Air Products & Chemicals: A Chemical Company With Earnings Issues, But A Solid Long-Term Outlook

Image Source: Pexels

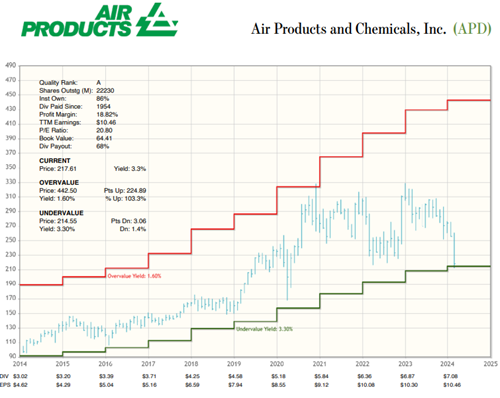

Air Products and Chemicals (APD) is one of the largest global producers of industrial gases, as well as a major player in specialty chemicals. It is the world’s leading supplier of hydrogen and carbon monoxide products (HYCO) and helium. The company's Q1 earnings report was not exactly stellar, but it remains a long-time favorite, counsels Kelley Wright, editor of Investment Quality Trends.

The capital-intensive industrial gases industry has historically expanded up to twice as fast as the overall economy. The company does not have a homogeneous customer base or end market, and no single customer accounts for more than 10% of the company’s revenues.

However, APD does have concentrations of customers in specific industries, primarily refining, chemicals, and electronics. Within each of these industries, APD has several large-volume customers with long-term contracts.

In November 2023, APD announced that the new capital budget for its blue hydrogen energy complex in Louisiana is $7 billion, an increase from $4.5 billion in October 2021. Much of the increase is driven by cost inflation, including the interest component of capital in the budget, and a smaller amount of the increase is driven by an expanded scope, supported by strong demand.

So, that’s the boilerplate. Moving on, in Q1, the company missed estimates, guided EPS lower, and reiterated its hefty capital expenditure commitment for 2024. Next, revenues did grow quarter-over-quarter, but the company’s rolling three-year free cash flow margins turned negative.

Peers L’Air Liquide S.A. and Linde Plc (LIN) were able to grow their free cash flow margins over the same period. The company’s three-year rolling capital expenditures exploded to three times those of their peers. Moody’s is suggesting a possible downgrade in its credit rating, and the dividend increase was lower than in previous years.

APD has recently returned to the “Undervalued” category after many years. But with economic book value of just $116 per share based on an ROIC of 9%, an FCFY of -6%, and a PVR of 1.9, it may take a while for the company to get right.

My recommended action would be to consider buying shares of APD.

About the Author

Kelley Wright entered the financial services industry in 1984 as a stock broker, first with a private investment boutique in La Jolla, and later with Dean Witter Reynolds. In 1990, he left the retail side of the industry for private portfolio management. In 2002, Mr. Wright succeeded Geraldine Weiss as the managing editor of the Investment Quality Trends newsletter, as well as the chief investment officer and portfolio manager for IQ Trends Private Client.

His commentaries have been published in Barron's, Forbes, BusinessWeek, Dow Jones MarketWatch, The Economist, and many other business and financial periodicals. Mr. Wright is an active speaker at trade shows and investment conferences, and is a frequent guest and contributor to radio and CNBC. He is the author of Dividends Still Don't Lie, which was published in February, 2010, by John Wiley & Sons, Inc.

More By This Author:

A Deep Inflation Dive Shows Why Getting Back To 2% Will Take Time

XLI: An Object Lesson In Why Long-Term Investors Shouldn't React To Every Short-Term Move

Amid Record Highs For Stocks, Should Investors Worry About Loan Delinquencies?

Disclaimer: © 2023 MoneyShow.com, LLC. All Rights Reserved.