

Nike continues to invest in its future through multiple shopping apps and its massive, wide-ranging digital marketplace. Nike is all-in on its own e-commerce and direct-to-consumer offerings, having cut ties with many retailers, all of which are great for margins and maintaining its brand cachet.

That said, it’s facing a rough near-term outlook as it continues to find it difficult to navigate the rocky supply chain ecosystem and it’s getting crushed by the strong U.S. dollar. Plus, Nike is finding it somewhat of a challenge to adapt to rapidly changing shopping patterns as more consumers tighten their purse strings.

Image Source: Zacks Investment Research

Nike’s Q1 FY23 (recently-reported quarter) revenue popped by nearly 4% and 10% on a currency-neutral basis. The company's direct-to-consumer segments continue to fuel sales growth. Despite its top-line expansion, the firm’s adjusted earnings tumbled 20% YoY as higher costs and surging inventory levels took a chunk out of its profits.

Nike said that its inventories soared 44% to $9.7 billion in the latest quarter, “driven by volatility in transit times in North America, strategic decisions to buy inventory for future seasons earlier, and lower inventory levels due to last year's factory closures in Vietnam and Indonesia.”

Bottom Line

Nike’s consensus earnings estimates have crumbled recently to help it land a Zacks Rank #5 (Strong Sell). NKE’s Shoes and Retail Apparel industry is also in the bottom third of over 250 Zacks industries. And it lands “F” grades for Value and Momentum in our Style Scores system.

Nike’s 1.4% dividend yield is nothing to write home about and it’s still not “cheap” in terms of forwarding earnings. And Nike is being forced to mark down its offerings heading into the vital holiday shopping season.

Zacks estimates call for Nike’s adjusted FY23 earnings to slide 17% to $3.13 per share on 5% stronger sales. The company is then set to post 9% sales growth the following year and 27% higher earnings to climb above its FY22 levels.

The long-term bullish case for Nike is somewhat firmly intact. Yet, investors might want to stay away from the stock for now given all of the economic uncertainty and inventory setbacks.

More By This Author:

Bull of the Day: DexCom, Inc. (DXCM)

Bear of the Day: Papa John's International

Top Tech Stocks To Buy In October And Hold For Long-Term Growth

Disclaimer: Neither Zacks Investment Research, Inc. nor its Information Providers can guarantee the accuracy, completeness, timeliness, or correct sequencing of any of the Information on the Web ...

more