3 Top Biotech Stocks Worth Adding To Your Portfolio In 2024

Image: Bigstock

The environment in the biotech sector is currently upbeat after a choppy ride in 2023. New drug approvals, pipeline development, and an increase in mergers & acquisitions (M&A) activity boosted investor sentiment in the last couple of months, even though an uncertain macroeconomic environment remains an overhang.

The sector is likely to witness further consolidation as M&A activity will intensify, with the Federal Reserve’s decision to cut interest rates and pharma and biotech bigwigs' bid to diversify their portfolios in the wake of generic competition for key drugs. Companies having obesity drugs in their portfolio/pipeline and gene-editing companies hold great potential, particularly with the recent FDA approval of gene therapies.

Given the continuous need for innovative medical treatments, the biotech industry may be a haven despite its inherent volatility and an uncertain macroeconomic environment.

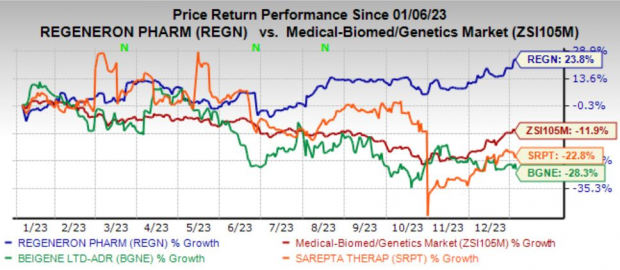

Here, we discuss three top biotech stocks that will likely perform well in 2024 on the back of a solid portfolio and a promising pipeline. These are Regeneron Pharmaceuticals (REGN - Free Report), BeiGene (BGNE - Free Report), and Sarepta Therapeutics (SRPT - Free Report).

Image Source: Zacks Investment Research

Our Picks - Regeneron

This company started 2024 on a high note after it won its lawsuit against Viatris for a proposed biosimilar copy of its lead drug, Eylea. This will likely ward off any biosimilar competition for the drug in the near future. While sales of Eylea were under pressure in 2023, the FDA approval of a higher dose of Eylea has boosted prospects.

Following its launch in late August, Eylea HD performed well, recording net product sales of $43 million in the final six weeks of the third quarter. Profits from Dupixent, for which Regeneron has collaborated with Sanofi, continued to grow. Dupixent’s uptake in the eosinophilic esophagitis indication has been strong, and its demand is also robust for the prurigo nodularis indication. Additional label expansion of the drug will boost its sales.

Regeneron is looking to solidify its presence in the lucrative oncology space. Its portfolio already includes an approved PD-1 inhibitor, Libtayo, which is approved to treat people with a type of skin cancer called cutaneous squamous cell carcinoma. Its pipeline progress has been encouraging as well.

Regeneron currently sports a Zacks Rank #1 (Strong Buy). The company's shares have gained 23.8% in the past year against the industry’s decline of 11.9%. Earnings estimates for 2024 have risen 4.4% in the past 60 days.

BeiGene

This company's Brukinsa is witnessing rapid uptake across all approved indications, including chronic lymphocytic leukemia. Sales of the drug were strong in the first nine months of 2023. The company is working to expand the drug’s label.

The Committee for Health and Medicinal Products of the European Medicines Agency gave a positive opinion for Brukinsa for the treatment of adult patients with relapsed or refractory follicular lymphoma who have received at least two prior systematic treatments.

BeiGene also regained global rights to the development, manufacture, and commercialization of Tevimbra, strengthening its global portfolio in solid tumors. The FDA accepted for review the company’s biologics license application for tislelizumab as a first-line treatment for patients with unresectable, recurrent, locally advanced, or metastatic esophageal squamous-cell carcinoma with a target action date in July 2024.

BeiGene similarly carries a Zacks Rank #1 (Strong Buy). Loss estimates for 2024 have narrowed by 24.3% over the past 60 days.

Sarepta

This company did not put up a good show in 2023, but prospects for 2024 look bright. The company’s portfolio includes Duchenne muscular dystrophy (DMD) drug Exondys 51, Vyondys 53, and Amondys 45.

The FDA approval for Elevidys — the first-ever gene therapy for the DMD indication — boosted its portfolio in 2023. The initial uptake has been encouraging. However, the mixed results of the proposed confirmatory study (EMBARK) for the full approval of Elevidys in the DMD indication were disappointing.

Nevertheless, Sarepta recently submitted the EMBARK post-marketing requirement to the FDA seeking conversion of the Elevidys accelerated approval to traditional approval. Apart from Elevidys, Sarepta is working to add new gene therapy treatments to its portfolio. It is developing gene therapy programs for Limb-girdle muscular dystrophy.

Sarepta also currently carries a Zacks Rank #1 (Strong Buy). Estimates for 2024 have improved from a loss of 98 cents to earnings of $1.72 per share in the past 90 days.

More By This Author:

Ford Sells 2M Vehicles In The US In 2023, Gains 7.1% Y/YBlackRock Stock Falls Amid Market Uptick: What Investors Need To Know

4 Stocks to Watch as Bitcoin Rally Continues Into 2024