Another Year, Another Early Head Fake

Image Source: Unsplash

This year seemed to be getting off to a promising start, at least if overnight futures were to be believed. ES Futures were up nicely early in the evening (US time), up about 17 points, then picked up steam when Hong Kong and Korean shares rallied.By the time many of us in the US woke up, those futures were about 45 points higher and NQ futures were up more than a full percent.But as we’ve seen all-too-often, the rally fizzled after a lack of follow-through buying.Hopefully this is a temporary phenomenon.

Indeed, as noted above, a wide range of global indices closed higher to start the year.Both the Hang Seng (HSI) and KOSPI (K200) indices were over 2% higher, while most of their major European counterparts also rose on the day.In fact, the Euro Stoxx 50 (ESTX) and FTSE100 (UKX) touched new all-time highs, as did the K200. It was understandable why many traders might have expected a similar reaction in US shares – particularly the megacap tech stocks that have powered the S&P 500 (SPX) and Nasdaq 100 (NDX) higher throughout the past three years.But after a solid start that saw most of the “Mag 7” stocks and friends trading higher initially, the bulk of them turned lower on the session by late morning.

It is not fair to read too much into the modest declines that prevailed by midday.Volumes remain relatively light as many professionals are finishing up vacation weeks.I headed into New York City this morning (here’s why) and there were literally only 12 cars at my town’s train station when I parked for the 7:58 departure. There are typically hundreds of cars parked before that departure.But I do think it is fair to wonder why stocks ended the year with a whimper when a modest bang was priced in.

Faithful readers know that I am a fan of old market adages, and this one is resonating with me today:

If Santa Claus should fail to call, bears may come to Broad and Wall

That refers to the market’s historical propensity to rally in the last five trading days of a calendar year into the first two days of the next – the so-called “Santa Claus” rally period.The closing level for SPX on December 23rd, the day prior to the period in question was 6,909.76.Although SPX closed at a record high of 6,932.05 on Christmas Eve, the index had lower closes on each of the remaining four trading days of 2025.Today’s activity is putting us no closer towards advancing past the close of the 23rd, though we did approach that level early in today’s session.We also seem to be repeating the lackluster trading patterns and lack of volatility that prevailed through most of the post-Christmas trading days.

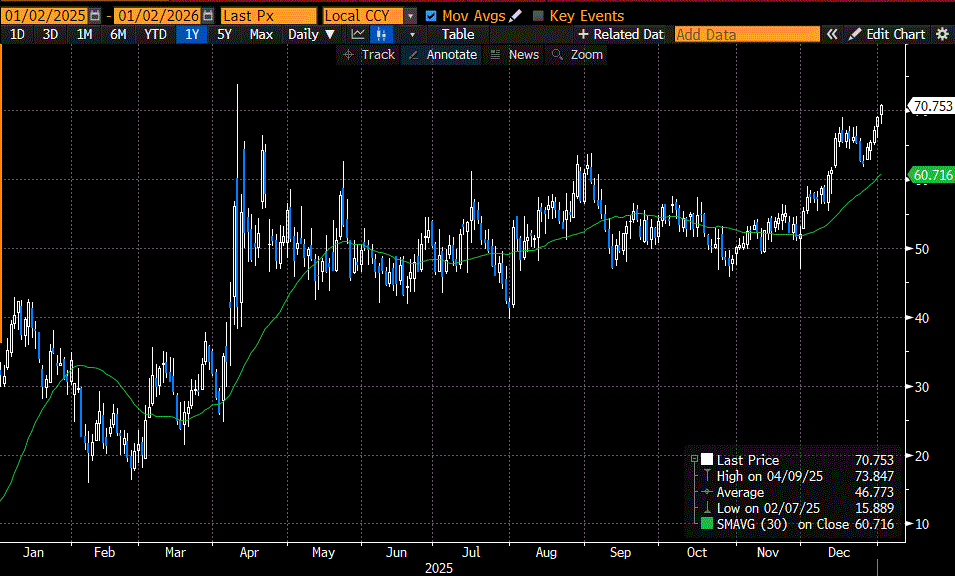

Beyond stocks, there are a few items worth watching.Bitcoin has managed to creep above $90,000, which bodes well for risk-taking in crypto specifically and risk assets overall.Not unrelatedly, gold and silver have continued their recent advances.On the flip side, we see the spread between 2- and 10-year Treasury yields widen past 70 basis points.That is hardly a dire sign, especially when it is occurring on light volume, but the trend is not promising at the moment.If the chart below showed a stock, many technical analysts would be calling for an imminent breakout.

Today is not a day to draw conclusions, however. If these patterns persist next week, when I expect the commuter lots to be full once again, then we can start to make more lasting inferences.Heck, if nothing else, Santa has one more day to bring his rally with him.

1-Year Chart: Spread between 2- and 10-year Treasury Yields (blue/white candles) with 30-Day Moving Average (green line)

(Click on image to enlarge)

Source: Bloomberg

More By This Author:

Markets Finish Off The Year Sluggishly

Top Fed Chair Candidate Odds Narrow Again

Look For The Silver Lining

Disclosure: Futures Trading

Futures are not suitable for all investors. The amount you may lose may be greater than your initial investment. Before trading futures, please read the CFTC ...

more