Bear Of The Day: IDEX

Although the Zacks Manufacturing-General Industrial Industry is in the top 33 percentile of more than 250 Zacks industries, IDEX Corporation (IEX) appears to be losing some of its footing in the space.

Declining earnings estimates and cracks in the company’s valuation land IDEX’s stock a Zacks Rank #5 (Strong Sell) and the Bear of the Day.

This cautionary tale is mostly attributed to weakness in IDEX’s Health and Sciences Technology segment, escalating cost of sales, and unfavorable movements in foreign currencies.

Various Valuation Concerns

IDEX's stock tends to be attractive as an applied solutions company that specializes in a diverse range of applications but several financial valuation metrics are concerning at the moment.

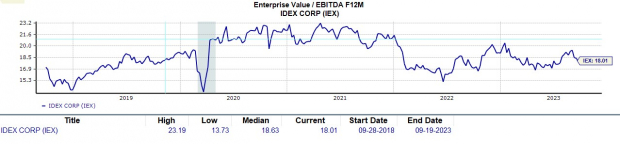

EV/EBITDA: In terms of enterprise value IDEX's EV/EBITDA of 18.01 is noticeably above its industry average of 9.79 with a lower number typically considered better.

(Click on image to enlarge)

Image Source: Zacks Investment Research

Price/Cash Flow: In terms of cash flow, IDEX's P/CF of 24.4X is above the optimum level of less than 20X and uncomfortably above the industry average of 10.2X and the S&P 500’s 17.1X.

(Click on image to enlarge)

Image Source: Zacks Investment Research

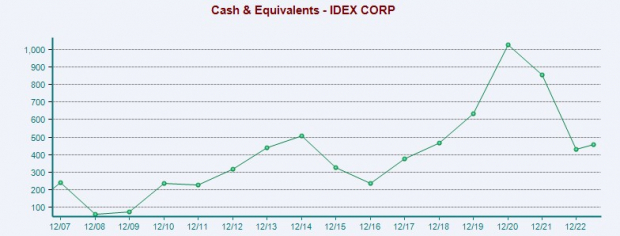

Notably, IDEX has shown the ability to generate strong net cash flow from its operating activities but its cash & equivalents were cut in half at the end of 2022 at $430 million compared to $855 million in 2021 after acquiring wastewater solutions provider Nexsight LLC for $120 million among other expansion costs.

(Click on image to enlarge)

Image Source: Zacks Investment Research

Declining Earnings Estimates

IDEX's annual earnings are now forecasted to dip -2% in fiscal 2023 but rebound and rise 8% in FY24 to $8.61 per share. However, in the last 60 days, FY23 and FY24 EPS estimates have dipped -6% and -5% respectively which can be an indication of more short-term volatility ahead.

(Click on image to enlarge)

Image Source: Zacks Investment Research

Piggybacking off of valuation concerns this also makes IDEX’s 26.4X forward earnings multiple much less attractive as it is above the industry average of 19.4X and the S&P 500’s 20.8X.

(Click on image to enlarge)

Image Source: Zacks Investment Research

Bottom Line

Considering investors are still paying a premium for IDEX’s price to sales relative to its industry and the S&P 500 as well, investors may want to be cautious at the moment. IDEX's stock is down a lackluster -8% year to date and more short-term risks continue to mount in terms of valuation despite the company’s long-term potential.

More By This Author:

Are These 3 Top-Ranked Mutual Funds In Your Retirement Portfolio?Should You Watch JPMorgan For A Higher Dividend?

Bear of the Day: Southwest Airlines

Disclosure: Zacks.com contains statements and statistics that have been obtained from sources believed to be reliable but are not guaranteed as to accuracy or completeness. References to any specific ...

more