Apple Slides After Iphone Sales Miss, China Revenues Unexpectedly Tumble

Image Source: Unsplash

Ahead of earnings of the world's largest company which however has been going through a painful period of remarkable underperformance vs the Nasdaq, UBS had Apple sentiment at a quite subdued 5/10, saying that a number of folks are "treating the name as a funding short – a view mirrored in its elevated short interest (though it’s not a stand-out short in our Prime book, and the recent -11% pullback may have taken out some of that caution)." That said, UBS writes that there’s "no doubt AAPL finds itself well-positioned to mediate consumer AI adoption – a fact that keeps long-onlies engaged at these multiples... which are not worrisome for a services company like the one AAPL continues to become, notwithstanding the loss of GOOGL’s TAC fee."

Still, for a stock that owes its last 50% in price upside to the euphoric post CCDC 2024 meltup, when the narrative emerged that AAPL would capitalize on the AI boom, only to find itself in a dismal position with virtually zero uptake, the downside for the company could be substantial if the market finally starts demanding some returns on the what is now becoming a very long AI hype cycle for the world's most valuable smartphone company with virtually no IRR to show for it.

Even Bloomberg admits that it’s undeniable that Apple is in a bit of a troubled period. While rivals are thriving in artificial intelligence, Apple is a clear laggard with an inferior product that has missed the boat in the age of ChatGPT, Gemini and, now, DeepSeek. While Apple Intelligence was meant to help sell iPhones, it’s likely that the year-over-year bump we may see today in revenue is stemming from other changes -- like slightly bigger screens and new camera features -- as well as pent-up demand. The AI features have rolled out slowly and are thus far not much more than a marketing gimmick.

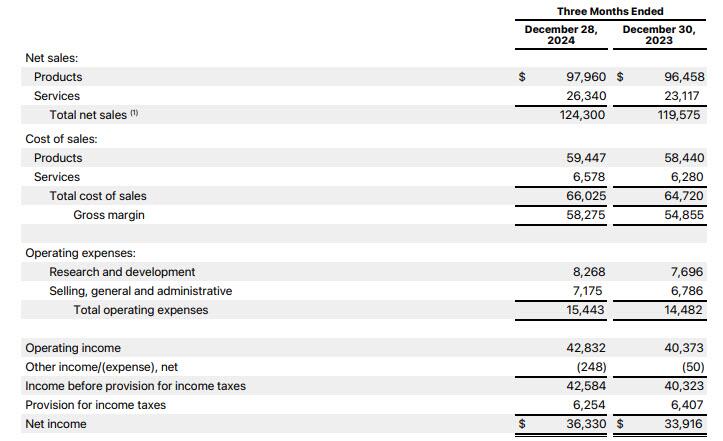

In any case, Apple is set to report its holiday quarter earnings results, which naturally is the most important period of the year, given that the company sees most of its sales over the holidays and saves its major new products for release during the quarter. Wall Street, matching Apple’s forecast from last fall, expects Apple’s sales to increase about 4% on an annual basis as the company reports its strongest results ever. As we previewed earlier, analysts estimate Apple will report $124 billion in revenue and its best iPhone quarter since 2022. Here are the average estimates compiled by Bloomberg for the major categories:

- iPhone revenue: $71 billion

- iPad revenue: $7.35 billion

- Mac revenue: $7.94 billion

- Wearables, Home and Accessories revenue: $12 billion

- Services revenue: $26.1 billion

If these numbers hold, that would mean Apple is looking at a clean sweep of growth annually in all of its product categories.

So how did AAPL do? Well, as many warned, the two weakest links - namely iPhone sales and China - is precisely what Apple disappointed. Here are the details:

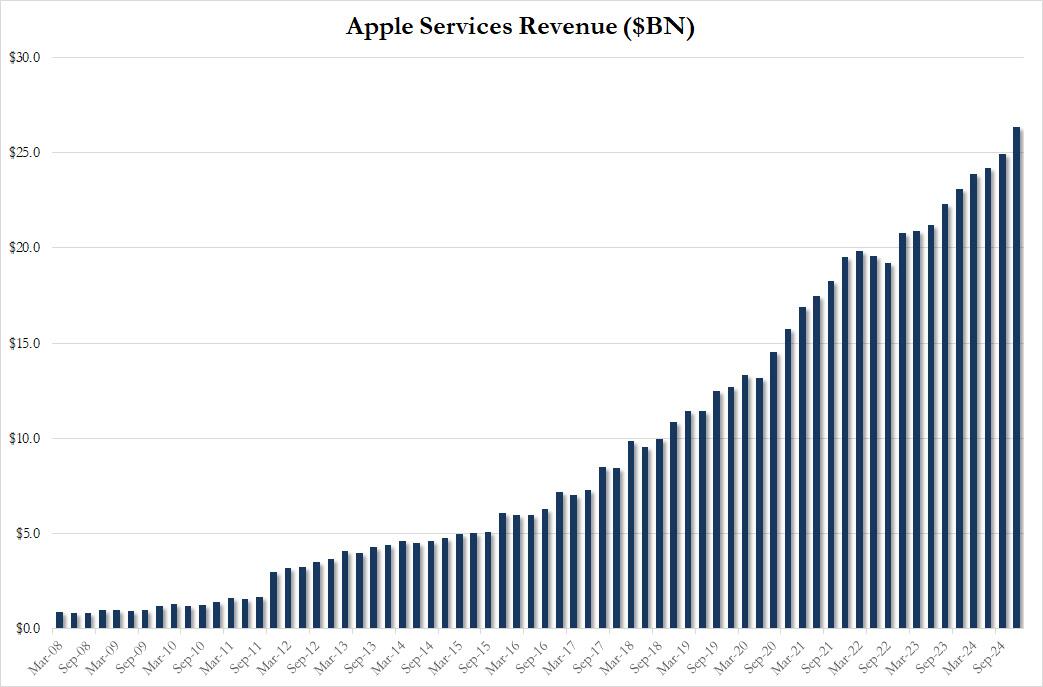

- Adjusted EPS $2.40 vs. $2.18 y/y, beating estimate $2.35

- Revenue $124.30 billion, +4% y/y, beating estimates $124.1 billion

- Products revenue $97.96 billion, +1.6% y/y, missing estimates of $98.02 billion

- IPhone revenue $69.14 billion, -0.8% y/y, badly missing estimates of $71.04 billion

- Mac revenue $8.99 billion, +16% y/y, beating estimates of $7.94 billion

- IPad revenue $8.09 billion, +15% y/y, beating estimates of $7.35 billion

- Wearables, home and accessories $11.75 billion, -1.7% y/y, missing estimates of $11.95 billion

- Revenue $124.30 billion, +4% y/y, beating estimates $124.1 billion

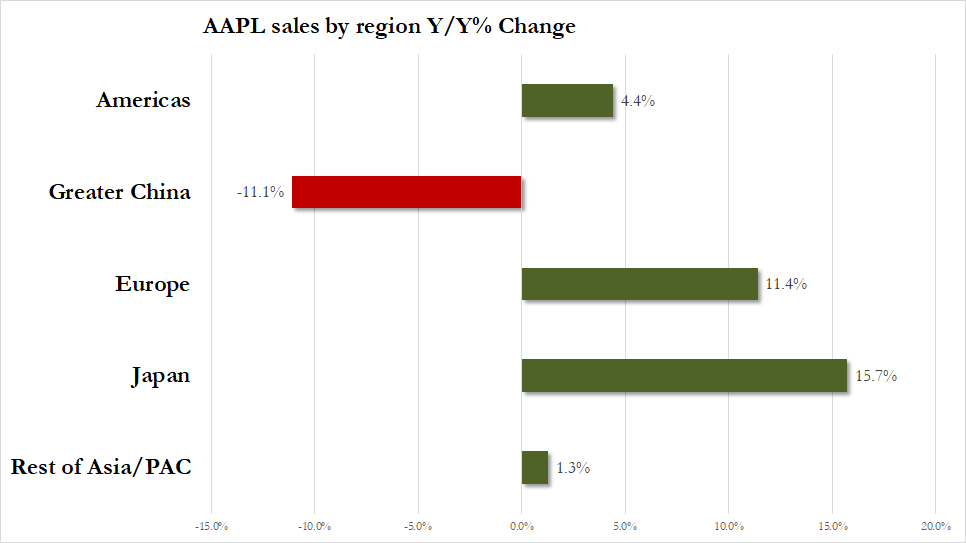

- Service revenue $26.34 billion, +14% y/y, beating estimates of $26.1 billion

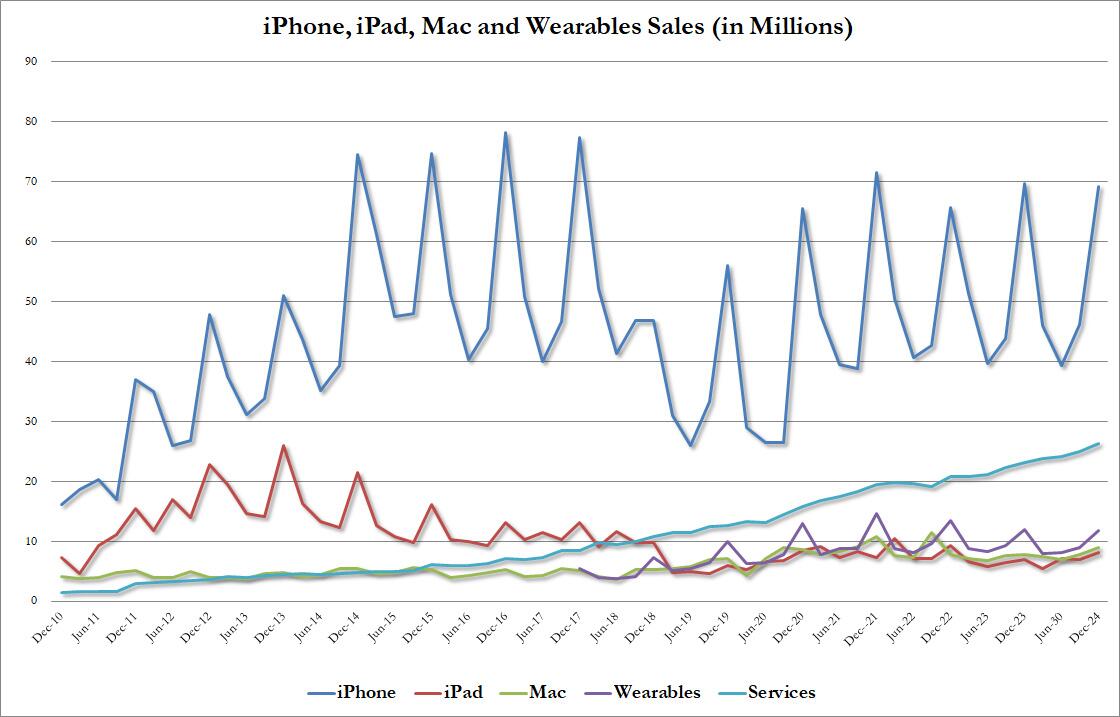

The one - very big - fly in the ointment was the usual suspect: China, where revenues unexpectedly tumbled, sliding a whopping 11%, and badly missing estimates of a $21.57BN print

- Greater China rev. $18.51 billion, -11% y/y, estimate $21.57 billion

Going down the line:

- Total operating expenses $15.44 billion, +6.6% y/y, above estimates of $15.34 billion

- Cost of sales $66.03 billion, +2% y/y, above estimates of $65.98 billion

- Gross margin $58.28 billion, +6.2% y/y, above estimates of $57.98 billion

- Cash and cash equivalents $30.30 billion, -26% y/y, below estimates of $36.45 billion

And so on:

Looking at a breakdown of sales by product category it goes from bad to worse, because not only did revenue from the iPhone came in much lower than expected, at $69.1 billion, below estimates of $71.0 billion but it was actually down 1.4% YoY. So much for any hopes of an AI supercycle.

The rest of the product suite was mixed with Mac and iPad revenue coming in above estimates while wearables missed. Here are the details: .

- IPhone revenue $69.14 billion, down 0.8% y/y, and missing estimate $71.04 billion

- Mac revenue $8.99 billion, +16% y/y, beating estimates of $7.94 billion

- IPad revenue $8.09 billion, +15% y/y, also beating estimates of $7.35 billion

- Wearables, Home and Accessories was another disappointment, declining considerably and missing Wall Street expectations, wit: 11.75 billion, down 1.7% y/y, and missing estimate $11.95 billion

Bottom line, there simply is not a lot of excitement in Apple’s wearables segment right now. The other concerning part about Wearables, Home and Accessories is that revenue continues to fall despite Apple launching a $3,500 device that is its first major new product category in a decade as part of the segment this year.

But if soft iPhone sales news was bad, the devastation that is China sales was catastrophic: contrary to expectations for a modest rebound, China sales declined for a sixth consecutive quarter, down a whopping 11.1%, and printing at only $18.5BN in what is supposed to be the strongest quarter, below the $21.6BN estimate. The rest of the world saw growth, modest in the Americas at 3.9%, and stronger in Europe and APAC, both double digits.

Greater China continues to be a very weak spot for Apple and the company hasn’t done much to push new products, pricing and initiatives in that market -- or other emerging areas -- to offset the issues.

The weakness there, which Apple will try to explain away in its conference call, is because of a combination of nationalism and interest in local products, whose designs are getting better. The local players are also trying new things like foldables while Apple continues to use the same design it rolled out five years ago.

The result: revenues declining now for an unprecedented 5 quarters!

There was a slight silver lining in the company's Service revenue, which after missing last quarter, come in stronger than expected, rising to a new record $26.34 billion, 14% YoY and above the $26.1 billion expected. The question is what will happen once this last saving grace flatlines or, worse, starts contracting.

In the press release, CEO Tim Cook tried hard to stay positive, calling it the company’s “best quarter ever.”

“Today Apple is reporting our best quarter ever, with revenue of $124.3 billion, up 4 percent from a year ago. We were thrilled to bring customers our best-ever lineup of products and services during the holiday season. Through the power of Apple silicon, we’re unlocking new possibilities for our users with Apple Intelligence, which makes apps and experiences even better and more personal. And we’re excited that Apple Intelligence will be available in even more languages this April.”

New CFO Kevan Parekh also got his first quote:

“Our record revenue and strong operating margins drove EPS to a new all-time record with double-digit growth and allowed us to return over $30 billion to shareholders. We are also pleased that our installed base of active devices has reached a new all-time high across all products and geographic segments.”

Yet despite management's valiant attempt to put lipstick on this particular pig, investors would have none of it and after an early headfake after hours which briefly sent the stock as high as $245, AAPL is now at session lows, dropping to $234 and falling.

(Click on image to enlarge)

More By This Author:

Q4 GDP Growth Comes In Unexpectedly Light Despite Red Hot Personal Spending Beating Estimates By A Record

Inflation Storm Leaves Americans More Reliant On Food Banks

Tesla Spikes Despite Soft Q4 Results After Forecasting Vehicle Business Returning To Growth

Disclosure: Copyright ©2009-2025 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies every ...

more