XLI: An Object Lesson In Why Long-Term Investors Shouldn't React To Every Short-Term Move

Image Source: Unsplash

When something falls by 2% one day and rallies by 2% the next, it’s still not completely back to where it was. A $100 stock that falls 2% is now worth $98. If that stock then rallies 2%, it’s worth $99.90. Yes, we can argue over 10 cents.

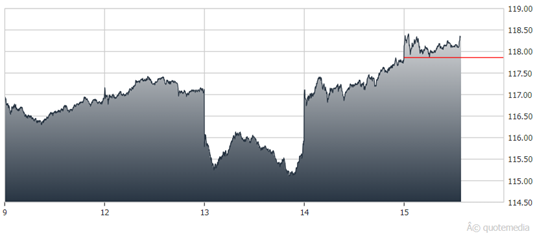

But the fact is, it needs to rally slightly more than 2% to be back to $100. With that said, take a look at the Industrials and what the Industrial Select Sector SPDR Fund (XLI) recently did, advises Kenny Polcari, chief market strategist at SlateStone Wealth.

XLI lost 1.1% on Tuesday, but gained 1.7% on Wednesday. So, that ETF was worth more Thursday morning than it was on Tuesday night. And that shows the issue with long-term investors that try to time the market.

Say you sold your XLI on Tuesday (because you got nervous with the CPI report), and put that money in cash (which is great). Then on Wednesday, Chicago Fed President Austan Goolsbee comes out and says he isn’t worried about the slight uptick in the CPI.

Industrial Select Sector SPDR Fund (XLI)

He adds that he expects maybe two or three months of higher CPI data, but that does not (in his opinion) change the narrative of cooling inflation (and by default, potential rate cuts -- even though he didn’t say that explicitly, he didn’t have to, and it was what the market heard).

So the algos go “Whoops – rate cuts are still alive and it’s time to get back in.” The XLI rallies back, taking back all the losses and then some.

Now, what do you do? Do you jump back in, thinking the pullback is over? Or do you sit tight and wait? And then what happens if it is over and the industrials continue to go higher? What exactly did you accomplish? You want industrial exposure. But you just blew it out, and now you have to get back in.

Do you see the hamster wheel investors are on? If you maintained your XLI position and it continued to sell off, you would get a chance to add to it at lower prices. The real question to ask is, did something fundamentally change with the industrials, or is the weakness just the algos creating havoc? Because if nothing fundamentally changed, then why would you blow out the position if you are a long-term investor?

All I’m saying is, the market never moves in just one direction forever. Trees don’t grow to the sky. Valuations get stretched, and then they reprice. The repricing (most times) depends on how stretched they were.

As for the S&P 500, anywhere between 5,000/5,050 still feels a bit toppy to me. I expect to see more “backing and filling.”

About the Author

Kenny Polcari is chief market strategist at SlateStone Wealth. He is a well-known TV personality appearing on Fox Business and CNBC, and he is often quoted in major print media outlets. Mr. Polcari writes a daily morning thoughts missive that is an informative, engaging, and entertaining look at global markets.

He also converts the daily written piece into a daily video piece as an alternative option for subscribers. Prior to that, Mr. Polcari was a managing director at O'Neil Securities/Member NYSE. He built the US equities business at ICAP and ran the NYSE trading floor division on behalf of Salomon Brothers. Mr. Polcari is also an Advisory Board member of The Headstrong Project.

More By This Author:

Amid Record Highs For Stocks, Should Investors Worry About Loan Delinquencies?

Peter Lynch, Toyota Motors, And The Virtues Of Being A Patient Investor

SPHQ: An ETF Whose Holdings Pass Three "Quality" Tests

Disclaimer: © 2023 MoneyShow.com, LLC. All Rights Reserved.