Bear Of The Day: Southwest Airlines

Overview

Based in Dallas, TX, Southwest Airlines (LUV) is a low-cost airline provider mainly servicing the United States and “ten near-international” markets. Southwest provides short-haul, high-frequency, point-to-point, low-fare services. The company’s point-to-point route structure includes services to and from many secondary or downtown airports such as Dallas Love Field, Houston Hobby, Chicago Midway, Baltimore-Washington International, and Ft-Lauderdale-Hollywood.

Low Cost = Low Performance

Low-cost carriers like Spirit Airlines (SAVE) and Southwest Airlines have been dramatically underperforming their larger peers such as United Airlines (UAL).

What is Behind the Underperformance?

Unprofitable and moving in the wrong direction

In Q4, Southwest Airlines swung to a loss for the first time in three quarters. The 38-cent loss was wider than the Zacks Consensus Estimate of 3 cents. Adding to the disappointment, Southwest earned has seen three straight quarters of negative EPS growth.

Operational Disruptions

Massive flight cancellations due to extreme winter weather conditions adversely impacted Southwest’s operations. Because Southwest is more focused on one part of the globe when compared to its larger counterparts, the company suffered more. Nearly 17,000 flights were cancelled in the last ten days of 2022 – equating to a pre-tax negative impact of approximately $800 million.

In Fighting & Bad Publicity

Southwest is known and loved by its customers because of the laid-back nature of its flight attendants and employees. This laissez faire attitude is that Southwest management has found that many customers appreciate a less stuffy environment. However, that may change soon. Southwest pilots and employees are seeing little progress in trying to reach a new contract deal. If a strike is to take place, it will lead to even higher costs – especially since competitors like United and American Airlines (AAL) have already reached deals with their respective unions.

Margins are Being Squeezed

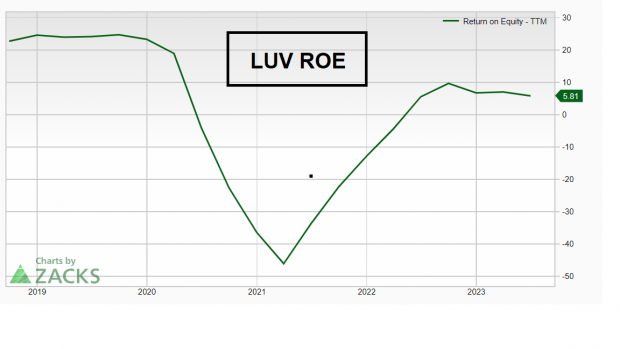

Rising fuel and labor costs are causing Southwest’s financial efficiency to take a significant hit. In fact, LUV’s return-on-equity of 5.81% pales in comparison to the S&P 500 Index’s 26.2%.

(Click on image to enlarge)

Image Source: Zacks Investment Research

Relative Weakness: When it comes to the stock market, price action = truth. Over the past six months, the S&P 500 Index is up 15.90%, while Southwest is down 14.1%

(Click on image to enlarge)

Image Source: Zacks Investment Research

Negative Earnings ESP Score

Zacks Earnings ESP (Expected Surprise Prediction) measures the chances a company will beat or miss on earnings. LUV has the unfortunate mix of a Zacks Rank #5 (Strong Sell) and a negative ESP – suggesting the company is likely to miss earnings when it reports October 26th.

(Click on image to enlarge)

Image Source: Zacks Investment Research

Conclusion

Prospective airline investors should avoid low-cost carriers, such as Southwest and instead opt for larger players such as United Airlines. Southwest has slower growth, shrinking margins, and notable reputational damage to contend with. Furthermore, the price action is disheartening when compared to the market and the airline group.

More By This Author:

Costco Lined Up For Q4 Earnings: What's In The Offing?These 2 Finance Stocks Could Beat Earnings: Why They Should Be On Your Radar

Time To Buy These Recent IPOs After Instacart's Day View?

Disclosure: Zacks.com contains statements and statistics that have been obtained from sources believed to be reliable but are not guaranteed as to accuracy or completeness. References to any specific ...

more