Bear Of The Day: IPG Photonics

IPG Photonics (IPGP) , a Zacks Rank #5 (Strong Sell) stock, develops and manufactures high-performance fiber lasers, fiber amplifiers, and diode lasers used for diverse applications such as materials processing and medical enhancements. The company also offers integrated laser systems used for fine welding, cutting, drilling, and cladding.

Founded in 1990, Massachusetts-based IPG Photonics markets its products to original equipment manufacturers, system integrators, and end users through its direct sales force, as well as through agreements with independent sales representatives and distributors.

The Zacks Rundown

IPG Photonics has been severely underperforming the market over the past year. The stock experienced a climax top in July of 2023 and has been in a price downtrend ever since. IPGP is hitting a series of lower lows this year and represents a compelling short opportunity as volatility begins to rise.

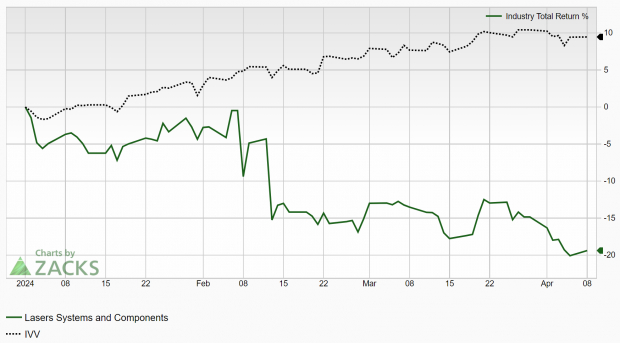

IPGP is part of the Zacks Lasers Systems and Components industry group, which currently ranks in the bottom 1% out of approximately 250 industries. Because this industry is ranked in the bottom half of all Zacks Ranked Industries, we expect it to underperform the market over the next 3 to 6 months, just as it has so far this year:

Image Source: Zacks Investment Research

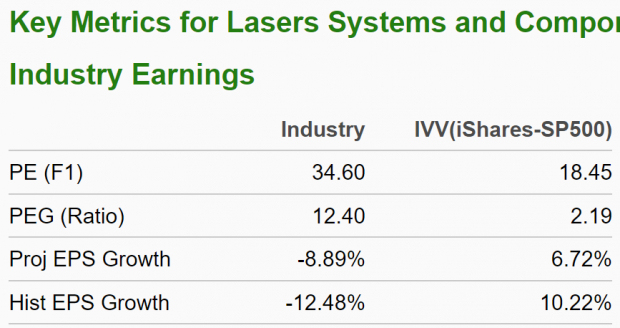

Also note the unfavorable characteristics for this group below:

Image Source: Zacks Investment Research

Candidates in the bottom half of industry groups can often represent potential short candidates. While individual stocks have the ability to outperform even when included in weak industries, their industry association serves as a headwind for any potential rallies. IPG Photonics is fighting an uphill battle and the stock is confirming this notion as it continues to lag behind.

Recent Earnings and Deteriorating Forecasts

The laser developer has a mixed history in terms of earnings. IPG Photonics most recently reported fiscal first-quarter earnings of $0.89/share, missing the $0.95/share consensus estimate by 6.32%. The company has missed the earnings mark in two of the past five quarters.

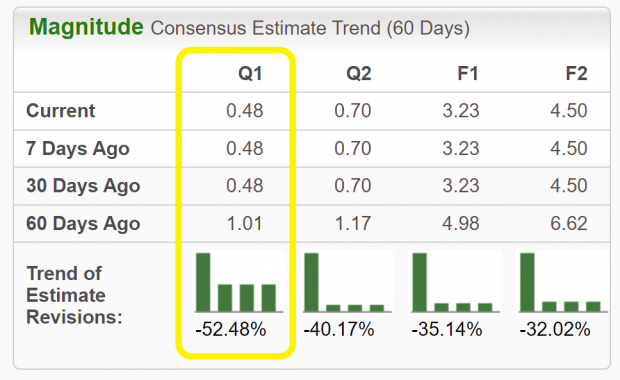

Analysts covering IPGP decreased their earnings estimates recently. For the current quarter, estimates have been slashed by 52.48% in the past 60 days. The Zacks Consensus Estimate sits at $0.48/share, reflecting a 61.9% drop from the year-ago period.

Image Source: Zacks Investment Research

Earnings are projected to plummet 30.2% in fiscal 2024, while sales are anticipated to fall 10.6% to $1.15 billion. These are exactly the types of trends that have the bears laser-focused.

Technical Outlook

IPG Photonics has been steadily falling since last year and has now established a well-defined downtrend. Notice how both the 50-day (blue line) and 200-day (red line) moving averages are sloping down. Shares have declined more than 20% in the past year, all while the major U.S. indices soar to new heights.

Image Source: StockCharts

IPGP stock has also experienced what is known as a “death cross”, whereby its 50-day moving average crosses below its 200-day moving average. IPG Photonics would have to make a serious move to the upside and show increasing earnings estimate revisions to warrant taking any long positions in the stock. Shares remain in negative territory this year while the general market is showing strength.

Final Thoughts

A deteriorating fundamental and technical backdrop show that this stock is not set to laser its way back to new highs anytime soon. The fact that IPGP is included in one of the worst-performing industry groups provides yet another headwind to a long list of concerns.

A history of earnings misses and falling future earnings estimates will likely serve as a ceiling to any potential rallies, nurturing the stock’s downtrend. Potential investors may want to give this stock the cold shoulder, or perhaps include it as part of a short or hedge strategy. Bulls will want to steer clear of IPGP until the situation shows major signs of improvement.

More By This Author:

3 Top Rated Retail Restaurant Stocks To Consider In April

3 Oil & Gas Stocks Poised To Continue Their Winning Streaks In 2024

3 Blue-Chip Retail Stocks Charting Your Course Of Investment

Disclosure: Zacks.com contains statements and statistics that have been obtained from sources believed to be reliable but are not guaranteed as to accuracy or completeness. References to any ...

more