3 Top Rated Retail Restaurant Stocks To Consider In April

Several retail restaurant stocks have become attractive this spring with a few being some of the market's top performers so far this year while others look poised for a rebound.

With these stocks sporting a Zacks Rank #2 (Buy), here’s a look at three of the top retail restaurant's to consider investing in right now.

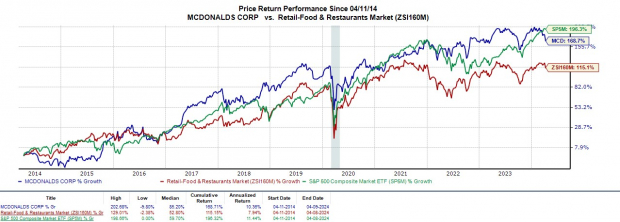

McDonald’s (MCD - Free Report) : Starting the list is McDonald’s, as the iconic fast food chain has remained a viable investment with steady growth. McDonald’s historical performance attests to this as well with MCD up a very respectable +168% over the last decade which has narrowly trailed the S&P 500’s +196% but has topped the Zacks Retail-Restaurants Market’s +115%.

Image Source: Zacks Investment Research

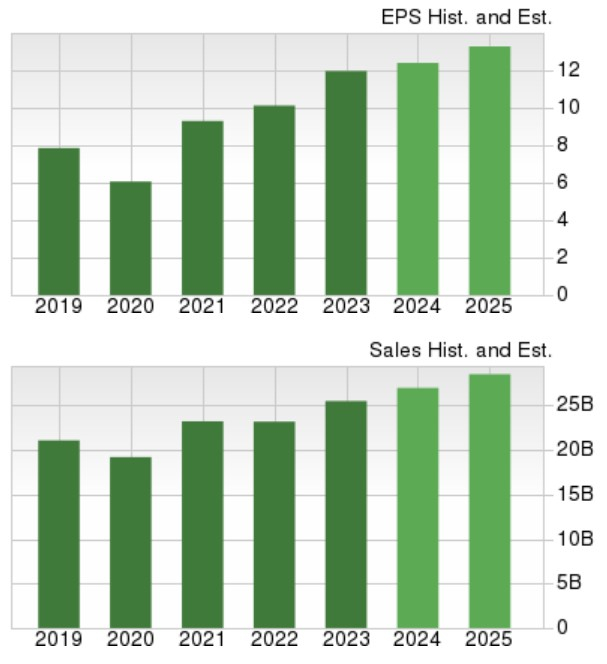

Keeping McDonald’s historical performance in mind, this year’s -10% dip in MCD is starting to look like a buying opportunity. To that point, McDonald’s annual earnings are expected to rise 3% in fiscal 2024 and jump another 9% in FY25 to $13.49 per share. The burger giant's total sales are projected to expand over 6% in FY24 and FY25 with projections well over $25 billion. Plus, McDonald’s offers a 2.5% annual dividend yield to support long-term investors.

Image Source: Zacks Investment Research

Brinker International (EAT - Free Report) : For consumers, Brinker International may not immediately ring a bell but the company operates two popular restaurant franchises in American style Chili’s Bar & Grill and Italian eatery Maggiano’s.

What stands out about Brinker International’s stock is its “A” Zacks Style Scores grade for Value. Brinker International’s stock trades at 13X forward earnings which is a significant discount to the Zacks Retail-Restaurant’s Industry average of 23.8X and the S&P 500’s 21.9X.

Image Source: Zacks Investment Research

Furthermore, Brinker International’s stock has risen +10% year to date with forecast of double-digit EPS growth in FY24 and FY25. Notably, EAT recently hit 52-week highs of $51.72 a share at the beginning of the month and a recent pullback over the last week looks like a healthy correction considering Brinker International’s stock is still up +25% over the last year.

Image Source: Zacks Investment Research

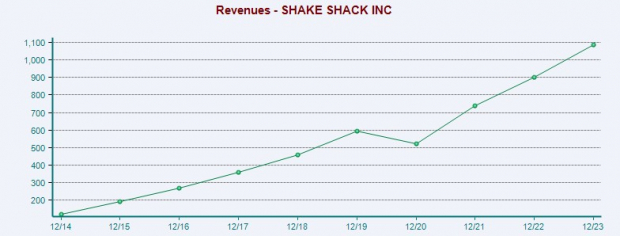

Shake Shack (SHAK - Free Report) : With its stock soaring +33% year to date, Shake Shack’s “A” Zacks Style Scores grade for Growth is compelling. Expanding as a fast food hamburger chain known for its frozen shakes and custards, Shake Shack’s stock has now climbed +75% in the last year.

Image Source: Zacks Investment Research

Since going public in 2015, Shake Shack has continued its domestic expansion while also embarking on an international presence that includes locations in Mexico, Dubai, the Bahamas, and Bangkok. Shake Shack has expanded into China as well and plans to operate 79 locations in the People's Republic by 2031.

Expecting double-digit percentage growth on its top and bottom lines in FY24 and FY25, Shake Shack's increased profitability is reassuring. Hitting $1 billion in annual sales last year, Shake Shack's earnings are projected to soar 92% in FY24 to $0.71 per share versus EPS of $0.37 in 2023. Better still, FY25 EPS is forecasted to leap another 37% to $0.97 a share.

Image Source: Zacks Investment Research

Takeaway

These top-rated retail restaurant stocks are starting to offer investors the options of growth and value that they look for in a portfolio. More importantly, McDonald’s, Brinker International, and Shake Shack’s stock should be viable investments for 2024 and beyond.

More By This Author:

3 Oil & Gas Stocks Poised To Continue Their Winning Streaks In 20243 Blue-Chip Retail Stocks Charting Your Course Of Investment

Hershey Stock Falls Amid Market Uptick: What Investors Need To Know

Disclosure: Zacks.com contains statements and statistics that have been obtained from sources believed to be reliable but are not guaranteed as to accuracy or completeness. References to any ...

more