With Rates Falling, Is Realty Income The Best Dividend REIT To Buy Now?

Image Source: Unsplash

With interest rates trending lower, income investors are asking the big question: is Realty Income (NYSE: O) the best dividend REIT to buy right now? Branded as “The Monthly Dividend Company,” Realty Income owns over 15,600 triple net lease properties, mainly with defensive, service oriented tenants that provide steady cash flow across market cycles.

Backed by more than 30 years of uninterrupted dividend growth and a yield north of 5%, O has long been a favorite among those seeking reliability.

Yet the story isn’t without its challenges. Supporters highlight Realty Income’s strong balance sheet, investment-grade credit rating, and unmatched history of paying dividends through downturns. Critics argue that its slow internal growth and reliance on acquisitions make it vulnerable in a higher-rate world, where financing costs eat into returns.

Today, the stock trades at a valuation below historical norms, reflecting these pressures but also offering potential upside if falling rates restore investor appetite for dependable income. That tension, between rock solid dividend stability and muted growth, sits at the heart of the current debate.

Is Realty Income a bargain dividend anchor poised to re-rate higher, or a slow-growth REIT reaching its limits?

Let’s map it using the IDDA (Capital, Intentional, Fundamental, Sentimental, Technical):

IDDA Point 1 & 2: Capital & Intentional

Before investing in Realty Income, ask yourself:

Do you want exposure to the largest triple net REIT, with a portfolio designed for defensive income stability?

Are you comfortable with slower growth, where long term lease structures limit internal expansion to approximately 1% annually?

Do you believe Realty Income can continue sourcing attractive acquisitions despite tighter financing spreads and competition?

Realty Income (O) is financially strong with solid credit and ample liquidity, and its dividends are well supported by steady cash flow. Investors view it as a dependable “sleep well at night” stock thanks to its monthly payouts and long history of stability, though its slower growth profile tempers enthusiasm.

Bottom line: For long-term investors, Realty Income offers a dependable dividend and defensive positioning, ideal for those prioritizing income and stability. For growth-oriented or short term investors, however, the limited upside and reliance on acquisitions make O less compelling compared to faster-growing REITs or equities. Investors should know their own unique risk tolerance before investing in Realty Income (O) or any asset.

IDDA Point 3: Fundamentals

Scale, Business Model, and Tenant Quality

Realty Income is the largest triple-net REIT in the U.S, with a portfolio of more than 15,600 properties. Its tenants are primarily in retail, but the majority are in defensive categories such as service-oriented or essential businesses that are resistant to both e-commerce disruption and economic downturns. The triple-net lease model shifts all operating costs, maintenance, and capital expenditures to tenants, leaving Realty Income with predictable rental income. These leases are typically long term, often 15 years or more with renewal options, providing consistent, contractual revenue stability.

Dividend Stability and Recognition

Known as “The Monthly Dividend Company,” Realty Income has paid and grown its dividend for over 30 years, offering investors a yield of about 5.5%. Unlike most companies that pay quarterly, O distributes dividends monthly, which makes it especially attractive for income-focused investors. Its consistency has earned it a place in the S&P High Yield Dividend Aristocrats Index and the rare distinction of maintaining an A- credit rating or better, highlighting both its dependability and financial credibility.

Financial Strength and Balance Sheet

Realty Income is in solid financial shape, supported by a strong credit rating and plenty of liquidity. This means the company can refinance its debt or fund new acquisitions on favorable terms. Upcoming debt obligations are manageable, and its overall borrowing levels and ability to cover interest costs remain well within healthy ranges. While REITs are required to pay out most of their income as dividends, Realty Income’s payout is comfortably supported by the cash it generates from operations. This gives the company flexibility to keep investing in acquisitions and redevelopment projects. In addition, its large base of unencumbered properties provides extra security and ensures continued access to capital markets when needed.

Valuation and Interest Rate Sensitivity

Realty Income’s stock is currently trading below where it has historically been valued, which reflects the pressure it has faced from higher interest rates. For investors, this creates a potentially attractive entry point. As interest rates decline, the company’s dividend becomes more appealing compared to safer alternatives, and its steady cash flow gives the stock room to recover toward past valuation levels. With its monthly payouts, defensive tenant base, and reliable income stream, Realty Income offers a compelling mix of steady income today and potential for long-term value growth.

Growth Constraints and Reliance on Acquisitions

Despite its stability, Realty Income faces structural growth limitations. Lease escalations average only about 1% annually, which restricts internal growth. To expand meaningfully, the company relies on acquisitions, completing over $28 billion in deals since 2021 at average cap rates near 7%. However, rising interest rates have narrowed spreads and made financing more costly, posing challenges to sustaining this acquisition-driven growth. Without a steady pipeline of attractively priced deals, Realty Income could be limited to slower internal growth, making its ability to balance stability with external expansion a key factor for long-term investors to monitor.

Fundamental Risk: Low-Medium

IDDA Point 4: Sentimental

Strengths

Reliable monthly dividend with decades of steady growth, resilient through market cycles.

Reasonable leverage and liquidity provide flexibility for acquisitions and growth opportunities.

Strong operating history, disciplined underwriting, and transparency build investor confidence.

Risks

Needs a growing volume of acquisitions to drive value, increasing pressure and risk.

Long-term leases have minimal rent growth, leaving them exposed to inflation and higher rates.

Rising interest rates narrow spreads between cap rates and financing costs, limiting growth potential.

Investor sentiment toward Realty Income is shaped by its reputation as one of the most dependable dividend payers in the market. Many investors view O as a safe haven for steady cash flow, especially during periods of falling interest rates when its yield becomes more attractive relative to bonds or savings accounts. The company’s scale, defensive tenant base, and monthly dividend reinforce confidence in its reliability, making it a cornerstone for income-focused portfolios. However, sentiment is tempered by awareness of its limited internal growth and dependence on acquisitions, which can be challenged by higher borrowing costs. Overall, O is perceived less as a growth story and more as a “sleep well at night” stock – trusted for stability and income but with modest capital appreciation expectations.

Sentimental Risk: Low-Medium

IDDA Point 5: Technical

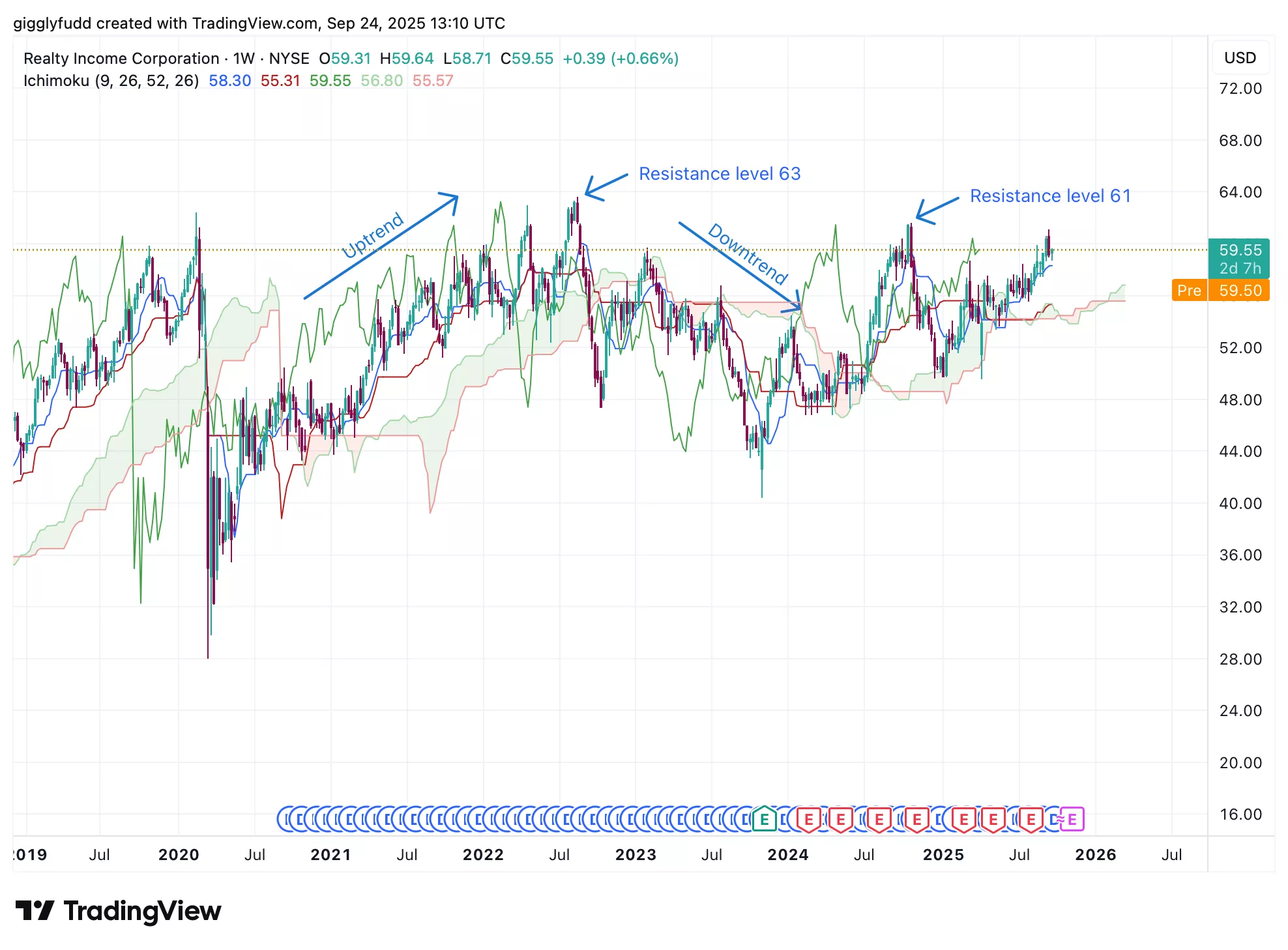

On the weekly chart:

The trend has been upward since the start of 2025.

The future cloud is bullish, signaling continued momentum and nearing a key resistance around 63.

Candlesticks remain above the cloud, which is acting as a strong support zone.

Over the past year, Realty Income’s stock has followed a cyclical pattern, with uptrends and downtrends typically lasting 1-2 years. It reached an all-time high of 63 in August 2022. The current uptrend that began in early 2025 is now approaching resistance around 61. With a bullish future Ichimoku cloud and candlesticks holding above support, upward momentum remains intact.

(Click on image to enlarge)

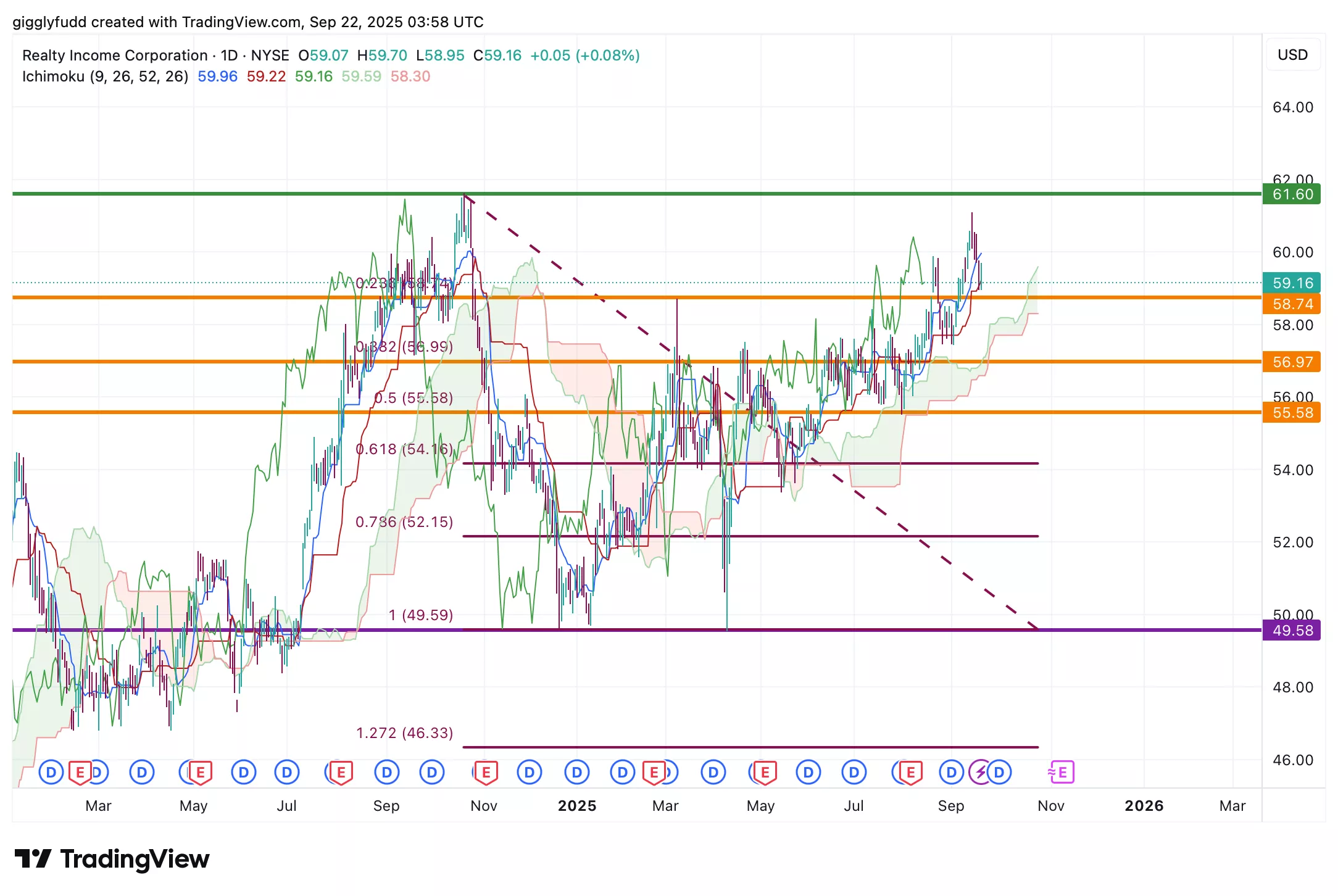

On the daily chart:

The trend has been upward since May 2025, with pullbacks retracing about 50%.

The future cloud is bullish, signaling continued momentum and approaching key resistance near 61.

Candlesticks remain above the cloud, which is acting as a strong support zone.

From March to July, the stock consolidated, with the sharpest dip in April. Since May, it has resumed an uptrend, experiencing healthy 50% pullbacks while moving toward the 61 resistance level. The bullish cloud and candlesticks above support reinforce the upward momentum.

If the bullish momentum breaks above the 61 level and 63 level, then we can expect further upward momentum.

(Click on image to enlarge)

Investors looking to get in O can consider these Buy Limit Entries:

58.74 (High Risk)

56.97 (Medium Risk)

55.58 (Low Risk)

Investors looking to take profit can consider these Sell Limit Levels:

61.60 (Short term)

63.50 (Medium term)

68.36 (Long term)

Here are the Invest Diva ‘Confidence Compass’ questions to ask yourself before buying at each level:

- If I buy at this price and the price drops by another 50%, how would I feel? Would I panic, or would I buy more to dollar-cost average at lower prices? (hint: this question also reveals your CONFIDENCE in the asset you’re planning to invest in).

- If I don’t buy at this price and the stock suddenly turns around and starts going up again, will I beat myself up for not having bought at this level?

Remember: Investing is personal, and what is right for me might not be right for you. Always do your own due diligence. You should ONLY invest based on your own risk tolerance and your timeframe for reaching your portfolio goals

Technical Risk: Medium

Final Thoughts on Realty Income (O)

Realty Income has regained attention as falling interest rates boost the appeal of its dependable monthly dividend. Branded as “The Monthly Dividend Company,” it owns a large portfolio of triple-net lease properties with defensive tenants that provide steady cash flow across cycles.

Supporters highlight its strong balance sheet, credit rating, and history of dividend growth, while critics point to its slow internal growth and heavy reliance on acquisitions, which become harder to fund when borrowing costs rise. Valuations remain below long term averages, creating potential upside if rates ease, but its external growth model still faces pressure. Technically, the stock shows a steady uptrend on both weekly and daily charts, with bullish signals in place, though resistance levels could bring periods of consolidation before further gains.

Key Takeaways:

The debate around Realty Income centers on whether it is a bargain dividend anchor ready to re-rate higher as interest rates fall, or a slow-growth REIT facing structural limits. Bulls see a fortress balance sheet, defensive tenants, and monthly dividend stability as unmatched strengths. Bears warn of limited internal growth and rising competition for acquisitions, which could cap returns. For long-term investors, Realty Income offers dependable income and portfolio stability. For shorter-term traders, however, modest upside and growth constraints may limit appeal compared to faster-moving opportunities.

Overall Stock Risk: Low-Medium

More By This Author:

Is The Smart Money Hinting At A New Phase For IonQ Stock?

Intel Stock Surges After $5B Nvidia Deal – Breakthrough In AI Chips Or Bubble In The Making?

Baidu Stock: Is This Rally Set To Last?