Tuesday, December 30, 2025 1:57 PM EST

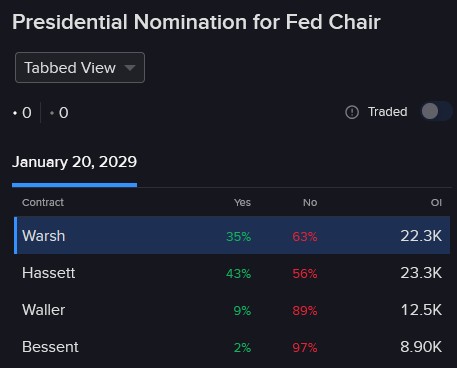

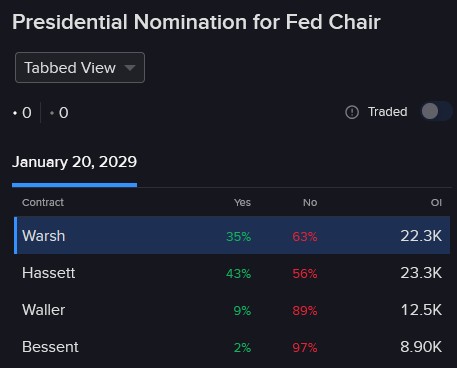

Former Fed Governor Kevin Warsh has been making a comeback in his probabilities of being nominated as the central bank’s leader in recent days, rising to as high as 38% yesterday from as low as 24% last week. Warsh’s gain has trimmed National Economic Council Director Kevin Hassett’s lead significantly with his chances now at 43%, while current central banking official Christopher Waller and Treasury Secretary Scott Bessent are at 9% and 2%, respectively. President Trump said yesterday that the announcement will arrive sometime next month while refraining from stating whether he favors either of the top two contenders. There are approximately 70k contracts open tied to the selection.

(Click on image to enlarge)

Participants Gearing Up for January Fed Decision

Yesterday’s trading action on ForecastEx featured building engagement in the Fed’s interest rate decision next month, as participants are increasingly sure that the central bank will pause with an 89% degree of certainty. Earlier in December, the chances of an unchanged benchmark in January were a lot lower at 64%.

(Click on image to enlarge)

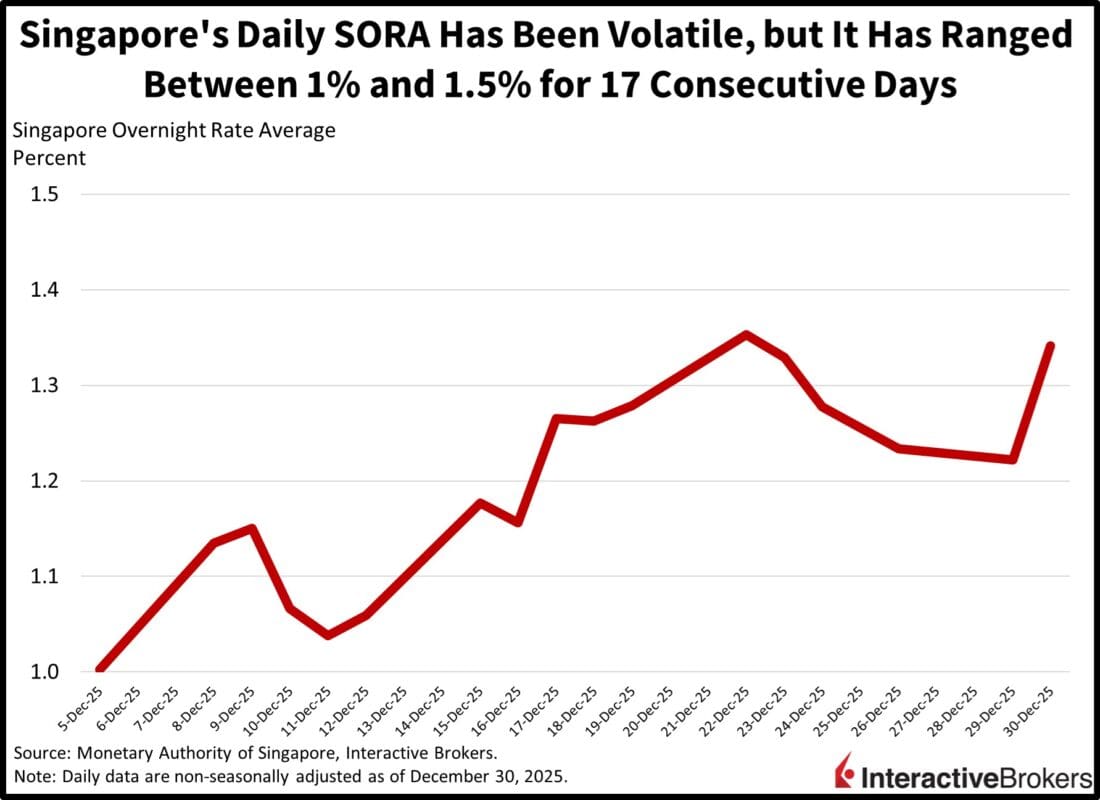

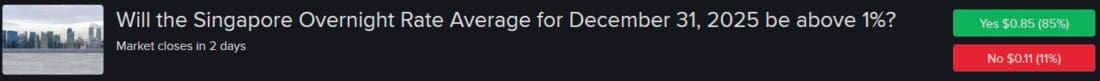

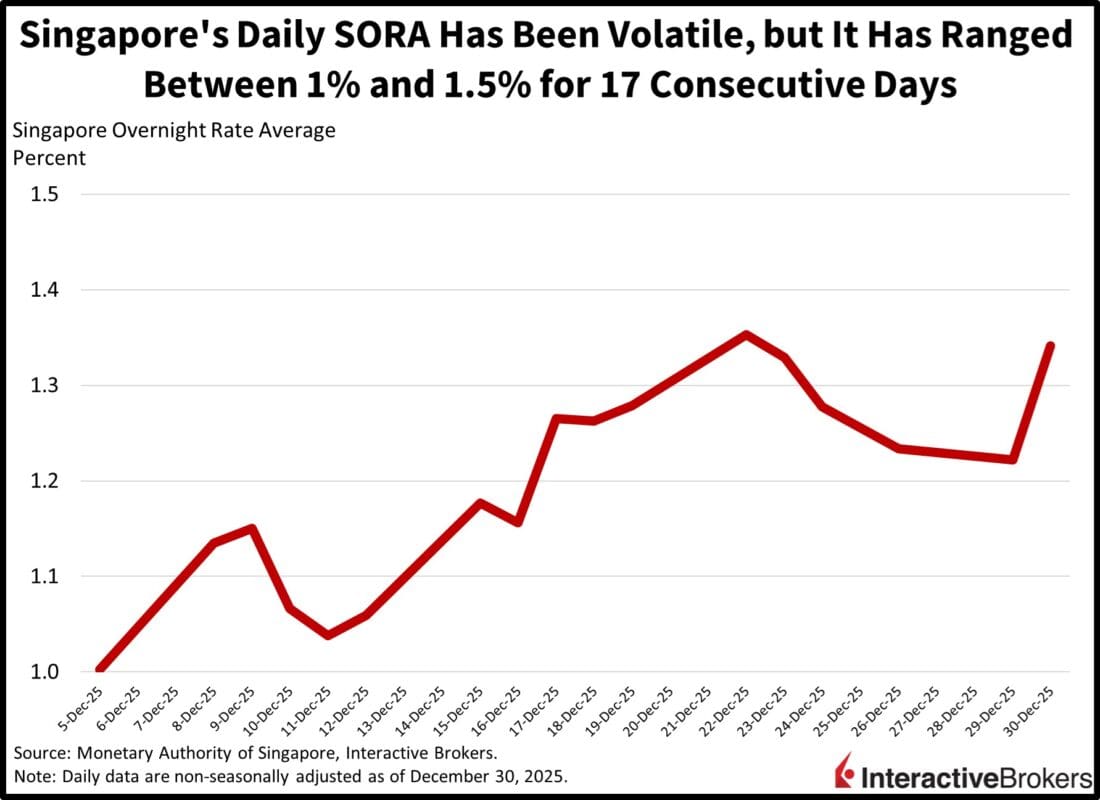

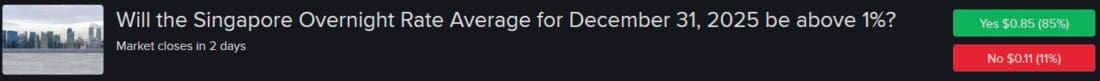

Singapore SORA Combo Trade Opportunity

The Singapore Overnight Rate Average (SORA) has ran between 1% and 1.5% for 17 consecutive days, averaging 1.16% for the month of December amidst a 7-day mean of 1.29%. Against this backdrop the “Yes/No” combo at 1% and 1.5% appears undervalued to me at an overall cost of $1.74, featuring a maximum total loss of $0.89.

(Click on image to enlarge)

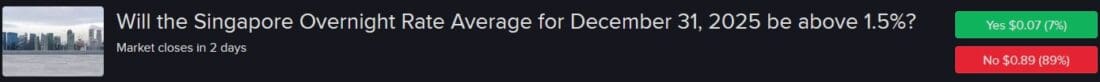

“Yes” at 2.2% Looks Modestly Undervalued

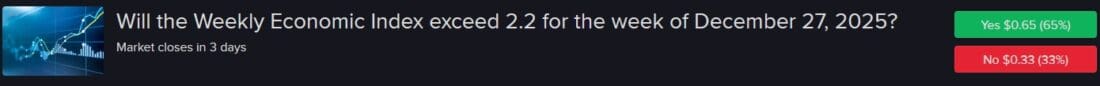

The Dallas Fed’s Weekly Economic Index has exceeded 2.2% for four consecutive weeks and is poised to come in north of that level again tomorrow in my opinion. Activity has been firm lately and the “Yes” at $0.65 isn’t hugely undervalued, but still offers a decent opportunity since the price should be closer to $0.75.

(Click on image to enlarge)

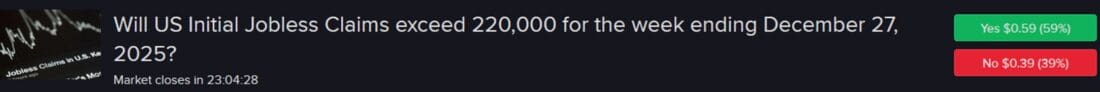

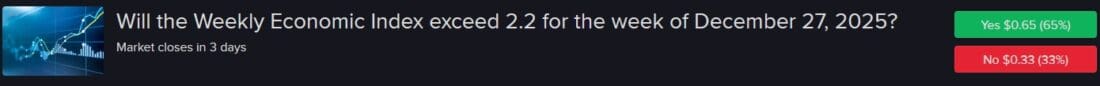

Claims Expected to Come in Near 220K

Wall Street expects initial unemployment claims to come in 220k tomorrow and our participants are right near there. Indeed, there’s an approximate 59% chance of a number arriving north of that level and a 39% probability of a figure coming in at 220k or under.

(Click on image to enlarge)

Source for images: ForecastEx

Note: Prices are highest bids as of the morning of Dec. 30, 2025.

More By This Author:

Look For The Silver Lining Notes For A Slow Day Great Quarter, Guys

Disclosure: ForecastEx

Interactive Brokers LLC is a CFTC-registered Futures Commission Merchant and a clearing member and affiliate of ForecastEx LLC (“ForecastEx”). ForecastEx is a ...

more

Disclosure: ForecastEx

Interactive Brokers LLC is a CFTC-registered Futures Commission Merchant and a clearing member and affiliate of ForecastEx LLC (“ForecastEx”). ForecastEx is a CFTC-registered Designated Contract Market and Derivatives Clearing Organization. Interactive Brokers LLC provides access to ForecastEx forecast contracts for eligible customers. Interactive Brokers LLC does not make recommendations with respect to any products available on its platform, including those offered by ForecastEx.

Forecast Contracts Risk

Futures, event contracts and forecast contracts are not suitable for all investors. Before trading these products, please read the CFTC Risk Disclosure. For a copy visit our Warnings and Disclosures Page.

ForecastEx Market Sentiment

Displayed outcome information is based on current market sentiment from ForecastEx LLC, an affiliate of IB LLC. Current market sentiment for contracts may be viewed at ForecastEx at https://forecasttrader.interactivebrokers.com/en/home.php. Note: Real-time market sentiment updates are only active during exchange open trading hours. Updates to current market sentiment for overnight activity will be reflected at the open on the next trading day. This information is not intended by IBKR as an opinion or likelihood of a potential outcome.

Forecast Contracts

Forecast Contracts are only available to eligible clients of Interactive Brokers LLC, Interactive Brokers Canada Inc., Interactive Brokers Hong Kong Limited, Interactive Brokers Ireland Limited and Interactive Brokers Singapore Pte. Ltd. Forecast Contracts on US election results are only available to eligible US residents.

CFTC Regulation 1.71

This is commentary on economic, political and/or market conditions within the meaning of CFTC Regulation 1.71, and is not meant provide sufficient information upon which to base a decision to enter into a derivatives transaction.

The analysis in this material is provided for information only and is not and should not be construed as an offer to sell or the solicitation of an offer to buy any security. To the extent that this material discusses general market activity, industry or sector trends or other broad-based economic or political conditions, it should not be construed as research or investment advice. To the extent that it includes references to specific securities, commodities, currencies, or other instruments, those references do not constitute a recommendation by IBKR to buy, sell or hold such investments. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Interactive Brokers LLC, its affiliates, or its employees.

Any trading symbols displayed are for illustrative purposes only and are not intended to portray recommendations.

In accordance with EU regulation: The statements in this document shall not be considered as an objective or independent explanation of the matters. Please note that this document (a) has not been prepared in accordance with legal requirements designed to promote the independence of investment research, and (b) is not subject to any prohibition on dealing ahead of the dissemination or publication of investment research.

If this page contains information regarding Options Trading, you must acknowledge that you have received the Characteristics & Risks of Standardized Options, also known as the options disclosure document (ODD). Options involve risk and are not suitable for all investors. For more information read the “Characteristics and Risks of Standardized Options”. For a copy, call 312 542-6901 or click here.

less

How did you like this article? Let us know so we can better customize your reading experience.