A Use Case For 1-Day VIX?

Last week a new volatility index joined the fray when the Cboe debuted its 1-Day Volatility Index (VIX1D). At the time, some options veterans expressed skepticism about what insight it might bring to one’s understanding of trends in volatility. Part of that sentiment arose because of the difficulty in interpreting any new market measure without historic context, but some of it arose because it wasn’t evident how the new index would enlighten us beyond simply looking at the implied volatilities of options with 0-1 days until expiration. If there was ever a day when VIX1D might prove to be a useful measure, it would be on a day like today, ahead of a “known unknown” that tends to be market-moving.

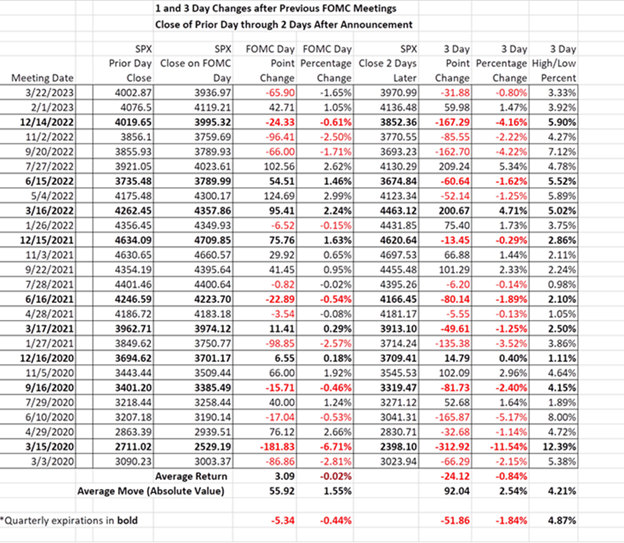

Tomorrow, at 2 PM EDT, we learn the outcome of the current FOMC meeting, with Chairman Powell’s press conference to follow shortly afterwards. As we noted yesterday, it is not unusual to see moves of 1% or more on Fed Day and the rest of the week that follows:

Source: Interactive Brokers

To be fair, when I started writing this piece shortly after today’s opening, we were looking at modest declines. Just a bit over an hour later, we are looking at substantial declines in major indices. Unusually, we see a bigger percentage move in the S&P 500 (SPX), down -1.7%, than the NASDAQ 100 (NDX), which is -1.3%. The key source of concern in today’s market is another set of declines in the banking sector, and NDX explicitly excludes financial stocks. KRE, the SPDR S&P Regional Banking ETF, is down almost 8% right now, pushed lower by double-digit percentage declines in the likes of Western Alliance Bancorp (WAL) and PacWest Bancorp (PACW). Bank worries are a bit like horror movie villains – they keep popping up even after you think it’s all clear.

The market has a fascinating tendency to shift its mood rather quickly. Today we see VIX leaping 3.4 points to 19.48 from a somnolent 16.08. The 9-day measure, VIX9D, which as we noted yesterday, comprises at least three days that tended to have high volatility, is up 4.34 points to 20.45. To put things in perspective, these are around the midrange of last year’s values, but at least we can’t call them complacent:

1 Year Chart, VIX (red/green daily bars), VIX9D (purple line)

The data gets lost on the graph above, but we see VIX1D rising most – up 6.25 pts to 16.31. It’s a fairly curious reading when we see at-money implied volatilities of roughly 26 for SPX daily options expiring tomorrow. That tells a more relevant story. Implied volatilities of 26 translate to an expected daily move of a bit more than 1.5%. Looking at the table above, it is a reasonable expectation for an FOMC day.It may be a little low, considering today’s move of greater magnitude, but that is certainly in the correct ballpark. It’s not clear that the 16 handle on VIX1D tells a useful story right now. Perhaps it might, if we get used to looking at it on a daily basis, but I’m presently unconvinced.

More By This Author:

Nowhere, Man

Traders Betting That Amazon Can Continue The Earnings Streak

We Love Our Junk Food And Are Willing To Pay Up For It

Disclosure: The analysis in this material is provided for information only and is not and should not be construed as an offer to sell or the solicitation of an offer to buy any security. To the ...

more