Tesla Spikes Despite Soft Q4 Results After Forecasting Vehicle Business Returning To Growth

Image Source: Pexels

Ahead of today's earnings by the smallest Mag7 member, Tesla TSLA (with a $1.3TN market cap) , the company’s online forum for investor questions showed more than 120 queries about Musk. They asked largely about his politics, including his role in DOGE, his endorsement of Germany’s far right AfD party, and the controversial gestures he made during a speech that many people compared to a Nazi salute. Several of the questions focused on the potential for Musk’s actions to alienate Tesla buyers, while others raised concern that the CEO is being stretched too thin.

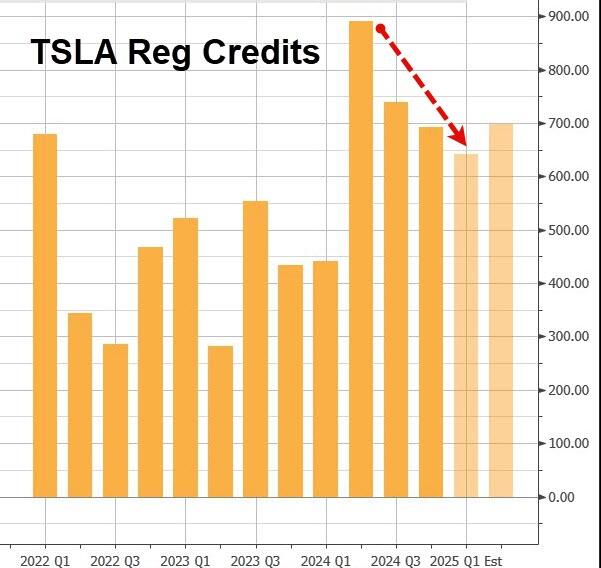

Turning to the actual results, one number which investors always go straight to in every earnings release is the company's regulatory credits, which as Bloomberg puts it, is "the gravy train that keeps on giving." In the third quarter, Tesla recognized $739 million in regulatory credit revenue, and said it was because other OEMs are still behind on meeting emissions requirements. Selling regulatory credits remains a tidy business for Tesla. It earns them by making and selling electric vehicles, then selling the credits to manufacturers whose new vehicle fleets exceed emissions limits set by various authorities, including in China, the European Union and the state of California.

Taking a step back, as investors are well aware, Tesla earnings have been a hugely volatile event for its shares over the past several quarters. The stock jumped 22% after the last quarterly results in October, and in the three quarters before that, it moved by at least 12% in either direction. This time, trading in the options market suggests investors are preparing for only a 7% move in Tesla shares after fourth-quarter results. If that happens, it would be the stock’s smallest post-results swing since October 2022.

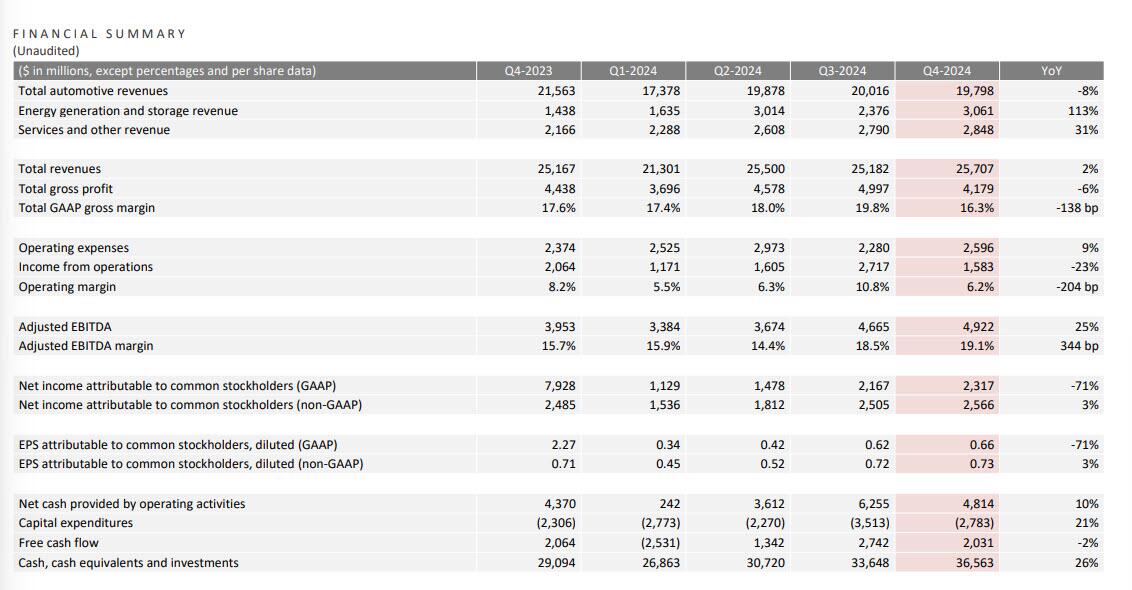

With all that in mind, here is what Tesla reported moments ago for the just concluded Q4:

- Revenue: $25.71BN, missing estimates of $27.21BN, up 2% YoY, although total automotive revenue of $19.8BN was actually down 8% YoY

- Operating Income $1.583BN, missing estimates of $2.6BN, and down 23% YoY

- Gross margin 16.3%, missing estimates 18.9% and down from 17.6% YoY

- Automotive gross margin ex regulator credits 13.6%

- EPS of $0.73, missing estimates of $0.75, and up 3% YoY

- Free Cash Flow $2.03BN, beating estimates of $1.75BN, and down 1.6% YoY

- Capital expenditure $2.78 billion, beating estimates of $2.72 billion, and up +21% y/y,

And visually:

(Click on image to enlarge)

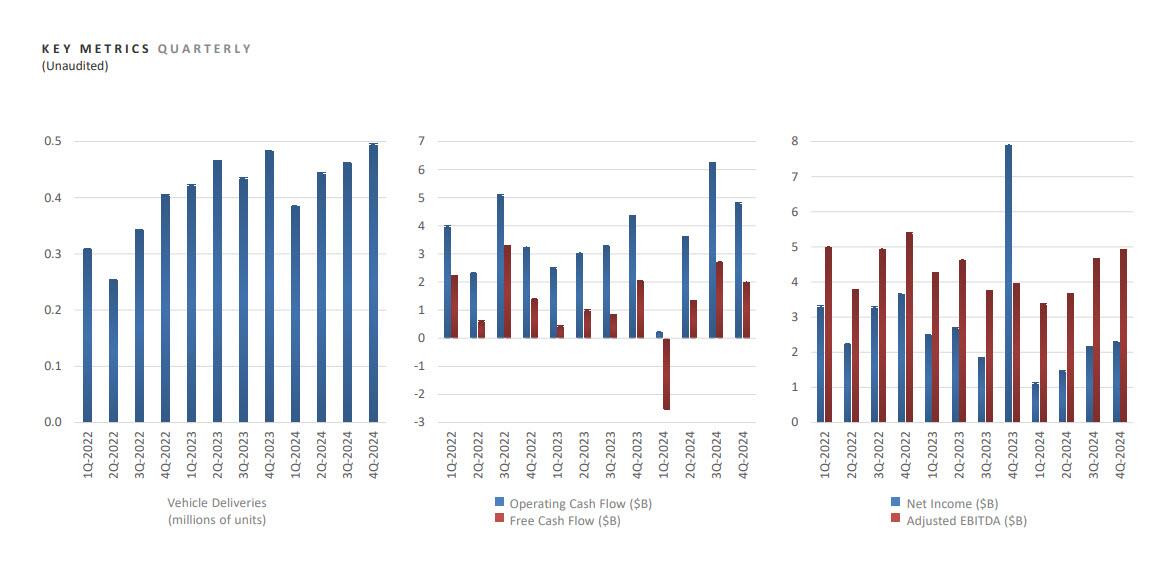

Here are the main income statement categories in chart format:

(Click on image to enlarge)

Taking a quick look at the slide deck, we find (on Page 6) that the big revenue driver was “growth in energy generation and storage and services and other”. Also of note, revenue from regulatory credits is $692 million. That’s a drop from $739 million last quarter, but still significant.

This suggests that over half of Tesla’s earnings are greenhouse gas credits and “other income”, a rather low quality result.

As Bloomberg notes, there are echoes of the second quarter in these numbers: "A very weak autos gross profit margin due to a big liquidation of inventory. Other items (credits, “other” income) shore that up and, similarly, account for about half of overall earnings."

Clearing inventory helps with free cash flow, as working capital swings positive to the tune of $1B, but the quality is weak.

Something else to note here: Tesla’s vehicle sales in 2024 were 36% higher than two years earlier and energy storage MW also soared in that time, meanwhile, total operating profit has almost halved during this period. Or as Bloomberg puts it, "economies of scale outweighed by price war, ageing vehicle lineup."

(Click on image to enlarge)

With automotive in decline, Tesla’s energy business continues to be its fastest growing division, with revenue more than doubling from a year ago. Gross profit for batteries were the highest ever. To this end, the company also says it completed construction of its Shanghai megafactory in December and will ramp up production there.

Here are some other highlights from the slidedeck:

Record deliveries:

"Q4 was a record quarter for both vehicle deliveries and energy storage deployments. We expect Model Y to once again be the best-selling vehicle, of any kind, globally for the full year 2024, and we have made it even better, with the New Model Y now launched in all markets. In 2024, we made significant investments in infrastructure that will spur the next wave of growth for the company, including vehicle manufacturing capabilities for new models, AI training compute and energy storage manufacturing capacity."

Margin expansion and price cuts:

"In Q4, COGS per vehicle reached its lowest level ever at <$35,000, driven largely by raw material cost improvement, helping us to partially offset our investment in compelling financing and lease options. "

Tesla's energy business humming:

"The Energy business achieved another record in Q4 with its highest-ever gross profit generation. Construction of Megafactory Shanghai was completed in December and will begin ramping this quarter. Powerwall deployments achieved another record quarter as we continue to ramp Powerwall 3 production and launch in additional markets:

Looking ahead, the company says that "2025 will be a seminal year in Tesla’s history as FSD (Supervised) continues to rapidly improve with the aim of ultimately exceeding human levels of safety. This will eventually unlock an unsupervised FSD option for our customers and the Robotaxi business, which we expect to begin launching later this year in parts of the U.S. We also continue to work on launching FSD (Supervised) in Europe and China in 2025. "

What may have helped reverse the drop in the stock price after hours, is the following outlook from the company's volume guidance:

"With the advancements in vehicle autonomy and the introduction of new products, we expect the vehicle business to return to growth in 2025. The rate of growth will depend on a variety of factors, including the rate of acceleration of our autonomy efforts, production ramp at our factories and the broader macroeconomic environment. We expect energy storage deployments to grow at least 50% year-over-year in 2025.”

Turning to profit, Tesla expects that it "while it continues to execute on innovations to reduce the cost of manufacturing and operations, over time, we expect our hardware-related profits to be accompanied by an acceleration of AI, software and fleet-based profits."

Finally, the company says that its "plans for new vehicles, including more affordable models, remain on track for start of production in the first half of 2025. These vehicles will utilize aspects of the next generation platform as well as aspects of our current platforms and will be produced on the same manufacturing lines as our current vehicle line-up. This approach will result in achieving less cost reduction than previously expected but enables us to prudently grow our vehicle volumes in

a more capex efficient manner during uncertain times. This should help us fully utilize our current expected maximum capacity of close to three million vehicles, enabling more than 60% growth over 2024 production before investing in new manufacturing lines."

Finally, worth nothing that while unboxed is still happening, it won't take place any time soon: "Our purpose-built Robotaxi product – Cybercab – will continue to pursue a revolutionary “unboxed” manufacturing strategy and is scheduled for volume production starting in 2026."

Tesla said that its newer vehicles will be built on the same production lines as the current line-up, which Tesla says will save money.The company also notes that should boost manufacturing volumes closer to its max capacity of about three million vehicles annually, allowing “more than 60% growth over 2024 production.”

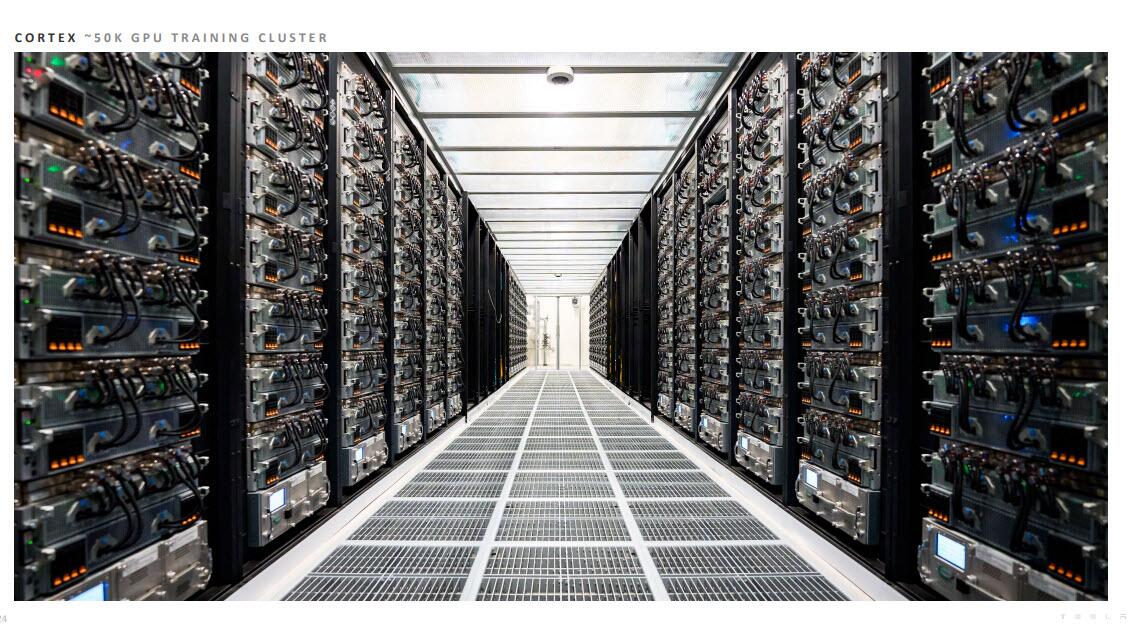

Eager to get an AI multiple, it is hardly surprising that the slidedeck included not one but two photos of the company's "cortex": the 50k GPU training center.

In kneejerk reaction to the results, the stock first slumped, dropping as much as 3%, before surging $40 from $365 to $407 and eventually stabilizing around $400, as investors focus on the company's optimistic outlook, are excited about the Megapack, or the idea of FSD Supervised launching in Europe and China. One other positive sign from a product perspective is the promise that Tesla’s plans for new vehicles, including more affordable models, remain “on track for start of production in the first half of 2025.”

(Click on image to enlarge)

Reactions were mixed, some bearish...

“It’s clear that the market was looking for better profitability and better guidance,” said Seth Goldstein of Morningstar. “We heard on the last earnings call 20% to 30% growth, and now it’s just ‘return to growth.’ People want more firm guidance: What is the plan, and how are you going to get there?”

... And some bullish:

Cathie Wood said she thinks the stock reversal was fueled, in part, by the idea that Tesla will be scaling the Cybercab in 2026 and that production has to start this year. “We can see Tesla get down to a $15,000 car,” she said on a livestream on X spaces, noting a five-year time horizon. “This is nothing a traditional auto analyst can relate to.”

That said, A lot rides on the comments from the earnings call this time, which can explain the relatively muted reaction. Indeed, if this move holds in the regular trading tomorrow, that will be the smallest post-earnings reaction in Tesla stock since early 2022.

The Q4 investor presentation is below (pdf link)

More By This Author:

MSFT Tumbles On Cloud Revenue Miss

Hawkish Fed 'Pauses' Rate-Cuts As Expected, Reignites Inflation Fears

US Durable Goods Orders Tumbled In December As Boeing Bloodbath Continues

Disclosure: Copyright ©2009-2025 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies every ...

more