Are Stock Prices Still Forming A Bottom?

The S&P 500 keeps extending its consolidation – is this a potential bottoming pattern?

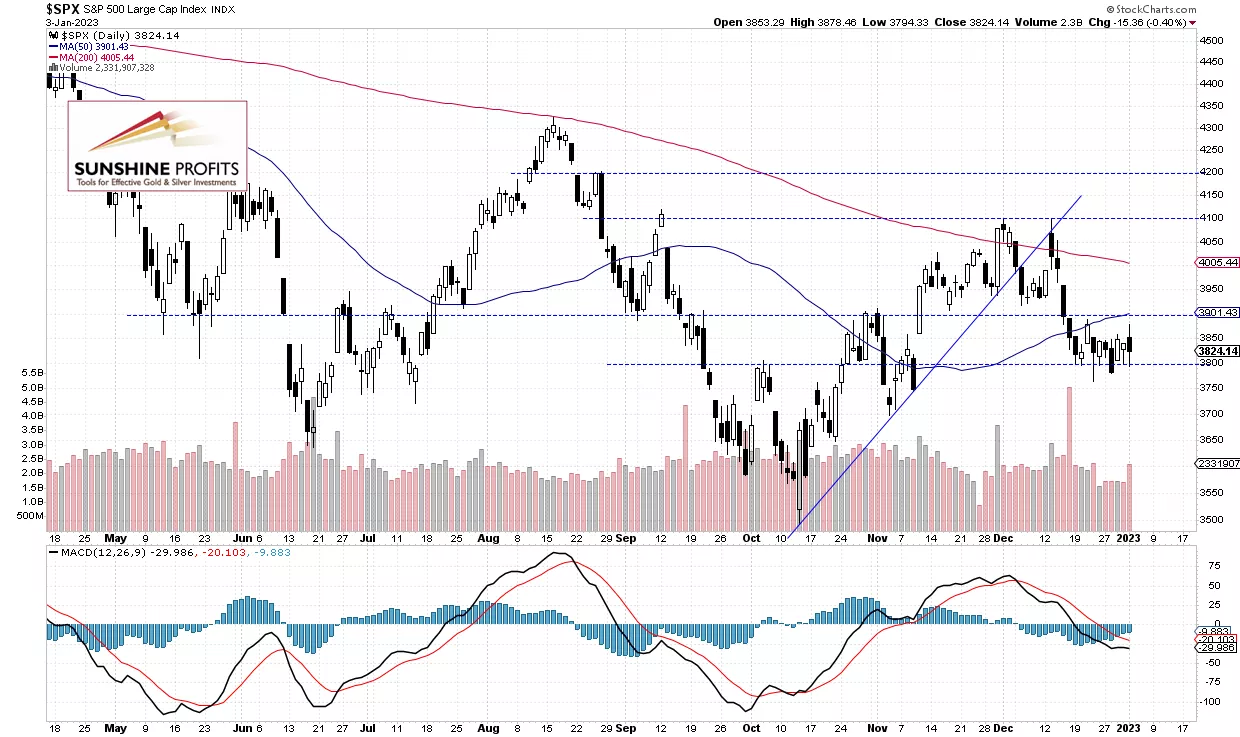

The broad stock market index lost 0.40% on Tuesday, after opening above its last Friday’s closing price. It extended an over two-week-long consolidation along the 3,800 level. On the previous week’s Thursday, it reached a new medium-term low of 3,764.49, before bouncing back above 3,800. Overall it kept extending a consolidation following the decline from the 4,100 level. In mid-December, the S&P 500 has been negatively reacting to the December 14 FOMC interest rate hike, among other factors.

The S&P 500 will likely open 0.3% higher this morning. We may see another attempt at breaking above the recent trading range. The S&P 500 index trades within an over two-week-long consolidation and above the 3,800 level, as we can see on the daily chart:

(Click on image to enlarge)

Futures Contract Bounces Back and Forth

Let’s take a look at the hourly chart of the S&P 500 futures contract. Yesterday it came back to the resistance level of around 3,900, but then it fell closer to the support level of 3,800 again.

(Click on image to enlarge)

Conclusion

The S&P 500 is expected to open slightly higher on Wednesday. The market will be waiting for the important ISM Manufacturing PMI, JOLTS Job Openings releases at 10:00 a.m. and the FOMC Meeting Minutes release at 2:00 p.m. So it may see more volatility today. There have been no confirmed positive signals so far. However, stocks may be forming a bottom here.

Here’s the breakdown:

- The S&P 500 index continues to trade within its short-term consolidation.

- There have been no confirmed positive signals so far, however, stocks may be forming a bottom.

- In our opinion, the short-term outlook is bullish.

More By This Author:

Stock Prices Go Sideways – Are They Forming A Bottom?

Stocks: Short-Term Uncertainty Following Recent Declines

Are Stocks Close To A Short-Term Bottom?

Disclaimer: All essays, research, and information found above represent analyses and opinions of Paul Rejczak and Sunshine Profits' associates only. As such, it may prove wrong and be a ...

more