3 Great Utility Stocks To Buy For A Steady Stream Of Income

Image Source: Unsplash

Investors get a return on their investment in stocks through regular dividends, bonus shares, share repurchases and share price appreciation during the trading session. For a steady stream of income, investors can strengthen their position in defensive, matured, regulated and domestic-focused utility companies. Utility companies are known for their stable performance and ability to distribute dividends at regular intervals, and are often considered substitutes for bonds.

The Utility space includes companies that provide electricity, water and natural gas to millions of customers across the United States. Demand for utility services tends to remain stable even during turbulent economic conditions. Our Earnings Trends report indicates 14.7% earnings growth for the utility space in fourth-quarter 2023. The growth momentum is expected to continue in the first three quarters of 2024.

The recent release from the U.S. Energy Information Administration (“EIA”) forecasts electricity supply to increase 2.4% in 2024 from 2023 levels. A transition is now evident in the utility space, with more operators shifting toward utility-scale renewable projects to generate electricity. Per EIA, solar and wind generation together are expected to overtake electric power generation from coal for the first year ever in 2024, exceeding coal by nearly 90 billion kilowatt hours.

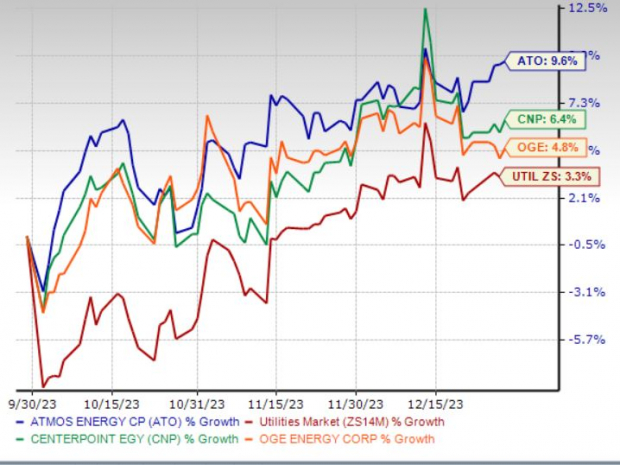

Investors can bet on utilities like Atmos Energy Corporation (ATO), CenterPoint Energy (CNP) and OGE Energy (OGE), which outperformed the Zacks Utilities sector in the past three months. These utilities are investing steadily to expand operations, which will create more opportunities to generate revenues and free cash flow.

Utility operations are capital-intensive and are traditionally averse to interest rate hikes. The Fed has raised the interest rate 11 times in the past two years, taking the interest rate to 5.25-5.50%. However, the Fed paused rate hikes at its last three meetings in 2023. There is a high probability of interest rate declines in 2024, which will benefit the utilities.

Picking the Right Utilities

Historical dividend payment should not be the only criteria for selecting utilities as it does not guarantee future dividend payment. With the help of our proprietary Zacks Stock Screener, we have selected three utility stocks based on their dividend yield and earnings growth expectations for 2024.

The stocks selected have an impressive VGM Score of A or B. Each of these stocks carries a Zacks Rank #2 (Buy). Back-tested results have shown that for stocks with a solid VGM Score and a favorable Zacks Rank, the returns are even better. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Price Performance (Three Months)

Image Source: Zacks Investment Research

Dallas, TX-based Atmos Energy, along with its subsidiaries, is engaged in regulated natural gas distribution and storage business. The company invested $2.8 billion in fiscal 2023, 85% of which was allocated to safety and reliability. The company expects $2.9 billion in capital expenditures during fiscal 2024.

It currently carries a Zacks Rank #2 and has a VGM Score of B. Its current dividend yield of 2.78% is better than the Zacks S&P 500 composite group’s average of 1.6%.

The Zacks Consensus Estimate for Atmos Energy’s fiscal 2024 earnings of $6.54 per share has increased 1.2% in the past 60 days. The stock has gained 9.6% over the past three months compared with the sector’s rally of 3.3%.

Houston, TX-based CenterPoint Energy is a domestic energy delivery company that provides electric transmission & distribution, natural gas distribution and competitive natural gas sales and services operations. CenterPoint Energy is investing significantly to expand its operations to meet increasing electricity demand, backed by expanding commercial activity. In the next 10 years, the company plans to invest $44 billion to further strengthen and expand its operation.

It currently carries a Zacks Rank #2 and has a VGM Score of A. CNP’s current dividend yield is 2.82%.

The Zacks Consensus Estimate for CenterPoint Energy’s 2024 earnings of $1.62 per share implies an increase of 8% from the 2023 estimated figure. The stock has gained 6.4% over the past three months.

Oklahoma City, OK-based OGE Energy provides energy and offers physical delivery and related services for both electricity and natural gas, primarily in the south-central United States. The company plans to spend $4.75 billion between 2023 and 2027, which is in line with its prior five-year capital expenditure plan. Apart from serving its expanding customer base in an efficient manner, such planned investments will also assist OGE Energy in continuing to grow its dividend in the next five years.

OGE Energy currently carries a Zacks Rank #2 and has a VGM Score of A. OGE’s current dividend yield is 4.81%.

The Zacks Consensus Estimate for OGE Energy’s 2024 earnings of $2.13 per share implies an increase of 4.9% from the 2023 estimated figure. The stock has gained 4.8% over the past three months.

More By This Author:

3 Tech Stocks Suited Nicely For Income Investors2 Energy Stocks To Buy With Robust Bottom Lines Going Into 2024

3 Stocks Displaying Considerable Momentum Heading Into 2024

Disclosure: Zacks.com contains statements and statistics that have been obtained from sources believed to be reliable but are not guaranteed as to accuracy or completeness. References to any specific ...

more