Amazon Stock Update 2025: Can AI And AWS Growth Outweigh Prime’s $2.5b FTC Settlement?

Image Source: Unsplash

Artificial intelligence is transforming industries, and Amazon (Nasdaq: AMZN) is at the center of the conversation. As the global leader in e-commerce, Amazon has built a powerful ecosystem through Prime memberships, fast delivery, and exclusive content that keeps both customers and sellers engaged.

At the same time, AWS dominates cloud computing, generating high-margin profits that fuel growth and give Amazon a front-row seat in the AI revolution.

Supporters point to Amazon’s constant innovation, fast-growing advertising segment, and strategic AI partnerships as reasons it can keep compounding value. Critics counter with rising competition from Microsoft and Google in cloud, heavy reinvestment in logistics, and the challenges of managing a massive global business. On top of that, Amazon now faces reputational and regulatory risks after agreeing to a multibillion-dollar FTC settlement over deceptive Prime practices.

Yet, with valuations still below past averages and new ventures like live sports streaming and AR wearables adding fresh growth drivers, Amazon remains one of the market’s most debated opportunities. The big question for investors: will AI and AWS usher in Amazon’s most profitable era yet, or will mounting risks, from regulators to rivals, slow the flywheel?

Let’s break it down using the IDDA framework (Capital, Intentional, Fundamental, Sentimental, Technical):

IDDA Point 1 & 2: Capital & Intentional

Before investing in Amazon, ask yourself:

Do you want exposure to the world’s e-commerce leader with unmatched scale and global reach?

Are you comfortable with a business model that reinvests heavily into new growth areas like AI, advertising, and live sports streaming?

Do you believe AWS and Prime memberships will continue to fuel high margin growth and reinforce Amazon’s powerful ecosystem?

Amazon (AMZN) is financially strong with expanding profitability, solid cash reserves, and leadership in both e-commerce and cloud computing. Its advertising and AWS segments are growing faster than the core retail business, helping lift margins and diversify revenue streams.

Investors see it as a relentless innovator that still operates like a disruptor despite its massive size. Technically, the stock remains in a bullish trend, though short-term caution is warranted as competition and execution risks rise.

Bottom line: For long term investors, Amazon offers a rare mix of scale, innovation, and diversified growth drivers that position it as a long-term compounder. For short term investors, rising competition and heavy reinvestment may create volatility, making patience key to unlocking its full upside. Ultimately, whether Amazon fits into your portfolio depends on your individual risk tolerance and investment goals.

IDDA Point 3: Fundamentals

Amazon’s core strength lies in its dominance across e-commerce and cloud computing. Its retail operations lead the global market, delivering unmatched scale, product variety, and pricing power, while AWS continues to set the pace in public cloud services with a commanding market share. Together, these two businesses provide both steady cash flow and high-margin profits, giving Amazon a powerful foundation for long-term growth.

The company’s business strategy centers on creating a powerful ecosystem that locks in customer loyalty while driving recurring revenue. Amazon Prime ties its e-commerce and media platforms together, offering fast shipping, exclusive video content, and other perks that keep consumers engaged and spending more frequently. Kindle devices and other hardware further support customer retention, making Amazon’s value proposition difficult for rivals to replicate. This virtuous cycle of buyers attracting sellers and sellers attracting buyers cements its leadership in retail.

Beyond retail, Amazon is building growth engines in higher-margin segments such as AWS and digital advertising. AWS not only supports Amazon’s own operations but also provides essential computing infrastructure for enterprises, particularly as demand for generative AI accelerates. Meanwhile, Amazon’s advertising business, boosted by placements across e-commerce and Prime Video, gives marketers access to vast consumer data. These businesses are expected to outpace e-commerce in growth over the next five years, driving operating profit and EPS faster than revenue.

Amazon’s culture of relentless innovation ensures it keeps expanding into new categories and geographies. It continues to push into grocery and luxury goods, while Whole Foods’ expansion into Asia highlights its ability to grow even mature retail operations. In media, Prime Video’s live sports rights and Emmy-winning series enhance the platform’s appeal, while experiments in augmented reality and wearables open future growth frontiers. Each new initiative strengthens its ecosystem, creating a “flywheel effect” where innovation in one area reinforces the entire business model.

Financially, Amazon pairs innovation with discipline. Revenue continues to grow at double digits, profitability is expanding, and cash reserves remain robust while debt levels decline. Despite its $2.5 trillion scale, valuation metrics such as P/E and price-to-cash-flow are below historical averages, making the stock attractively priced relative to its history.

Regulatory & Reputation Risk: Recently, Amazon agreed to a $2.5 billion settlement with the U.S. Federal Trade Commission over allegations of misleading Prime subscription enrollments and making cancellations difficult. As part of the settlement, Amazon must reform its signup and cancellation processes, enhance disclosure, and submit to third-party monitoring. While it denied wrongdoing, the case underscores the growing regulatory scrutiny on how tech giants monetize subscriptions and manage consumer consent.

Fundamental Risk: Low – Medium

IDDA Point 4: Sentimental

Strengths

Amazon dominates e-commerce with unmatched scale and customer reach.

AWS and advertising are fast-growing, high-margin businesses that drive profits.

Prime memberships create loyalty, recurring revenue, and a strong network effect.

Risks

Regulatory pressure is rising as Amazon expands globally.

Heavy investments in logistics and cloud may weigh on free cash flow.

$2.5B FTC settlement over Prime practices adds reputational and compliance risk

Investor sentiment toward Amazon is very positive, with confidence in its ability to keep innovating while leading in e-commerce and cloud. The market sees Amazon as a growth machine that still acts like a disruptor despite its massive size. Optimism comes from its push into AI, fast-growing advertising, and new ventures like live sports streaming and AR wearables.

Risks remain, including stronger competition in cloud, the challenges of running such a huge business, and growing regulatory pressure such as the recent FTC settlement over Prime practices. Even so, the outlook is bullish, and Amazon is widely seen as a long-term winner that earns a Strong Buy rating.

Sentimental Risk: Medium

IDDA Point 5: Technical

On the weekly chart

Ichimoku cloud remains bullish, signifying upward momentum

Candlesticks continue to hold above the cloud, which is acting as a support zone

On the weekly chart, AMZN has been in an overall uptrend since 2023 with healthy pullbacks. At the start of 2025, the stock entered a brief downtrend, after reaching a new high at 242, testing the cloud but the cloud held as support. This confirms ongoing long term upward momentum.

(Click on image to enlarge)

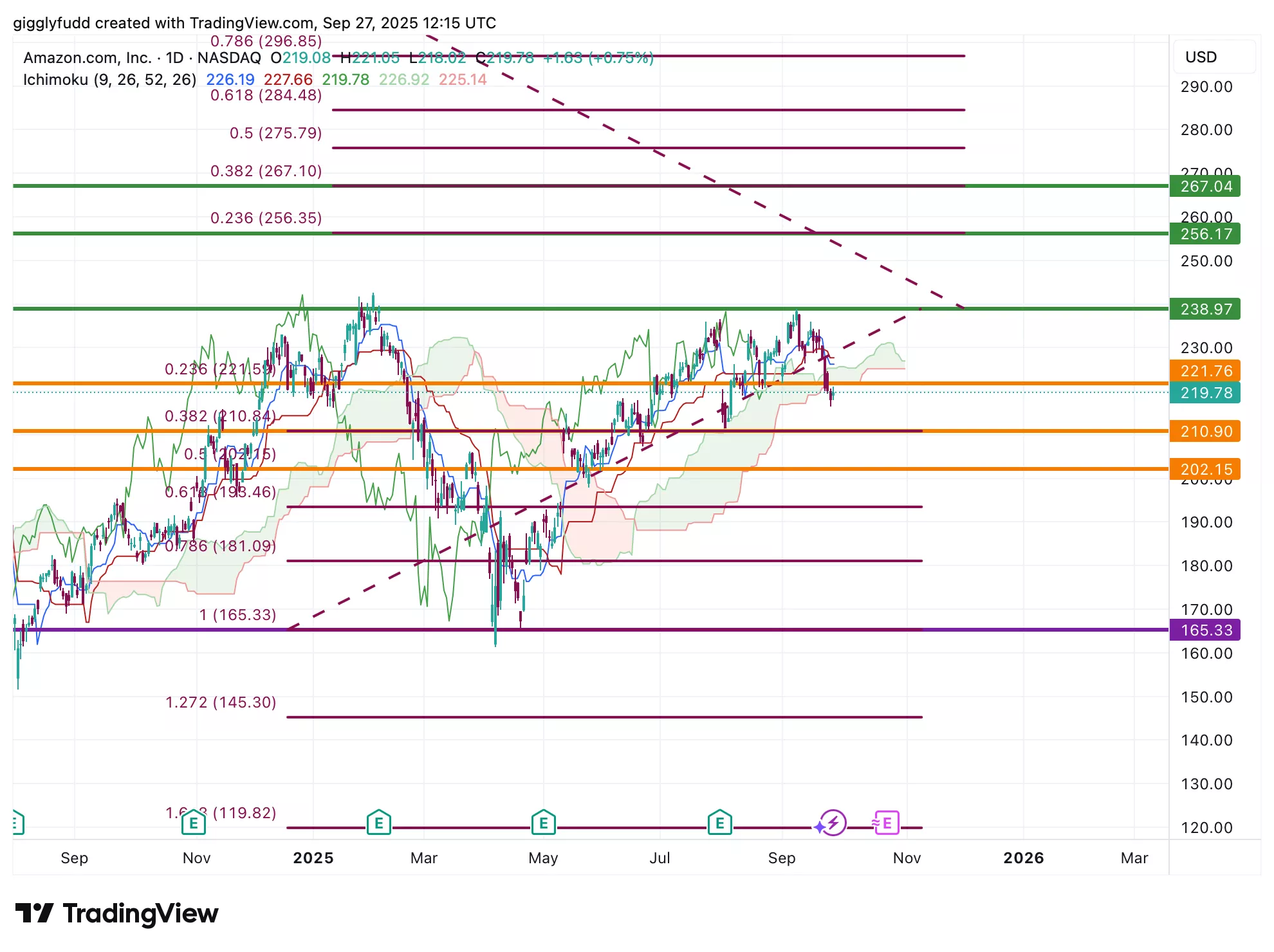

On the daily chart

The future cloud is still bullish, though it is thinning and flattening, signaling weakening momentum

The Kijun has crossed below the Tenkan line, forming a death cross—an early bearish signal

Candlesticks have dipped under the cloud, which is now serving as a resistance zone

On the daily chart, technicals lean more bearish. The death cross has formed, and candlesticks are below the cloud, turning it into resistance. While the future cloud remains bullish, its flat and thinning shape shows momentum may be weakening. If sentiment stays positive, however, this could prove to be a ‘false break’ with potential for a near term rebound.

The current market price has slipped just below the 23% Fibonacci retracement level, which often acts as an early support zone where prices may pause or bounce.

(Click on image to enlarge)

Investors looking to get in AMZN can consider these Buy Limit Entries:

219.78 (High Risk)

210.90 (Medium Risk)

202.15 (Low Risk)

Investors looking to take profit can consider these Sell Limit Levels:

238.97 (Short term)

256.17 (Medium term)

267.04 (Long term)

Hold (Long term)

Here are the Invest Diva ‘Confidence Compass’ questions to ask yourself before buying at each level:

- If I buy at this price and the price drops by another 50%, how would I feel? Would I panic, or would I buy more to dollar-cost average at lower prices? (hint: this question also reveals your CONFIDENCE in the asset you’re planning to invest in).

- If I don’t buy at this price and the stock suddenly turns around and starts going up again, will I beat myself up for not having bought at this level?

Remember: Investing is personal, and what is right for me might not be right for you. Always do your own due diligence. You should ONLY invest based on your own risk tolerance and your timeframe for reaching your portfolio goals

Technical Risk: Medium

Final Thoughts on Amazon (AMZN)

Amazon has returned to the spotlight as investors weigh its dominance in e-commerce against the explosive growth potential of AWS and artificial intelligence – while also grappling with fresh regulatory risks tied to its $2.5B FTC Prime settlement. Its “flywheel” strategy connects retail, Prime, cloud, and advertising into one powerful ecosystem that fuels loyalty and recurring revenue. Bulls highlight Amazon’s relentless innovation, cloud leadership, and expanding high-margin businesses, while bears point to intensifying competition, regulatory pressure, the FTC settlement, and the challenges of managing such a vast global empire. Technically, the long-term trend remains bullish with strong support, though short-term signals suggest caution as momentum shows signs of weakening.

Key Takeaways:

The debate around Amazon centers on whether it is entering its most profitable era – powered by AI, AWS, and advertising – or if competition, regulation, and execution risks could slow its momentum. Bulls see a diversified growth engine, strong financial discipline, and valuations that leave room for upside. Bears warn that rising reinvestment needs, regulatory scrutiny—including the Prime settlement—and competitive threats may cap returns in the short term. For long-term investors, Amazon remains a compelling compounder with multiple growth levers. For short-term traders, however, volatility and execution risks mean patience will be key.

Overall Stock Risk: Medium

More By This Author:

Keurig Dr Pepper’s $18b Coffee Bet: Game Changing Split Or Brewing Trouble For Investors?

With Rates Falling, Is Realty Income The Best Dividend REIT To Buy Now?

Is The Smart Money Hinting At A New Phase For IonQ Stock?