Bear Of The Day: Masimo

Masimo (MASI) , a medical device company, has seen significant downward pressure on its earnings estimates over the last two months, downgrading the stock to a Zacks Rank #5 (Strong Sell), and indicating near-term weakness for the stock price.

Masimo is a medical technology company specializing in non-invasive patient monitoring solutions. Known for its innovative Signal Extraction Technology (SET), Masimo develops and manufactures a range of devices for monitoring vital signs, including pulse oximeters and continuous monitoring systems.

These technologies are widely used in healthcare settings to enhance patient safety by providing real-time and accurate data on parameters such as oxygen saturation, pulse rate, and other physiological indicators.

Although MASI stock has been a strong performer over the last decade, with a CAGR of 14.6%, there are numerous headwinds that leave the stock vulnerable to a sell-off in the near future. In addition to falling earnings estimates, the company also expects nearly flat sales growth over the next year, while also having a relatively high valuation.

Furthermore, stiff industry competition which is constantly creating comparable products as well as product reimbursement uncertainty compounds the risk in the stock going forward.

Cratering Earnings Estimates

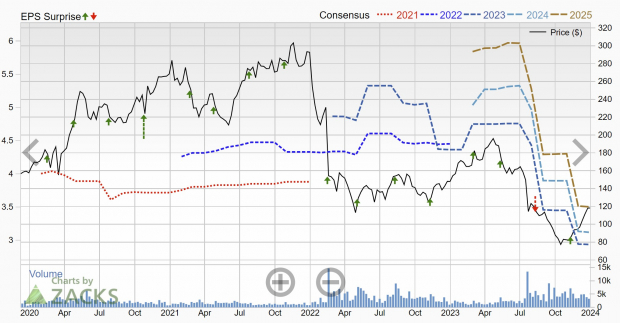

The headwinds listed above have not been overlooked by analysts, as they have significantly lowered earnings estimates. In the chart below we can see just how severely earnings projections have been lowered since this summer, especially in FY25.

In just the last two months, current quarterly earnings estimates have declined by -40%, and are expected to fall -38% YoY to $0.82 per share. FY23 earnings estimates have been lowered by -14.8% and are forecast to decrease by -36% YoY to $2.94.

(Click on image to enlarge)

Image Source: Zacks Investment Research

Premium Valuation

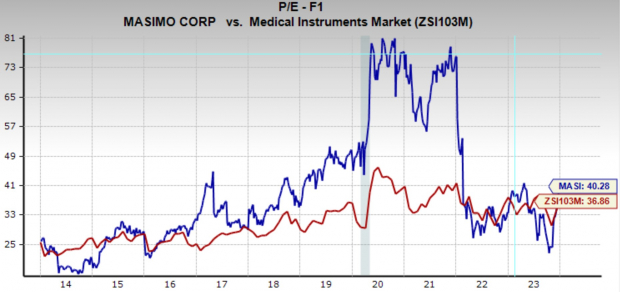

Even with these bearish catalysts, Masimo still boasts a relatively high earnings multiple. MASI is trading at a one year forward earnings multiple of 40.3x, which is above the industry average, market average, and its 10-year median of 33.8x.

(Click on image to enlarge)

Image Source: Zacks Investment Research

Bottom Line

Unfortunately for Masimo the current outlook is both not promising, and only worsened by its rich valuation. However, as patient monitoring is more important than ever, and with positive studies coming out for its products coming out there is still a potentially promising future for the company.

Nonetheless, until these near-term risk can current, investors should avoid Masimo stock, and look for opportunities elsewhere in the market.

More By This Author:

2 Highly Ranked Stocks To Buy For Growth & Value At Year's End

Here Are 2023's Top-Performing Stocks From The S&P 500

3 Great Utility Stocks To Buy For A Steady Stream Of Income

Disclosure: Zacks.com contains statements and statistics that have been obtained from sources believed to be reliable but are not guaranteed as to accuracy or completeness. References to any specific ...

more