2 Highly Ranked Stocks To Buy For Growth & Value At Year's End

Image: Bigstock

Rounding out the year, investors will start looking for stocks that offer value and have favorable growth prospects. This points us to a few highly ranked stocks that currently boast spots on the Zacks Rank #1 (Strong Buy) list.

In addition to their Strong Buy ratings, here are two intriguing stocks with an “A” Zacks Style Scores grade for both Growth and Value, making them very attractive heading into the new year.

Insight Enterprises (NSIT - Free Report)

With a very expansive bottom line, Insight Enterprises is certainly a growth stock to consider going into 2024. To that point, easing inflation is promising for consumer spending on non-essential items such as electronics, with Insight Enterprises being a global direct marketer and retailer of brand-name computers, hardware, and software.

Marketing to small and medium-sized businesses, Insight Enterprises is now expected to round out fiscal 2023, with EPS up 7% and FY24 earnings projected to jump another 15% to $11.29 per share. Plus, in the last 60 days, FY23 earnings estimates are up 3% while FY24 EPS estimates have risen 5%.

Image Source: Zacks Investment Research

Most impressive, FY24 EPS projections would represent 82% growth over the last five years, with earnings at $6.19 per share in 2020. Considering the stock has soared +77% year-to-date, its 18.2X forward earnings multiple is very reasonable and alludes to more upside as NSIT shares still trade pleasantly below the S&P 500’s 22.4X.

Over the last three years, Insight Enterprises stock is up +134%, easily outperforming the S&P 500’s +27% and the Nasdaq’s +17%. This further alludes to the notion that the company’s business model and offerings were well-suited to survive a potential economic downturn coming out of the pandemic.

Image Source: Zacks Investment Research

REX American Resources (REX - Free Report)

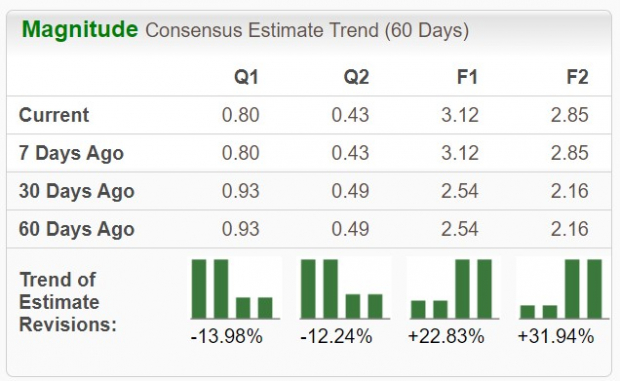

Another company with very promising prospects in recent years is REX American Resources, which is a producer of ethanol and distillers’ grains. In regards to biofuels, REX American Resources has turned into a very capable energy player, with earnings forecasted to soar 99% in its current fiscal 2024 to $3.12 per share compared to $1.57 a share in FY23.

While FY25 EPS is expected to dip -8% after what would be an exceptional year, projections of $2.85 per share would represent a remarkable 630% increase over the last five years, with earnings at $0.39 a share in 2020. More compelling, earnings estimate revisions for FY24 and FY25 have soared 23% and 32% over the last 60 days, respectively.

Image Source: Zacks Investment Research

The very positive trend of earnings estimate revisions certainly supports REX American Resources' 15.3X forward earnings multiple, with REX shares up +49% year-to-date and climbing +90% over the last three years.

Image Source: Zacks Investment Research

Bottom Line

With such expansive bottom-line growth over the last few years, investors shouldn’t overlook Insight Enterprises or REX American Resources going into 2024. Rising earnings estimates and attractive P/E valuations indicate their strong price performances could continue, and now looks like a good time to buy.

More By This Author:

Here Are 2023's Top-Performing Stocks From The S&P 5003 Great Utility Stocks To Buy For A Steady Stream Of Income

3 Tech Stocks Suited Nicely For Income Investors

Disclosure: Zacks.com contains statements and statistics that have been obtained from sources believed to be reliable but are not guaranteed as to accuracy or completeness. References to any specific ...

more