Baidu Stock: Is This Rally Set To Last?

Image Source: Pexels

You’re right. Here’s a smoother intro with clean flow.

Baidu (BIDU) is China’s search giant, and it also builds AI tools, runs a fast-growing cloud, and tests robotaxis. It designs AI chips as well. The stock has climbed since August, and September looks strong. Why now, and can this rally last? Let’s dig in.

The IDDA Analysis framework is used to analyze companies and determine which are right for you. There are five steps to the process:

- Capital Analysis – Your personal risk tolerance.

- Intentional Analysis – Your unique financial goals and timelines based on your age, health, and lifestyle.

- Fundamental Analysis – The viability of the asset based on company performance, financial health, and market position.

- Sentimental Analysis – The current emotions of Wall Street and other market participants.

- Technical Analysis – Historical price action to identify key psychological levels and market patterns.

Let’s dive into the IDDA analysis to assess Baidu’s fundamental, sentimental, and technical outlook.

IDDA Point 1&2: Capital & Intentional

The capital and intentional analysis need to be conducted by you.

Select your assets in alignment with your financial goals. Listen to your intuition about each asset, but remember to invest based on your own values, not just because of recommendations from others.

IDDA Point 3: Fundamental

AI mix grows

AI means artificial intelligence. Non ad revenue passed 10B yuan in Q2 and grew 34% year over year, led by AI cloud. This shifts the story away from ads and adds balance.

Ads are weak

Online marketing revenue fell 15% year over year as China’s economy stayed soft. This still drags on total growth today.

Robotaxi at scale

Apollo Go delivered 2.2M fully driverless rides in Q2 and passed 14M total rides by August. That shows real demand, not just tests.

Cloud standing

Global tech research firm IDC ranked Baidu the No. 1 AI public cloud provider in China in 2024. This adds credibility and helps the long term case.

Model upgrades

Baidu launched ERNIE X1.1 with better reasoning and also released a new large model for builders. This keeps developers inside its stack.

Own chips reduce risk

Baidu now trains models on its Kunlun P800 chips, not only on foreign chips. That lowers export risk and can cut compute cost over time.

Balance sheet support

Baidu issued 4.4B yuan notes at 1.90% due 2029 and returned about 677M dollars to shareholders since Q1 2025. That supports the floor on dips.

Cash burn to fund AI

Free cash flow was negative 4.7B yuan in Q2 and costs rose with AI work. Heavy spend continues near term.

Fundamental risk: medium high.

IDDA Point 4: Sentimental

Overall sentiment is bullish for Baidu.

Strenghts

The stock trends up since August, and buyers step in on dips.

AI launches spark hope, and the chip story lowers export fear.

Robotaxi rides keep growing, which builds trust in the story.

Cloud wins add credibility, and big clients keep testing tools.

Cheap new notes and buybacks send a strong signal.

Talk of a TikTok deal cools policy fear and helps China tech mood.

Risks

Ads stay weak while China demand crawls.

Heavy AI spend pressures cash flow.

Rules on data, AI, and robotaxis can change fast.

Strong rivals fight for users and ad budgets.

Export limits and chip supply still hang over the plan.

Headlines on U.S. China ties can swing the tape.

Sentimental risk: medium.

IDDA point 5 – Technical

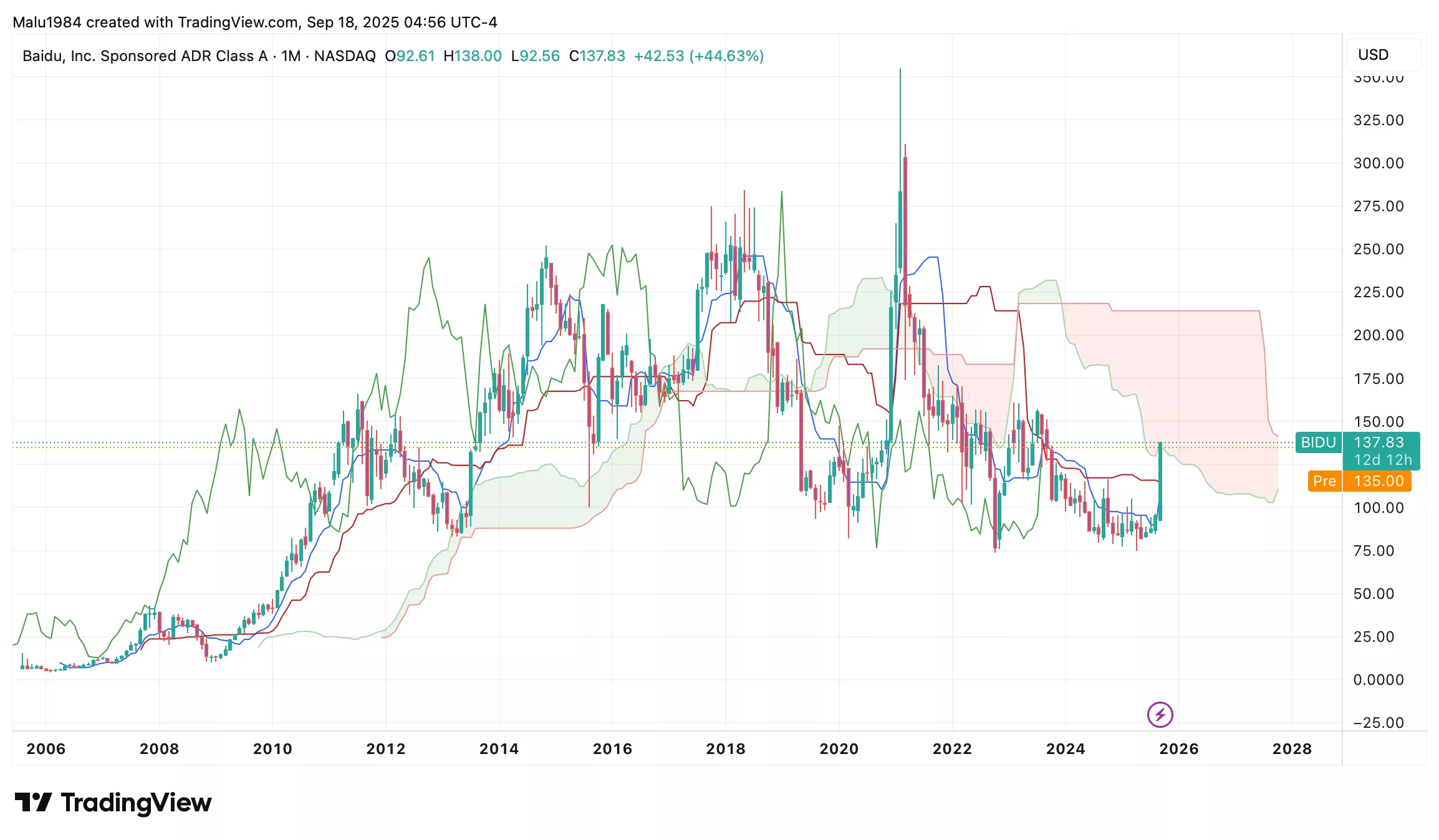

Monthly chart

In February 2021, price hit its all-time-high of $354.82 and by October 2022, it fell to its all-time-low of $73.58.

Since April 2025, price has been making higher highs, and September is up about 48% until the time of writing.

Chinese tech stocks have been on a rally with Baidu leading the growth due to renewed AI optimism, rising capital expenditures, and a tentative warming in US-China relations.

Candles are still below the Ichimoku cloud, the cloud is red and wide, and it acts as resistance.

If buying stays strong, a trend reversal can form later.

(Click on image to enlarge)

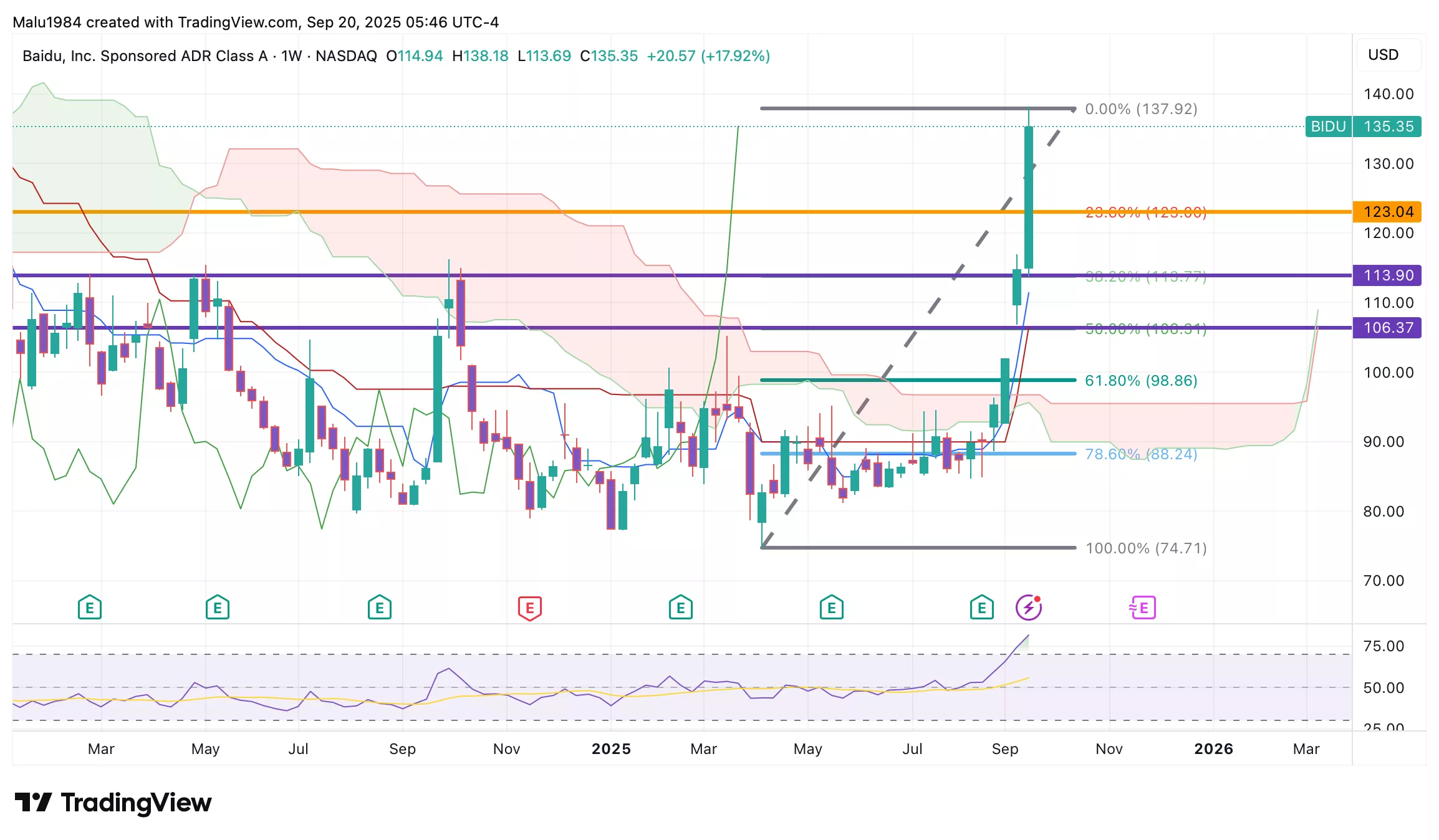

Weekly chart

Candles broke above the Ichimoku cloud, and the cloud just turned green though it is narrow.

The conversion line crossed above the baseline, a golden cross that signals buyers are in control.

RSI is 81, so it is overbought.

Overall technical view

Monthly still fights cloud resistance, while weekly shows a fresh break with a golden cross. RSI shows BIDU is overbought, so we can expect a pause or pullback. If buyers hold above the weekly cloud, the bigger trend can flip over time.

(Click on image to enlarge)

Buy Limit (BL) levels:

$123.04 – High Risk

$113.90 – Moderate Risk

$106.37 – Low Risk

Suitable for long-term investors.

Here are the Invest Diva ‘Confidence Compass’ questions to ask yourself before buying at each level:

- If I buy at this price and the price drops by another 50%, how would I feel? Would I panic, or would I buy more to dollar-cost average at lower prices? (hint: this question also reveals your CONFIDENCE in the asset you’re planning to invest in).

- If I don’t buy at this price and the stock suddenly turns around and starts going up again, will I beat myself up for not having bought at this level?

Remember: Investing is personal, and what is right for me might not be right for you. Always do your own due diligence. You should ONLY invest based on your own risk tolerance and your timeframe for reaching your portfolio goals

Technical risk: medium high.

Summary: Final Thoughts

Baidu rallies since August, and September is strong. AI tools, cloud, chips, and robotaxi drive hope. Ads are weak, and AI spend is heavy. The story shifts, but the turn is not done.

On the fundamentals, cloud and AI grow fast, and robotaxi use is real. The note issue and buybacks help the floor. Risks are soft ads, cash burn, and rules that can change. Fundamental risk is medium high.

On sentiment, buyers step in on dips, and news on AI and chips lifts mood. Policy chill helps China tech as well. Risks are export limits, rivals, and macro headlines. Sentimental risk is medium.

On the chart, the monthly candle sits under the cloud, so big trend repair is pending. The weekly broke above the cloud, the cloud turned green, and a golden cross printed. RSI is 81, so a pullback can come. Technical risk is medium high.

Overall view

Bias is cautiously bullish while price holds above the weekly cloud. A cool off can reset the move, and a monthly close above the cloud would strengthen the case.

Overall risk is medium high.

More By This Author:

Wall Street Says Tesla Stock Is 70% Overvalued – But Are Investors Missing The Real Story?B2Gold Just Turned On Its Goose Mine – So Why Is Wall Street Still Sleeping On This Stock?

Oracle Stock Soars On $455b AI Cloud Deals – Can Investors Bet On It Catching Google By 2030