Keurig Dr Pepper’s $18b Coffee Bet: Game Changing Split Or Brewing Trouble For Investors?

Image Source: Pixabay

Keurig Dr Pepper (Nasdaq: KDP) is in the middle of one of the biggest transformations in its history. The company is pursuing an $18 billion acquisition of JDE Peet’s while simultaneously planning to split into two separate, U.S.listed companies in 2026: Beverage Co., focused on North American soft drinks and energy, and Global Coffee Co., positioned as a worldwide coffee leader. The shake-up is designed to sharpen focus and unlock value across both segments.

Yet this ambitious strategy brings both promise and pitfalls. Beverage Co. leans on strong consumer loyalty, pricing power, and partnerships (like its expanded collaboration with Disney Advertising), with mid-single-digit growth potential. But the coffee arm faces weak demand, rising costs, and execution risks that could weigh on the overall transformation. Debt will also climb significantly with the JDE Peet’s deal, testing management’s ability to deleverage as promised.

Today, KDP trades under pressure after its stock fell on the news of the acquisition and split. Supporters argue the sell off may be overdone, especially with Beverage Co.’s resilient growth drivers. Skeptics point to weak coffee demand, heavy reliance on North America, and governance questions around JAB’s influence. This tension, between a refreshed growth story and near-term execution risks, sits at the heart of the current debate. Is KDP brewing a long-term growth blend, or will investors get stuck with a bitter aftertaste?

Let’s map it using the IDDA (Capital, Intentional, Fundamental, Sentimental, Technical):

IDDA Point 1 & 2: Capital & Intentional

Before investing in Keurig Dr Pepper, ask yourself:

Do you want exposure to a beverage company splitting into two distinct plays – a growth oriented refreshment arm and a global coffee contender?

Are you comfortable with near-term volatility from debt financing, execution risks, and investor skepticism?

Do you believe Beverage Co. can offset the challenges in Global Coffee and deliver stronger long-term returns?

KDP has been reducing debt since the 2018 merger and still has strong liquidity, but debt levels will rise again after the JDE Peet’s acquisition. This means investors should expect some short term pressure as the company manages higher borrowing and the complexity of splitting into two separate businesses.

On top of this, the consumer beverage sector brings its own risks. Trends can change quickly as people shift toward healthier drinks, input costs like sugar and packaging can rise, and competition is intense from both global players and smaller brands. All of this can affect demand and pricing power over time.

Because of these factors, investors need to think about their own risk tolerance – those looking for steady, defensive income might find the swings uncomfortable, while those open to short-term volatility may see a longer-term opportunity if KDP’s management delivers on its plans.

IDDA Point 3: Fundamental

Keurig Dr Pepper (KDP) is in the middle of a major transformation with the planned $18 billion acquisition of JDE Peet’s and the 2026 split into two U.S. listed companies: Beverage Co. (North America soft drinks and energy) and Global Coffee Co. (a global coffee leader). This move is designed to sharpen focus – Beverage Co. on its high growth refreshment and energy brands, and Global Coffee Co. on competing in the $400 billion coffee market with a larger scale and international reach.

The JDE Peet’s acquisition would make KDP the second largest coffee company worldwide with about 11% market share, behind Nestlé at 23%. While the deal adds valuable brands and global exposure, coffee growth remains uncertain. Demand for both KDP and JDE Peet’s has been weak in recent years, and innovation plus stronger marketing will be needed to unlock growth. With cost inflation and limited overlap between the two companies, the targeted $400 million in savings looks ambitious, making execution a key risk.

In contrast, the refreshment beverage segment looks more promising. Brand loyalty, unique taste profiles, and reformulation for health conscious consumers provide pricing power, while investments in premium water, sports drinks, energy, and canned coffee support expansion. This arm should deliver mid single-digit annual growth in North America. However, limited international rights for brands like Dr Pepper continue to cap growth outside the U.S.

KDP has also been working to strengthen its finances. Since the 2018 merger, the company has reduced debt significantly and now generates strong, steady cash flow – about 19% of sales. It also has solid liquidity with $600M in cash and access to over $6B in credit facilities and short-term borrowing. While the JDE Peet’s deal will temporarily increase debt levels, management has a history of paying it down and aims to bring it back to safer levels by the end of the decade.

Finally, KDP is investing heavily in brand partnerships and consumer engagement to reinforce its market position. In August 2025, the company expanded its strategic collaboration with Disney Advertising, integrating Dr Pepper into college football culture through digital, broadcast, and mixed reality campaigns. This partnership combines Disney’s storytelling and reach with KDP’s consumer insights to deliver personalized and shoppable experiences, strengthening brand loyalty and driving growth in the highly competitive U.S. refreshment market.

Fundamental Risk: Medium

IDDA Point 4: Sentimental

Strengths

#1 single serve brewer maker in North America with strong retail ties and large customer base

Expanding partnerships with third-party hot beverage and ready-to-drink brands boosts scale and distribution power

Cost savings from sourcing, distribution, and admin can be reinvested into growth initiatives

Risks

Declining U.S. soft drink demand poses long term growth challenges

Heavy reliance on North America limits exposure to faster-growing international markets

Complexity of the JDE Peet’s deal and breakup could distract management from fixing the coffee business amid weak demand and high costs

Investor sentiment around KDP is cautious. Shares dropped after the $18B JDE Peet’s deal and planned split, as investors worry about higher debt, JAB’s influence, and unclear communication from management.

The breakup could create stronger, more focused businesses, but questions about debt and execution remain. Some see the sell-off as an overreaction, especially with Beverage Co.’s growth potential in soft drinks and energy, but most are waiting for clearer guidance in October before regaining confidence.

Sentimental Risk: High

IDDA Point 5: Technical

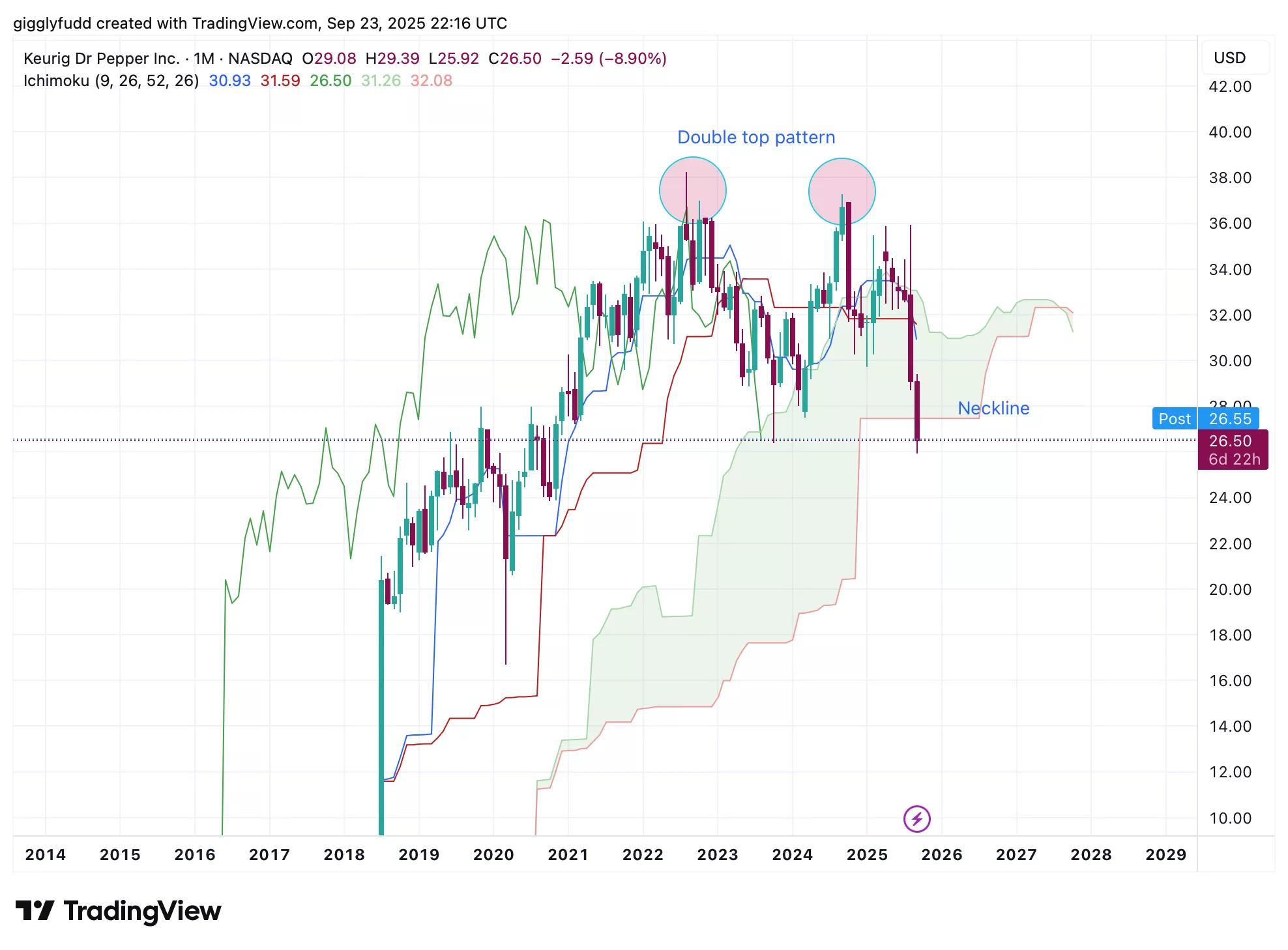

On the monthly chart

The latest candlesticks have dipped into the cloud and are testing the lower band as a support zone.

A double-top pattern has formed, signaling a potential bearish reversal.

The Kijun line has crossed below the Tenkan line, adding another bearish signal.

The latest candlesticks have dipped into the cloud and are testing the lower band as a support zone. A double-top pattern has formed, signaling a potential bearish reversal, and the Kijun line has crossed below the Tenkan line, adding another bearish signal. If price breaks below this support zone, which aligns with the neckline, further downward momentum could follow.

(Click on image to enlarge)

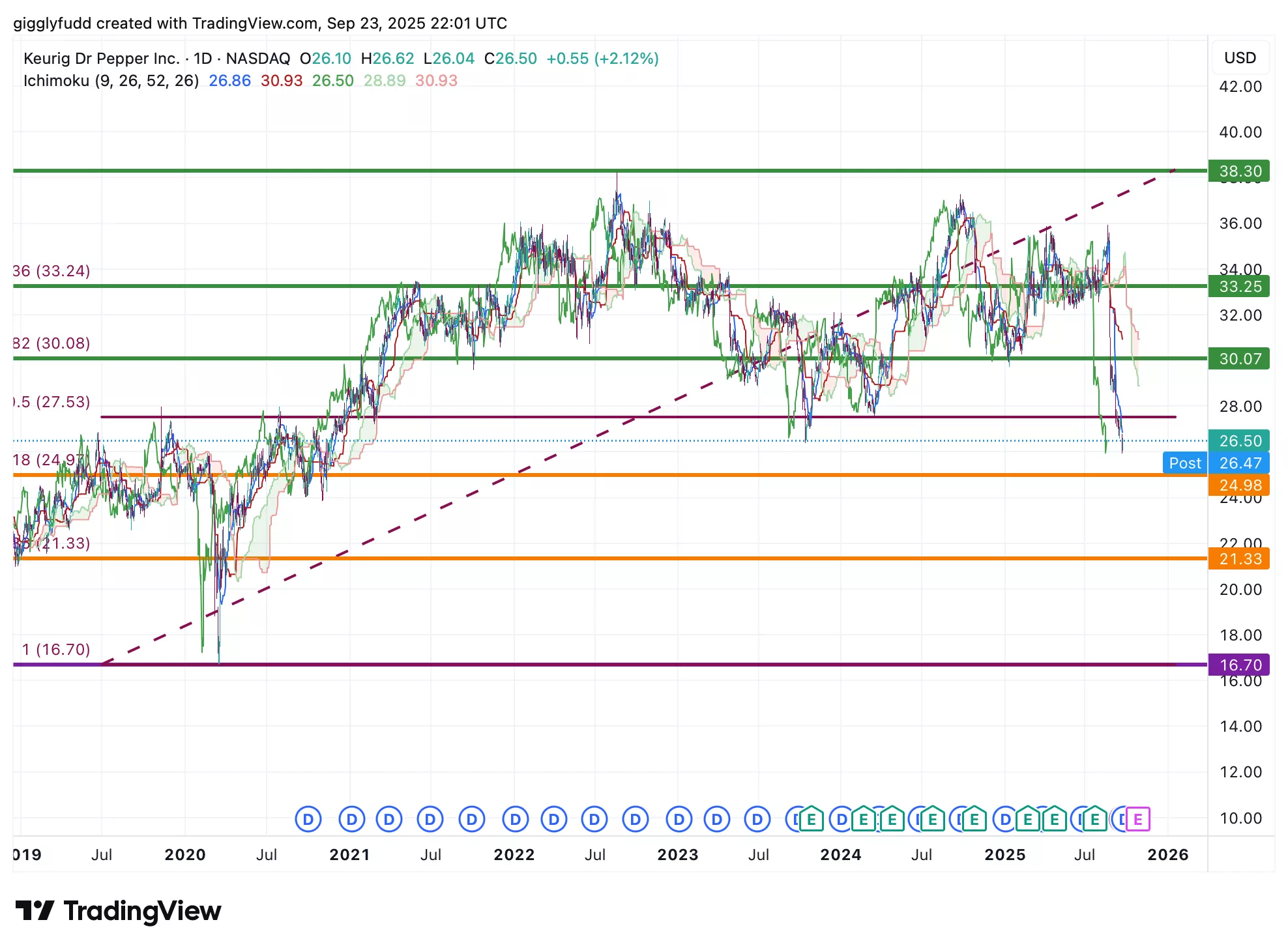

On the daily chart

Recent candlesticks show a steep downtrend driven by negative sentiment around KDP’s acquisition.

The future Ichimoku cloud is bearish, indicating continued downward momentum.

Candlesticks remain well below the cloud, further supporting the bearish outlook.

Recent candlesticks show a steep downtrend driven by negative sentiment around KDP’s acquisition. The future Ichimoku cloud is bearish, pointing to continued downward momentum, and the candlesticks sitting well below the cloud further reinforce this bearish outlook. It is sitting on the strong psychological level of 26.50, if negative sentiment continues and it breaks below that below then further downward momentum can be expected.

(Click on image to enlarge)

Investors looking to get in KDP can consider these Buy Limit Entries:

Current market price 26.50 (High Risk)

24.98 (Medium Risk)

21.33 (Low Risk)

Investors looking to take profit can consider these Sell Limit Levels:

30.07 (Short term)

33.25 (Medium term)

38.30 (Long term)

Here are the Invest Diva ‘Confidence Compass’ questions to ask yourself before buying at each level:

- If I buy at this price and the price drops by another 50%, how would I feel? Would I panic, or would I buy more to dollar-cost average at lower prices? (hint: this question also reveals your CONFIDENCE in the asset you’re planning to invest in).

- If I don’t buy at this price and the stock suddenly turns around and starts going up again, will I beat myself up for not having bought at this level?

Remember: Investing is personal, and what is right for me might not be right for you. Always do your own due diligence. You should ONLY invest based on your own risk tolerance and your timeframe for reaching your portfolio goals

Technical Risk: High

Final Thoughts on Keurig Dr Pepper (KDP)

Keurig Dr Pepper is undergoing one of the biggest shake-ups in its history with the planned acquisition of JDE Peet’s and a future split into two companies – Beverage Co., focused on soft drinks and energy, and Global Coffee Co., aimed at expanding its global coffee presence.

Supporters see strength in Beverage Co.’s brand loyalty, pricing power, and partnerships like its collaboration with Disney, alongside the company’s record of reducing debt and generating cash flow. Critics point to sluggish coffee demand, the challenges of integrating a large acquisition, and higher debt that could strain finances. Technically, the stock remains under pressure with bearish signals on the charts, though a shift in sentiment could open the door for a rebound.

Key Takeaways:

The debate around Keurig Dr Pepper is whether its big coffee deal and planned split will create two stronger companies or burden investors with debt and execution risks. Optimists see Beverage Co. as a steady growth driver in the U.S., while skeptics worry about weak coffee demand and the challenges of restructuring. Long term investors may view the sell off as an opportunity, while cautious ones might prefer to wait for clearer guidance.

Overall Stock Risk: Medium – High

More By This Author:

With Rates Falling, Is Realty Income The Best Dividend REIT To Buy Now?

Is The Smart Money Hinting At A New Phase For IonQ Stock?

Intel Stock Surges After $5B Nvidia Deal – Breakthrough In AI Chips Or Bubble In The Making?