Markets Finish Off The Year Sluggishly

Image Source: Unsplash

Markets are having a sluggish session to end 2025 with stocks dipping modestly while rates rise slightly. Part of the decline in equities has to do with investors pocketing some profits against the backdrop of the third consecutive annual return in the high double digits. Yields, meanwhile, are taking their cue from mounting evidence depicting increasingly favorable labor conditions, as unemployment claims remain subdued, especially in the initial segment. Pricier borrowing costs are helping the dollar though while hurting the commodity complex, with all of its majors lower minus crude oil, which maintains a heavier geopolitical premium due to ongoing international tensions involving significant energy producers. Traders are adding hedges to their books as volatility protection instruments rise in price amidst retreats across every equity sector. Elsewhere, bitcoin is near its flatline while forecast contracts catch bids.

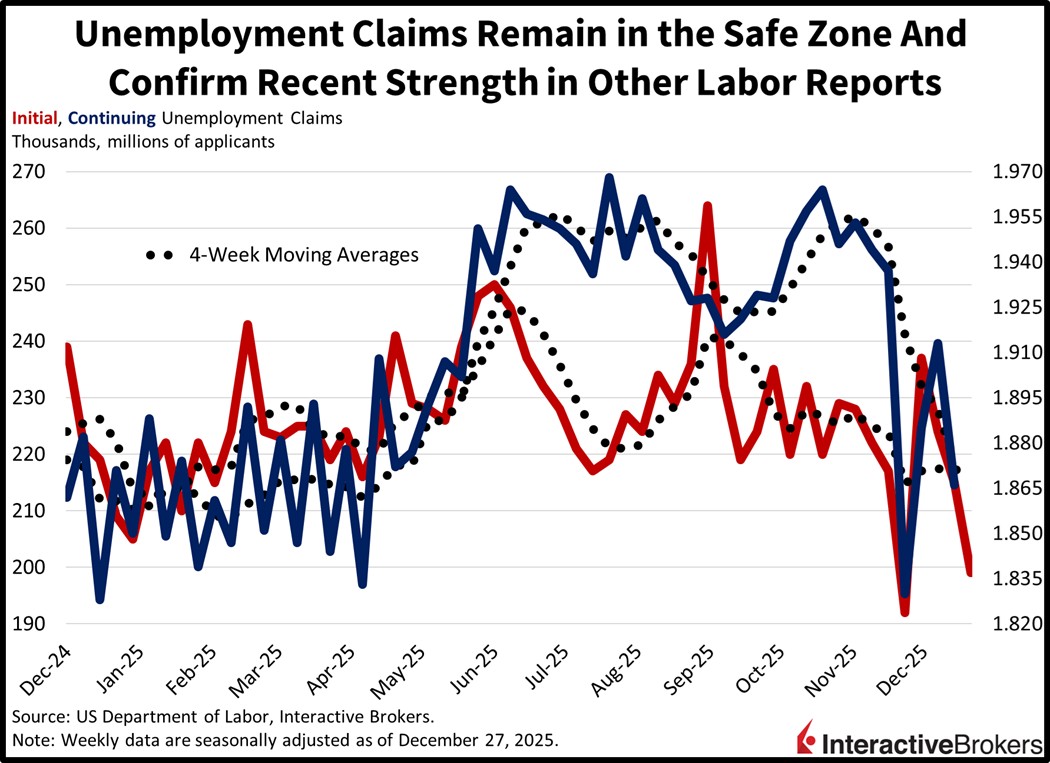

Unemployment Claims Point to Improving Labor Market

This morning’s unemployment claims continue to signal improving conditions, although this month’s figures are notoriously volatile. Initial filings dropped to 199k during the week ended Dec. 27, well below the 220k median estimate and the 215k from the preceding period. Continuing applications fell to 1.866 million for the seven-day interval culminating on Dec. 20, beneath the 1.913 million from the previous print. The four-week moving averages remained in the safe-zone at 218.75k for the former category and 1.874 million for the latter.

(Click on image to enlarge)

Equity Tailwinds Strengthen, But Downside Risks Remain

An economic reacceleration is poised to offer a wide path for continued corporate earnings growth next year, as the tailwinds of the Trump policy mix begin to increasingly bolster the landscape. Lighter taxation, milder regulations, subdued energy costs and measures to incentivize business investment are geared up to coincide with stimulative policies from the Fed and from Congress. Indeed, the central bank has already begun to support Treasury market liquidity, and its projections signal an additional rate cut in 2026, although Wall Street expects two. Fiscal accommodation is likely to come in the form of direct, pandemic style checks to households, which are set to generate a short-term, significant boost to activity. But things could go wrong and three consecutive years of buoyant equity performance may require a pause if the returns from AI fail to meet expectations or if unemployment starts to climb further, hurting consumer spending via the wealth effect in the former case and hampering household shopping momentum in the latter situation through a fall in incomes.

International Roundup

China’s Economy Creeps into Expansion

The world’s second-largest economy moved from contraction to expansion this month, according to data from the Chinese government and S&P Global. The National Bureau of Statistics of China reported last night that the Composite Purchasing Managers’ Index climbed from 49.7 to 50.7, exceeding the contraction-expansion threshold of 50. It was the first expansionary print since September, when the index climbed from 50.5 to 50.6.

The official data depicts broad improvement with the Manufacturing and Non-Manufacturing PMIs climbing from 49.2 and 49.5 to 50.1 and 50.2. Economists anticipated that the Manufacturing and Non-Manufacturing gauges would depict ongoing contractions with scores of 49.2 and 49.6. The government data depict improvements in sales as well as production.

The S&P RatingDog China General Manufacturing PMI also strengthened, climbing from 49.9 to 50.1. It was the fourth improvement in the past five months with December production, after previously declining, growing even as export sales weakened. Survey respondents attributed the increase in work orders to the introduction of new products and successful business development efforts. Despite the improved business conditions, payrolls declined, a result of resignations and restructuring efforts that reduced redundancies. Input costs, furthermore, jumped for the sixth consecutive month with rising prices for raw materials. Manufacturers, however, continued to reduce their gate prices to support sales and reduce inventory. Exports were an exception with stickers for items shipped abroad climbing at the fastest rate since July 2024. In another development, sentiment weakened slightly but remained positive even though it fell below historical averages. Firms were optimistic about expansion plans and new products but also had lingering concerns about future growth.

Price Pressure Returns in South Korea

South Korea price pressures returned on a monthly basis in December but eased modestly year over year (y/y), according to the Consumer Price Index. The gauge depicted 0.3% month-over-month (m/m) and 2.3% y/y increases. The economist consensus estimates called for 0.2% and 2.3% prints following November’s 0.2% monthly decline and the 2.4% y/y climb. When excluding food and energy, the CPI was up 0.2% m/m after dropping 0.1% in November. It ascended 2% y/y, matching November’s print.

Within the headline, the following items and the extent of their changes had the largest m/m increases:

- Food and alcoholic beverages, 0.7%

- Furnishings, household equipment and routine maintenance, 0.7%

- Transport, 0.6%

- Restaurants and hotels, 0.4%

- Miscellaneous goods and services, 0.3%

Conversely, alcoholic beverages and health stickers slipped 0.2% and 0.1%.

More By This Author:

Top Fed Chair Candidate Odds Narrow Again

Look For The Silver Lining

Notes For A Slow Day

Disclosure: The analysis in this material is provided for information only and is not and should not be construed as an offer to sell or the solicitation of an offer to buy any security. To the ...

more