Stock Prices Go Sideways – Are They Forming A Bottom?

The stock market extends its week-long consolidation – is this still a potential bottoming pattern?

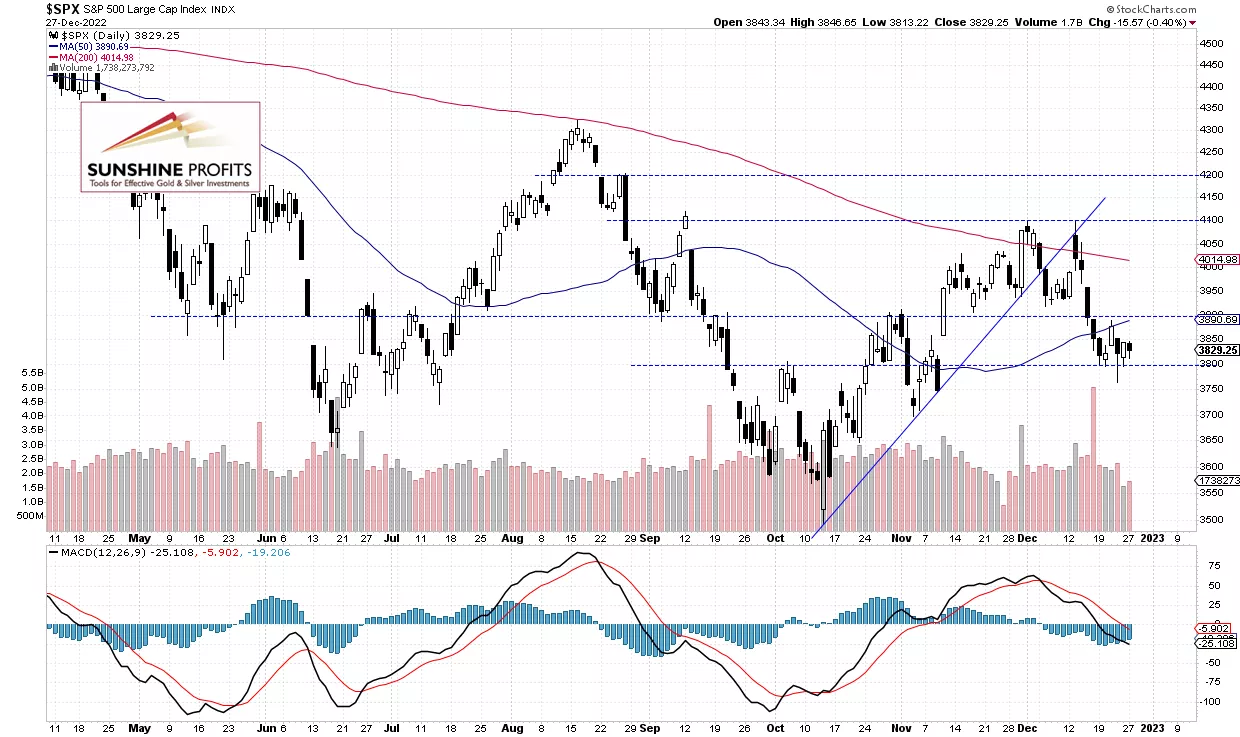

The S&P 500 index lost 0.40% on Tuesday, as it bounced from the 3,800 level once again. Last week on Thursday it reached a new medium-term low of 3,764.49, before bouncing back above 3,800. Overall it extended a week-long consolidation following the decline from the 4,100 level. Recently the S&P 500 has been negatively reacting to the December 14 FOMC interest rate hike, among other factors.

Today the S&P 500 will likely open 0.1% higher and we may see more uncertainty and consolidation along the 3,800 level. In early December the S&P 500 index broke below its two-month-long upward trend line and recently it moved sharply lower after getting back to that line, as we can see on the daily chart:

(Click on image to enlarge)

Futures Contract – Still Close to 3,850

Let’s take a look at the hourly chart of the S&P 500 futures contract. This morning it is trading within a relatively narrow price range. The resistance level remains at 3,900-3,920, and on the other hand, the support level is at 3,800.

(Click on image to enlarge)

Conclusion

The S&P 500 index keeps extending its consolidation following the mid-month sell-off. Today we may see a quite neutral opening of the trading session. There have been no confirmed positive signals so far. However, stocks may be forming a bottom here.

Here’s the breakdown:

- The S&P 500 index extended its short-term consolidation on Tuesday.

- There have been no confirmed positive signals so far, however, stocks may be forming a bottom.

More By This Author:

Stocks: Short-Term Uncertainty Following Recent Declines

Are Stocks Close To A Short-Term Bottom?

Are Stocks In A New Downtrend?

Disclaimer: All essays, research, and information found above represent analyses and opinions of Paul Rejczak and Sunshine Profits' associates only. As such, it may prove wrong and be a ...

more