4 Defense Stocks Likely To Move Higher From Here

Despite substantial decreases in military spending from the highs around a decade ago, the defense budget should increase in future years. We saw defense spending get cut by around 20% from 2010 - 2016. However, the cyclical nature of defense spending implies that the current cycle recently bottomed out and could hit approximately $1 trillion by the end of the decade. It would require an average year-over-year increase of around 4% to achieve $1 trillion in military spending by 2030. While 2022's budget expenditures should rise by only 2% YoY, future spending will likely accelerate more than anticipated due to a heightened inflationary environment currently eclipsing 5%. Due to the potential rise in military expenditure in future years, well-positioned aerospace and defense contractors should prosper and experience significant share price appreciation.

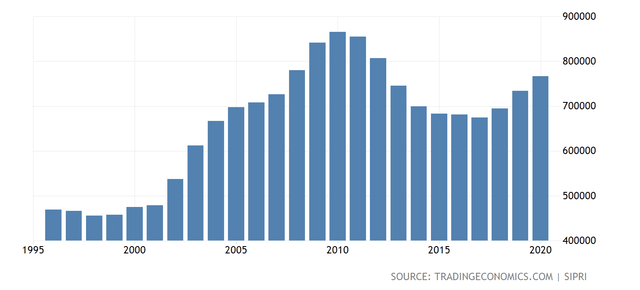

U.S. Military Spending

Source: tradingeconomics.com

While U.S. defense spending fell off from its recent all-time highs, the military budget remains much higher than in the late 1990s and the early 2000s. Moreover, defense spending is not likely going to go lower but should head higher instead.

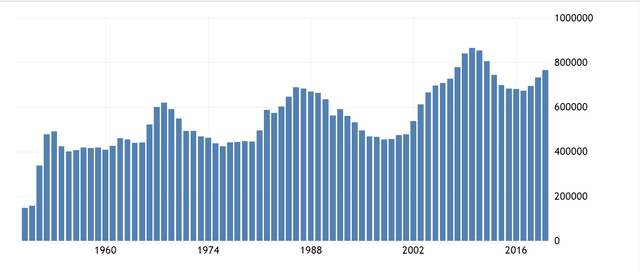

Source: tradingeconomics.com

If we take a longer-term view, defense spending moves in waves and continuously makes higher lows and higher highs. Therefore, it's highly likely that the low for the most recent cycle is in, and trillion-dollar defense spending years are probably approaching before this decade runs out.

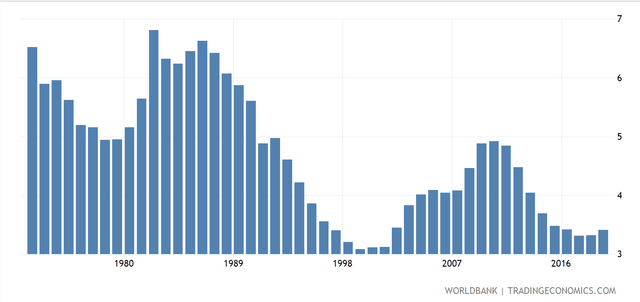

Military Expenditures as % of GDP

Source: tradingeconomics.com

Also, we see that recent military spending is far lower than during prior periods when measured as a percent of GDP. The U.S.'s current spending is only slightly above 3% of GDP. This relatively low rate is far lower than most other periods in recent history and was only marginally lower during the late 1990s and early 2000s. This dynamic implies that the U.S. could quickly return to a modestly higher percentage of GDP spending for military expenditures. The U.S. should generate roughly $25 trillion in GDP in 2023. Considering a 4% defense budget allocation, we arrive at exactly $1 trillion for defense spending.

The U.S. should allocate around $753 billion to defense spending in fiscal 2022, so spending will not surge to $1 trillion in 2023. However, we will likely continue to see increases in military spending as we advance and could see the defense budget hit $1 trillion by the end of the decade. Even if the defense budget does not increase to 4% of GDP, at just 3.3% of an estimated $30 trillion GDP by 2030, the military allocation should come out to around $1 trillion.

Four Defense Stocks to Own

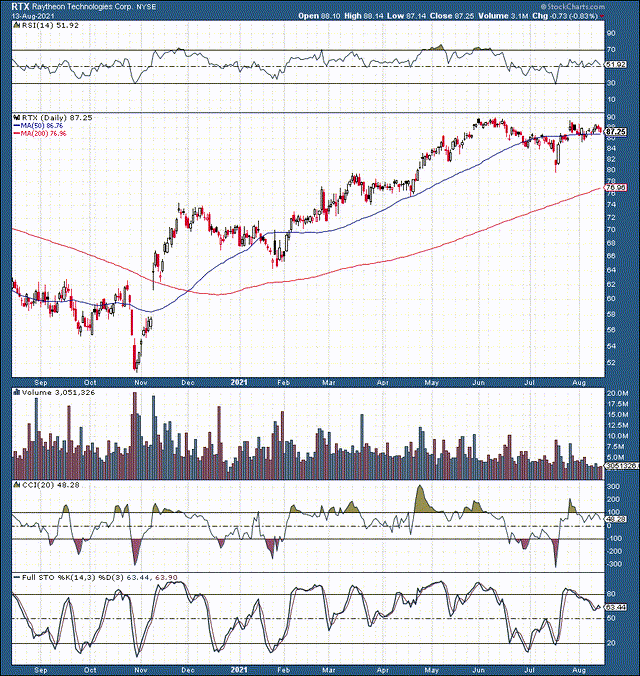

1. Raytheon (RTX) - Market Cap: $130 Billion

Source: stockcharts.com

Raytheon remains one of my favorite defense names. The company has a very diversified business portfolio and should continue to deliver growth and value for shareholders. The stock has done well over the last year, appreciating by nearly 40%. Yet, it remains relatively inexpensive as the company trades at about 17 times 2022's consensus EPS estimates. Moreover, EPS and revenue growth should continue through 2025 and beyond. Analysts anticipate the company to deliver 9% revenue growth this year. RTX also provides a dividend of around 2.4%.

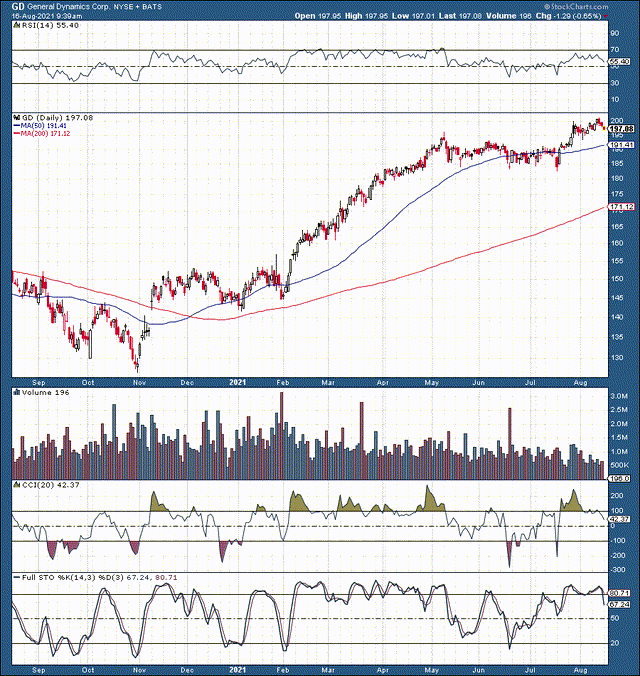

2. General Dynamics (GD) - Market Cap: $55 Billion

Source: stockcharts.com

General Dynamics is another top defense contractor that's well-positioned to expand in the future. The company makes combat vehicles, tanks, battleships, submarines, and a lot more. The stock also has done well, appreciating by about 30% over the last year. The stock trades at less than 16 times 2022's consensus estimate EPS figures. Moreover, analysts anticipate that EPS can rise to around $16 in 2025, and revenue growth should remain constant. Therefore, General Dynamics remains relatively cheap and offers a dividend of 2.4%.

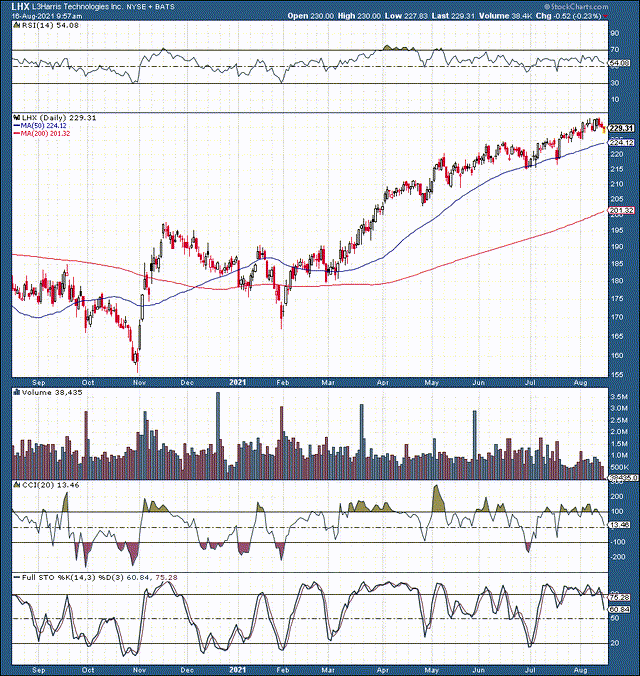

3. L3Harris Technologies (LHX) - Market Cap: $46 Billion

Source: stockcharts.com

L3Harris is another top performer in the defense sector. The company trades at about 16 times 2022's expected EPS, but analysts anticipate the company to bring in close to $23 in 2025. This trend illustrates very robust EPS growth and implies that we should continue to see the share price trend higher in this name. In addition, L3Harris provides a dividend of about 1.8%.

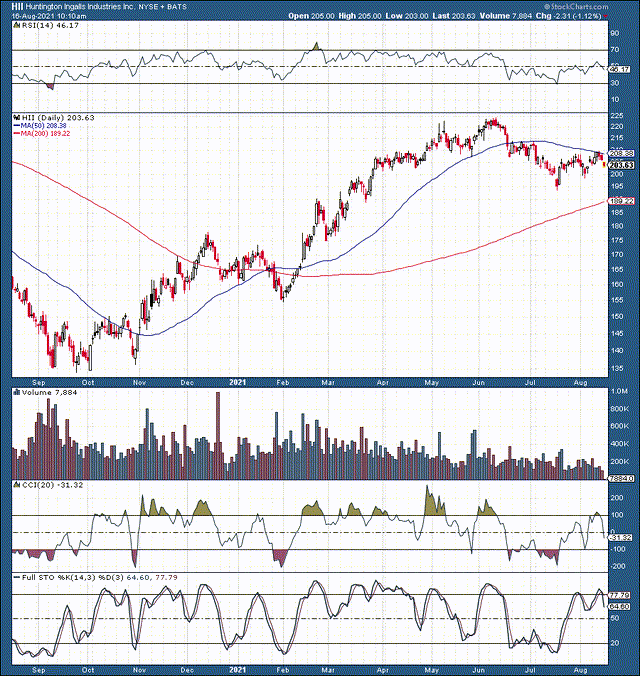

4. Huntington Ingalls (HII) Market Cap - $8.2 Billion

Source: stockcharts.com

HII designs, builds, overhauls, and repairs military ships in the U.S. Analysts expect this company to deliver $14.74 in EPS in 2022. This valuation puts the company's P/E ratio at only 13.5. Moreover, EPS projections are for about $25 in 2025. Next year HII is expected to deliver 22% in EPS growth while maintaining consistent YoY revenue growth simultaneously. In addition to robust growth and a low valuation, HII provides a 2.2% dividend.

The Bottom Line

Defense spending will increase next year, and the trend of higher defense spending should continue as we advance. Historic military expenditure trends suggest that the defense budget recently bottomed, and spending could hit $1 trillion in future years. Several key aerospace and defense companies like Raytheon, General Dynamic, L3Harris, HII, and others should continue to grow, prosper, and expand share prices in future years.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the ...

more