3 Tech Stocks To Buy For High Growth

Image Source: Unsplash

Investors commonly have different preferences. Some people favor focusing on income, while others favor value.

Of course, some choose a growth-oriented strategy, concentrating on those with high expectations. It's important to remember that many growth stocks carry a higher degree of volatility, reflecting their explosive nature.

For those interested in the approach, three tech stocks – Palo Alto Networks (PANW), Smartsheet (SMAR), and Uber Technologies (UBER) – should all catch your attention.

On top of robust growth, all three sport a favorable Zacks Rank, reflecting optimism among analysts. Let’s take a closer look at each.

Palo Alto Networks

Palo Alto Networks, a current Zacks Rank #1 (Strong Buy), has benefited nicely from the AI frenzy in 2023, with shares up more than 80% YTD. Analysts have taken their earnings expectations higher across the board.

Image Source: Zacks Investment Research

The company’s forecasted growth is rock-solid, with earnings forecasted to climb 20% in its current year on 19% higher revenues. Peeking ahead to FY25, estimates allude to a further 20% earnings growth paired with an 18% sales bump.

Image Source: Zacks Investment Research

Keep an eye out for the company’s next quarterly release expected in mid-November, as the Zacks Consensus EPS Estimate of $1.16 reflects year-over-year growth of 40%, with the estimate being revised 5% higher over the last several months.

Smartsheet

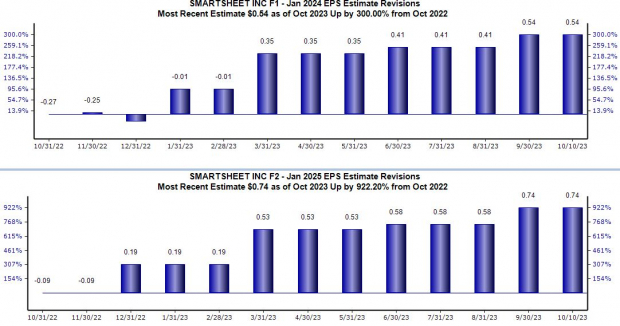

Smartsheet, a current Zacks Rank #1 (Strong Buy), offers mobile applications, pre-built templates, and integrations with cloud applications such as Box, Dropbox, Salesforce, Google Drive, and Zapier. The revision trends have been notably bullish for its current and next fiscal years, as we can see below.

Image Source: Zacks Investment Research

Growth estimates for its current fiscal year suggest a 25% bump in sales, with FY25 expectations alluding to an additional 20% improvement year-over-year. The company’s revenue growth has remained rapid, further illustrated below.

Image Source: Zacks Investment Research

And the company has consistently blown away expectations as of late, exceeding the Zacks Consensus EPS Estimate by an average of 280% across its last four releases. In its latest print, Smartsheet delivered a 100% EPS beat and posted revenue 2.7% ahead of the consensus.

Uber Technologies

Uber shares have also been big-time outperformers in 2023, up nearly 90% and crushing the general market. Like those above, the stock is a Zacks Rank #1 (Strong Buy), with the revisions trend notable for its current fiscal year, up 450% over the last year.

Image Source: Zacks Investment Research

The company’s shares have benefited from continued strong business momentum, with Uber posting record quarterly trips in four consecutive quarters. Like SMAR, Uber’s top line growth has remained solid.

Image Source: Zacks Investment Research

Regarding growth expectations, the Zacks Consensus EPS Estimate of $0.42 for its current year is nowhere near the year-ago figure of a loss, with revenue expectations of $37.4 billion 17% higher than FY22 sales of $31.9 billion.

Bottom Line

Growth investors faced a challenging environment in 2022, with many macroeconomic forces dampening the mood.

However, all three stocks above – Palo Alto Networks, Smartsheet, and Uber Technologies – have jumped back into favor in 2023, with analysts positively revising their earnings expectations.

More By This Author:

Bear Of The Day: Hormel Foods

Bull Of The Day - Palo Alto Networks

Bull Of The Day - Amazon

Disclosure: Zacks.com contains statements and statistics that have been obtained from sources believed to be reliable but are not guaranteed as to accuracy or completeness. References to any specific ...

more