All-Time Highs In Sight: The Critical Signals You Can't Ignore

Watch the free-preview video below extracted from the WLGC session before the market open on 14 May 2024 to find out the following:

- Is the S&P 500 (SPX) showing signs of a sustainable rally, or are we headed for a pullback

- Why the volume in the past week might be a concern

- The most important signal to judge for a bearish reversal

- Analogue comparison of the current volume

- And a lot more...

Video Length: 00:07:02

Market Environment

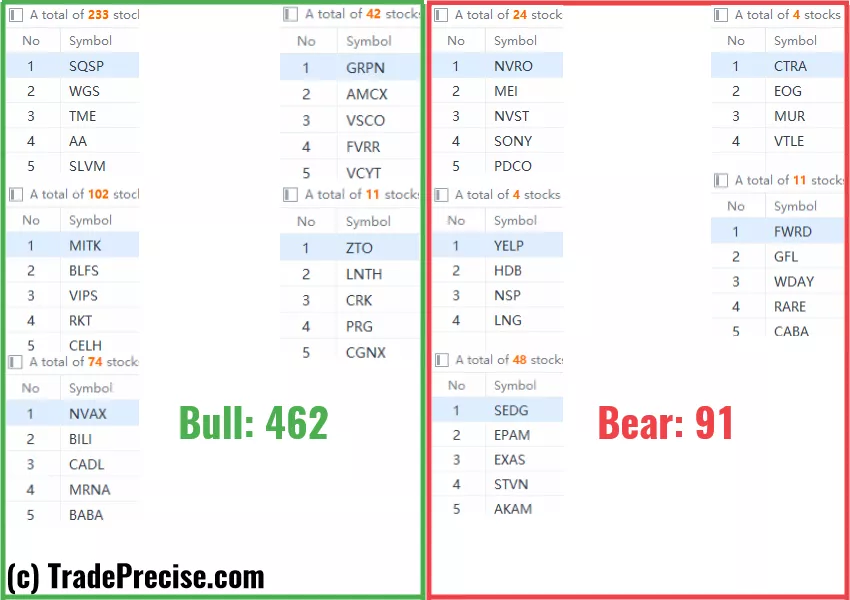

The bullish vs. bearish setup is 462 to 91 from the screenshot of my stock screener below.

There is no shortage of bullish setup while the market is still grinding up.

However, I am paying close attention to any potential reversal from the key levels due to the volume analogue as discussed in the video.

Meanwhile, enjoying the trade entry setup as they are still working well. I especially like the multi-year accumulation structure in Gold as discussed in this post.

Market Comment

8 “low-hanging fruits” VIST, RMD trade entries setups + 10 actionable setups DELL were discussed during the live session before the market open (BMO).

(Click on image to enlarge)

(Click on image to enlarge)

(Click on image to enlarge)

More By This Author:

Is A Reversal Coming To S&P 500?

Market Reversal Alert: Unveiling A Strategic Trading Plan From The Resistance Zone

How The S&P 500 Reacts To The Mysterious Dance Of The 10-Year Yield

Disclaimer: The information in this presentation is solely for educational purpose and should not be taken as investment advice.