3 Blue-Chip Retail Stocks Charting Your Course Of Investment

Image: Bigstock

In the dynamic world of investing, finding the right balance between risk and reward is like walking a tightrope. While the promise of quick profits can be alluring, it is equally important to anchor your portfolio with stable, long-term investments. This approach is essential now more than ever when there are speculations that the Federal Reserve might reconsider interest rate cuts if inflation persists. Adding to the uncertainty, surging oil prices are causing ripples in the stock market.

Rather than chasing after high-risk, high-reward stocks that often make headlines, investors should meticulously assess market dynamics and develop a well-thought-out investment strategy. The emphasis should be on well-established companies with a proven record and resilience to weather economic downturns.

For long-term stability and consistent growth, market experts incline toward highly reputable companies with substantial market capitalization, commonly known as blue-chip companies. These industry giants showcase financial resilience and have a history of delivering robust returns to shareholders.

Blue-chip companies are less susceptible to sudden stock price fluctuations, making them a reliable choice for both experienced and novice investors. For those seeking regular income, blue-chip companies provide steady dividend payouts, adding to their stability.

These companies boast a winning combination of established market positions, strong brand recognition, loyal customer bases, and extensive market penetration. These traits give them a distinct competitive advantage, make them investor favorites, and can unlock growth opportunities.

By investing in blue-chip stocks, investors can build a well-diversified portfolio. Here, we have identified three stocks from the Retail - Wholesale sector — Walmart Inc. (WMT - Free Report), The Home Depot, Inc. (HD - Free Report), and Costco Wholesale Corporation (COST - Free Report).

Thanks to their successful business operations, these bellwethers have withstood multiple market gyrations and delivered returns to investors. These blue-chip stocks have enough balance sheet strength to tackle any untoward market volatility.

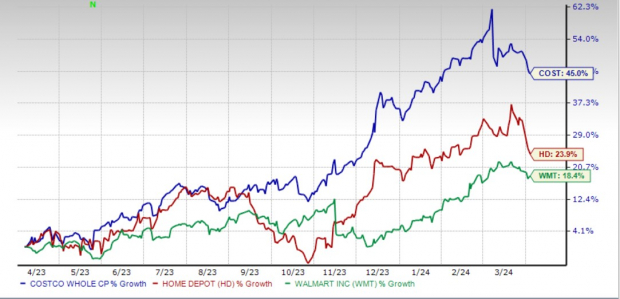

Past-Year Price Performance

Image Source: Zacks Investment Research

3 Prominent Picks - Walmart

This omnichannel retail giant has been diligently working to strengthen its already formidable presence in the market. The company has embarked on a series of strategic e-commerce initiatives, encompassing acquisitions, partnerships, and significant improvements in its delivery and payment systems.

Simultaneously, Walmart is committed to elevating its merchandise offerings, ensuring a diverse and appealing product assortment. This innovation extends to its supply chain, wherein the company is enhancing capacity and introducing cutting-edge solutions.

Walmart has a market cap of $479.5 billion as of April 4, 2024. This Zacks Rank #3 (Hold) stock has a trailing four-quarter earnings surprise of 7.3%, on average.

The Zacks Consensus Estimate for Walmart’s current financial-year sales and earnings suggests growth of 3.6% and 6.3%, respectively, from the year-ago reported numbers. The company pays out a quarterly dividend of about 21 cents per share (83 cents annualized), giving a 1.4% yield at the recent stock price. The stock's payout ratio is 34, with a five-year dividend growth rate of 1.8%.

Home Depot

Headquartered in Atlanta, GA, Home Depot stands as another distinguished blue-chip stock, dominating the home improvement retail sector. Its consistent expansion in the Professional and Do-It-Yourself segments, fortified by an extensive product lineup and digital innovations, underpins its remarkable success. The company's interconnected retail strategy and robust technological infrastructure have amplified web traffic, leading to growth in digital sales.

Home Depot has a market cap of approximately $354.5 billion. This Zacks Rank #3 (Hold) stock has a trailing four-quarter earnings surprise of 2%, on average.

The Zacks Consensus Estimate for Home Depot’s current financial-year sales and earnings suggests growth of 1.2% and 1.8%, respectively, from the year-ago reported numbers. The company pays out a quarterly dividend of $2.25 per share ($9 annualized), giving a 2.5% yield at the recent stock price. The stock's payout ratio is 55, with a five-year dividend growth rate of 11.1%.

Costco

Finally, this consumer defensive stock has been surviving the recent market turmoil rather well. Strategic investments, a customer-centric approach, merchandise initiatives, and an emphasis on memberships have served as this discount retailer’s primary strengths.

Costco's distinctive membership business model and pricing power set it apart from other traditional players. Through a calculated approach that involves identifying untapped markets and tailoring offerings to meet customer preferences, Costco has managed to deepen its roots.

Costco has a market cap of around $312.6 billion. This Zacks Rank #3 (Hold) stock has a trailing four-quarter earnings surprise of 2.6%, on average.

The Zacks Consensus Estimate for Costco’s current financial-year sales and EPS suggests growth of 4.1% and 8.9%, respectively, from the year-ago period’s actuals. The company pays out a quarterly dividend of $1.02 per share ($4.08 annualized), giving a 0.6% yield at the recent stock price. The stock's payout ratio is 26, with a five-year dividend growth rate of 11.7%.

More By This Author:

Hershey Stock Falls Amid Market Uptick: What Investors Need To Know3 Stocks To Tap Growth And Value In The Software & Services Industry

Time To Buy Stock In These Highly Ranked Multi-Sector Conglomerates

Disclosure: Zacks.com contains statements and statistics that have been obtained from sources believed to be reliable but are not guaranteed as to accuracy or completeness. References to any ...

more