Stocks: Short-Term Uncertainty Following Recent Declines

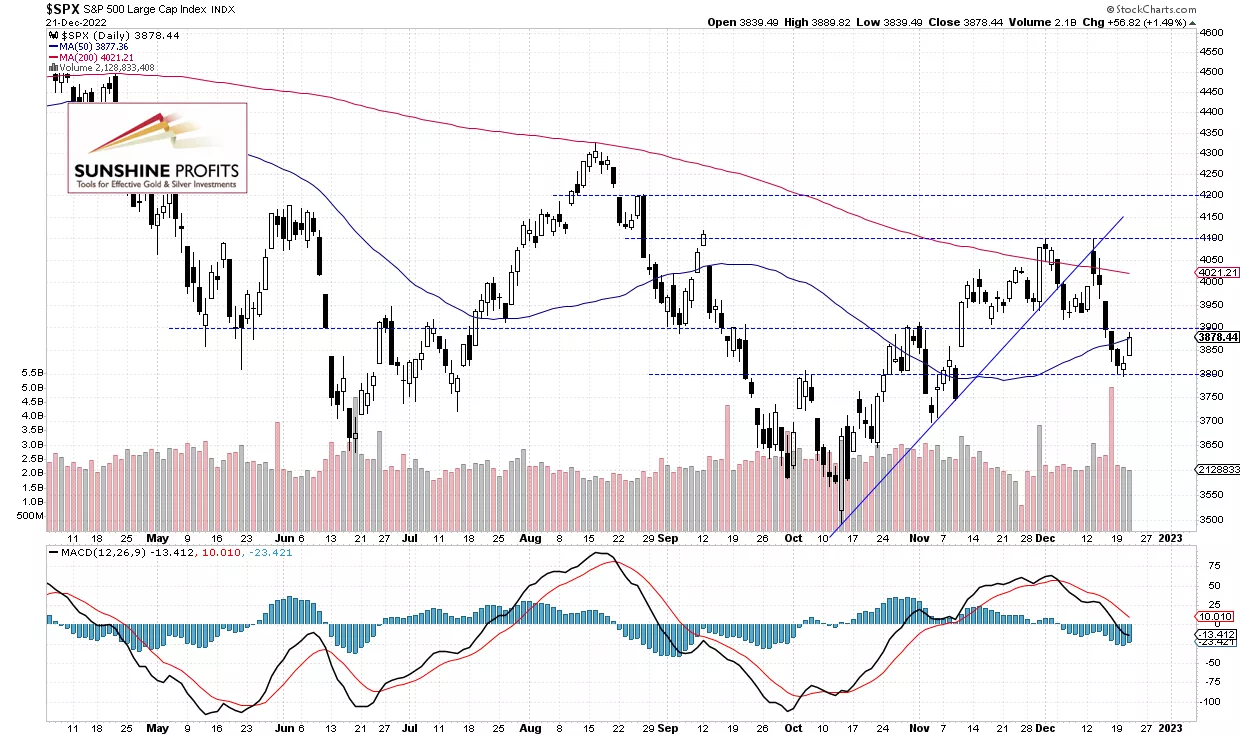

S&P 500 index bounced from the 3,800 level – was it a reversal or just an upward correction?

The S&P 500 index gained 1.49% yesterday, as it retraced some of the recent declines. It went closer to the 3,900 level again after bouncing from Tuesday’s new local low of 3,795.62. On Tuesday the markets were very volatile, but they didn’t extend their declines. Recently the S&P 500 reacted to last week’s Wednesday’s FOMC interest rate hike, among other factors.

Today stock prices are expected to open 0.8% lower after better-than-expected economic data releases (Final GDP, Unemployment Claims). In early December the S&P 500 index broke below its two-month-long upward trend line and it moved sharply lower after getting back to that line last week, as we can see on the daily chart:

(Click on image to enlarge)

Futures Contract Trades Below 3,900

Let’s take a look at the hourly chart of the S&P 500 futures contract. Yesterday it broke above the 3,900 level, but this morning it’s trading lower again. The support level remains at around 3,800.

(Click on image to enlarge)

Conclusion

The S&P 500 index will likely open 0.8% lower this morning. Stocks bounced on Wednesday, but today we may see some more uncertainty and sideways trading action. There have been no confirmed positive signals so far. However, stocks may be forming a bottom here.

Here’s the breakdown:

- The S&P 500 index retraced some of its recent declines yesterday.

- Stocks will likely extend their short-term consolidation ahead of a holiday weekend.

More By This Author:

Are Stocks Close To A Short-Term Bottom?

Are Stocks In A New Downtrend?

Stocks to Rally After CPI, But Will They Reach New Highs?

Disclaimer: All essays, research, and information found above represent analyses and opinions of Paul Rejczak and Sunshine Profits' associates only. As such, it may prove wrong and be a ...

more