Amid Record Highs For Stocks, Should Investors Worry About Loan Delinquencies?

Stocks are making new record highs, with the S&P 500 now up 5.4% year to date and up 40.5% from its October 12, 2022 closing low of 3,577.03. While the data in aggregate continues to confirm the economy is in pretty good shape, some of the data show it isn’t quite as hot as it used to be. One set of metrics that has been deteriorating over the past couple of quarters is debt delinquency rates.

Image Source: Pixabay

Coming into 2024, Deutsche Bank and Societe Generale were among a handful of banks whose economists were calling for a recession this year. Now, they have both pulled that call. The banks’ revised views follow a slew of better-than-expected economic reports released since the beginning of the year.

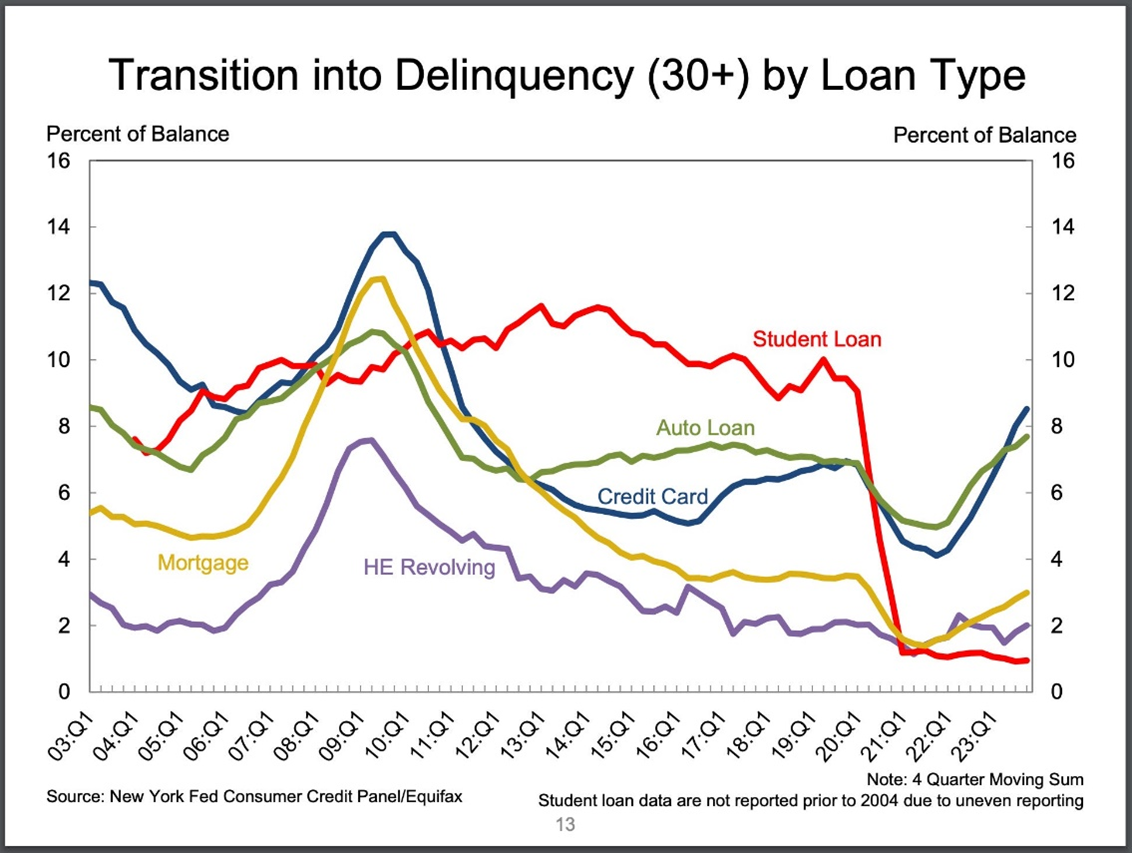

As for delinquencies, according to the New York Fed’s Q4 Household Debt and Credit (HHDC) report, the share of debt newly transitioning into delinquency continued to rise for most forms of borrowing.

“Annualized, approximately 8.5% of credit card balances and 7.7% of auto loan balances transitioned into delinquency,” the New York Fed observed. “Early delinquency transition rates for mortgages increased by 0.2 percentage point yet remain low by historic standards.”

When you consider all outstanding debt, the delinquency rates, while rising, continue to reflect a normalization back to pre-pandemic levels. In other words, while the “flow” into new delinquency has been picking up, the “stock” of delinquencies remains below pre-pandemic levels.

“As of December, 3.1% of outstanding debt was in some stage of delinquency, up by 0.1 percentage point from the third quarter,” New York Fed researchers wrote. “Still, overall delinquency rates remain 1.6 percentage points lower than the fourth quarter of 2019.”

So, while debt delinquency rates have deteriorated, absolute levels of debt delinquencies aren’t too bad. Metrics like these suggest things are relatively worse than they were during the hottest periods of the current economic expansion. But it’s a normalization that’s to be expected with the Fed’s efforts to bring down inflation.

The absolute levels of most metrics suggest the economy continues to be generally good — further confirming we are experiencing a bullish “Goldilocks” soft landing scenario where inflation cools to manageable levels without the economy having to sink into recession.

More By This Author:

Peter Lynch, Toyota Motors, And The Virtues Of Being A Patient InvestorSPHQ: An ETF Whose Holdings Pass Three "Quality" Tests

Apple: Services, Vision Pro Growth Should Offset China Sales Concerns

Disclaimer: © 2023 MoneyShow.com, LLC. All Rights Reserved.