ASX Trading: BHP Group Ltd. Analysis & Forecast, July 21

ASX: BHP GROUP LIMITED – BHP Elliott Wave Technical Analysis (TradingLounge 1D Chart)

Greetings,

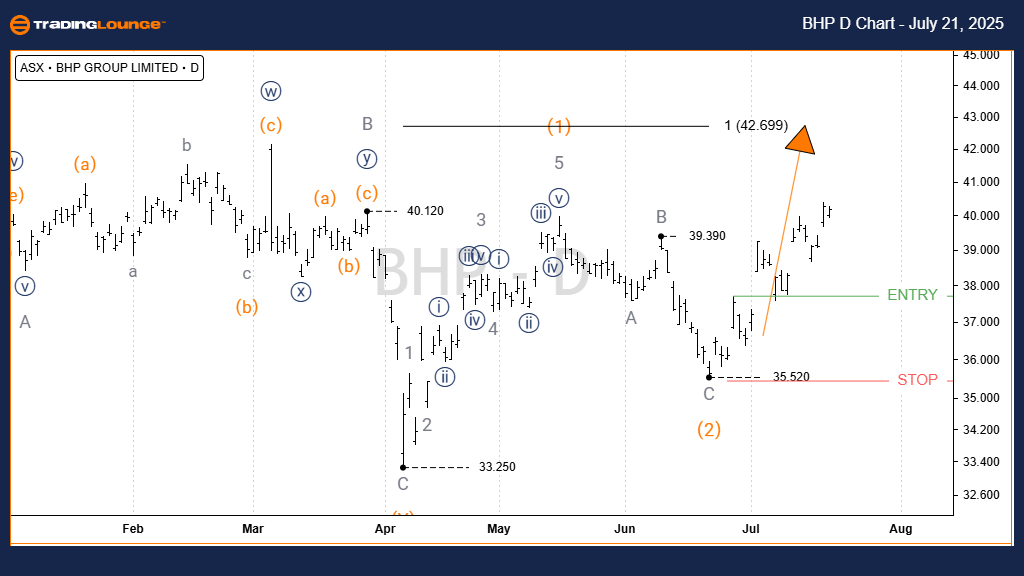

Today's Elliott Wave analysis brings an update for BHP GROUP LIMITED – BHP on the Australian Stock Exchange (ASX). Based on our analysis, ASX:BHP has potential for further upward movement. The wave 2 (orange) appears to have ended as a Zigzag pattern, which could lead into a stronger wave 3 (orange) rally. This article focuses on potential price targets and the conditions needed for this forecast to remain valid.

ASX: BHP Elliott Wave Technical Analysis (1D Chart – Semilog Scale)

- Function: Major Trend (Intermediate Degree, Orange)

- Mode: Motive

- Structure: Impulse

- Position: Wave 3 (Orange)

Analysis Details:

From the low of 33.25, wave 1 (orange) completed as a five-wave pattern. Following this, wave 2 (orange) likely completed a Zigzag correction labeled A-B-C (grey). This structure now supports the development of wave 3 (orange), targeting a range between 42.70 and 47.84. The bullish scenario remains valid as long as the price stays above 35.52.

- Invalidation Point: 35.52

ASX: BHP Elliott Wave Technical Analysis (4-Hour Chart)

- Function: Major Trend (Intermediate Degree, Orange)

- Mode: Motive

- Structure: Impulse

- Position: Wave 3 (Orange)

Detailed Analysis:

Looking into the 4-hour chart, the structure confirms the previous 1D chart outlook. Traders can consider a Long Trade setup once the price breaks above the Entry level, triggering confirmation of the uptrend.

- Invalidation Point: 35.52

Conclusion

This analysis delivers an updated Elliott Wave count and short-term strategy for ASX: BHP GROUP LIMITED (BHP). It highlights current market conditions and how traders might capitalize on them. Price points are clearly defined to validate or invalidate the current wave outlook, supporting higher confidence in trading decisions. Our goal is to provide precise and practical insights into price action.

Technical Analyst: Hua (Shane) Cuong, CEWA-M (Certified Elliott Wave Analyst – Master Level)

More By This Author:

Elliott Wave Technical Forecast: Newmont Corporation - Friday, July 18

U.S. Stocks: Rigetti Computing Inc.

Elliott Wave Technical Analysis: Australian Dollar/U.S. Dollar - Friday, July 18

At TradingLounge™, we provide actionable Elliott Wave analysis across over 200 markets. Access live chat rooms, advanced AI & algorithmic charting tools, and curated trade ...

more