Alphabet’s Q2 2025 Earnings Beat Expectations But This One Detail On Google Could Matter More

Image Source: Pixabay

Alphabet (GOOGL) isn’t just a tech company, it’s the digital backbone of the modern internet. From dominating global search and online advertising to scaling YouTube, cloud computing, and autonomous driving through Waymo, Alphabet sits at the center of innovation and information.

In Q2 2025, the company did very well and beat expectations with 12% revenue growth to $96.4B, fueled by gains in Search, YouTube Ads, and Google Cloud. While the market remains cautiously optimistic, analysts project 17 – 35% upside based on valuation models.

But perhaps the most overlooked detail? AI Overviews, Alphabet’s newest AI-powered search experience, is now used by over 2 billion people monthly, helping reverse the slowdown in Search engagement and laying the groundwork for future monetization.

Alphabet isn’t just defending its lead from AI disruptors like ChatGPT, it’s transforming how users interact with Google Search entirely. Waymo’s steady rollout adds another layer of long-term optionality beyond ads and cloud. Still, investors should be mindful of regulatory risks, AI monetization hurdles, and the timing of returns on its heavy investments.

Let’s review it using the IDDA Framework: Capital, Intentional, Fundamentals, Sentimental, and Technical.

IDDA Point 1 & 2: Capital & Intentional

Before investing in Alphabet, ask yourself:

Do you want exposure to a diversified tech leader with high-margin businesses and proven AI execution?

Are you comfortable with heavy AI-related CapEx today for potentially higher growth tomorrow?

Do you believe Alphabet’s innovation and market dominance outweigh regulatory and competitive risks?

Alphabet’s intentional strategy revolves around AI-first transformation, from enhancing search experiences to enabling creators on YouTube and scaling Google Cloud into a profitability machine. Its multi-segment model (ads, subscriptions, cloud, autonomous tech) ensures revenue diversity, while its financial strength provides a wide moat. For long-term investors, Alphabet remains less of a speculative play and more of a high-growth, cash-rich compounder.

IDDA Point 3: Fundamentals

Alphabet posted a strong Q2 2025, with revenue up 12% YoY to $96.43B. Growth came from all major areas: Search (+12%), YouTube (+13%), and Google Cloud (+32%), which also saw margins improve to 20.7%. Operating profit rose 14% YoY to $31.27B, though free cash flow dipped due to a sharp increase in CapEx, now expected to hit $85B for the year, mostly to support AI and cloud growth.

AI is driving momentum across Alphabet’s business. AI Overviews alone helped boost search usage by 10%, now reaching over 2 billion monthly users across more than 200 countries. This level of engagement not only stabilizes Google’s search dominance but also opens the door for monetization at scale. YouTube gained from AI-enhanced recommendations and the success of Shorts. Google Cloud continues to benefit from strong enterprise adoption and AI integration, reinforcing the case for ongoing investment.

With a market cap of $2.33T, Alphabet still trades below its estimated valuation range of $2.6T to $2.91T, making it attractive for long-term investors. While Waymo hasn’t yet delivered major revenue, its expansion and partnerships (e.g. Toyota) point to future potential. Backed by strong leadership, innovation, and diversified growth, Alphabet remains well-positioned for the years ahead.

Fundamental Risk: Low – Medium

IDDA Point 4: Sentimental

Strengths

Strong AI Integration – Alphabet’s successful adoption of AI in its search features and Google Cloud strengthens its position in the market, driving growth and user engagement.

YouTube Growth – YouTube continues to see increased engagement, especially through new initiatives like YouTube Shorts, contributing to robust revenue growth in both ads and subscriptions.

Google Cloud Expansion – Google Cloud posted impressive growth, with a significant increase in operating margin and continued expansion in AI, positioning it for long term success in the cloud market.

Risks

Increased Competition – Platforms like ChatGPT are posing a growing threat to Google’s search dominance, particularly in non-commercial queries.

Regulatory Risks – Ongoing legal and regulatory challenges, especially related to search and advertising monopolies, could limit Alphabet’s future growth potential.

High CapEx Spending – Alphabet’s increased CapEx investments, while aimed at long-term growth, could strain short-term profitability and delay expected returns, raising concerns among investors.

Market sentiment toward Alphabet remains broadly positive, supported by strong growth in AI-driven search, YouTube, and especially Google Cloud. Despite rising competition from platforms like ChatGPT and the company’s aggressive $85 billion CapEx plan, investors are optimistic due to Alphabet’s proven leadership and strategic investments in AI and cloud. While risks like regulation, AI monetization, and slow returns on spending exist, Alphabet’s strong business model and history of innovation support a positive long-term outlook.

Sentimental Risk: Medium

IDDA Point 5: Technical

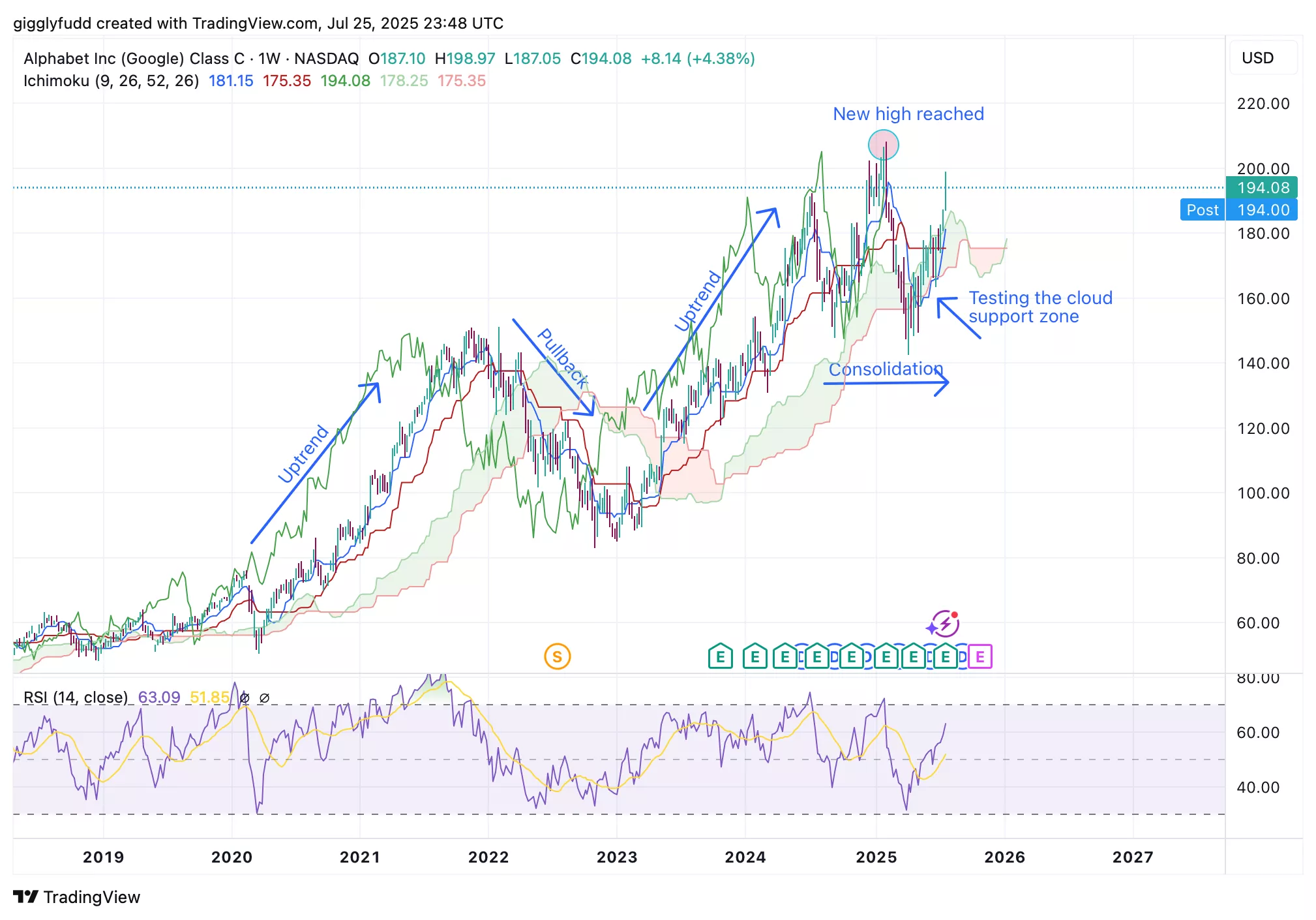

On the weekly chart:

The Ichimoku Cloud has just turned bullish, signaling the start of upward momentum.

The cloud has been tested as a support zone and continues to hold, with the candlestick remaining above it, reinforcing the bullish outlook.

The Tenkan line has crossed above the Kijun line, forming a golden cross, another strong bullish signal.

Looking at the broader trend, the stock has shown long term growth over the past 6 years. It was in a clear uptrend from 2019 to 2022, before the broader market pullback in 2022 affected Alphabet as well. In 2023, the stock rebounded, breaking past the previous resistance at $150 and reaching a new high of $208 in February 2025.

Since then, it has been consolidating, repeatedly testing the Ichimoku cloud as support, which continues to hold. The latest bullish candlestick reflects a positive market reaction to Alphabet’s Q2 earnings, suggesting renewed momentum.

(Click on image to enlarge)

On the daily chart:

The Ichimoku Cloud is green and bullish, signaling continued upward momentum in the shorter term.

The candlesticks, along with the Kijun, Tenkan, and Chikou lines, are above the cloud, supporting the bullish trend.

RSI is overbought at 74.63, indicating a potential pullback in the near term.

On the daily chart, the stock has been in a continued bullish trend since April 2025 and is now approaching the recently formed resistance level at $208. However, with the RSI in overbought territory at 74.63, a short term pullback is possible, potentially presenting opportunities to buy at lower prices or buy the dip.

(Click on image to enlarge)

Investors looking to get in GOOG can consider these Buy Limit Entries:

194.08 (High Risk – FOMO entry)

178.38 (High Risk)

160.17 (Medium Risk)

145.24 (Low Risk)

Investors looking to take profit can consider these Sell Limit Levels:

207.70 (Short term)

236.57 (Medium term)

254.75 (Long term)

Hold long term

Here are the Invest Diva ‘Confidence Compass’ questions to ask yourself before buying at each level:

- If I buy at this price and the price drops by another 50%, how would I feel? Would I panic, or would I buy more to dollar-cost average at lower prices? (hint: this question also reveals your

- CONFIDENCE in the asset you’re planning to invest in).

- If I don’t buy at this price and the stock suddenly turns around and starts going up again, will I beat myself up for not having bought at this level?

Remember: Investing is personal, and what is right for me might not be right for you. Always do your own due diligence. You should ONLY invest based on your own risk tolerance and your timeframe for reaching your portfolio goals

Technical Risk: Low – Medium

Final Thoughts on Alphabet (GOOG)

Alphabet (GOOG) isn’t just a tech company, it’s the backbone of the digital world. In Q2 2025, it beat expectations with 12% revenue growth to $96.4B. But one underappreciated highlight was the rapid rise of AI Overviews, now used by over 2 billion people, silently revitalizing its core Search product and deepening user engagement.

While its $85B CapEx is weighing on free cash flow, long-term potential remains strong, with 17–35% upside projected. Risks like regulation and AI monetization exist, but Alphabet’s strong leadership and diversified growth offset them. Technically, the stock is bullish but nearing resistance at $208, with a short-term pullback likely.

Key Takeaways: Long-Term Buy | Cost Average on Pullbacks

Alphabet is a long-term, high-quality compounder well-positioned to benefit from key trends in AI, cloud, and digital media. While short-term volatility may occur due to regulatory risks and heavy CapEx pressuring margins, the stock still offers strong upside for investors with a 3+ year horizon.

It’s a solid fit for long-term growth investors seeking a stable tech leader with broad AI exposure and strong financials. New buyers could consider cost-averaging or staged Buy Limits on dips, provided this aligns with their risk tolerance, strategy, and goals.

Overall Stock Risk: Medium

More By This Author:

QuantumScape Stock Before And After Earnings: Buy The Dip Or Stay Away In 2025?

What If The Next Quantum Leader Isn’t IBM Or Google… But Rigetti Stock?

First Apple, Now The Pentagon… What’s Really Going On With MP Materials Stock?