Bear Of The Day: Hormel Foods

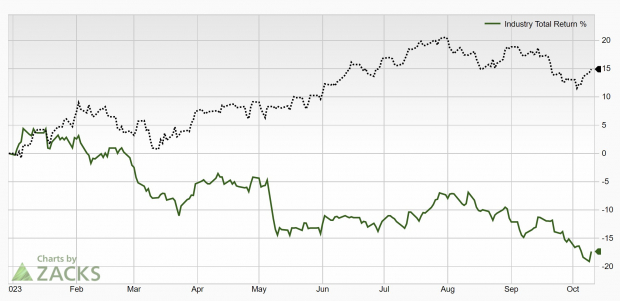

Hormel Foods (HRL) is underperforming in an industry that is already underperforming the broad market. Additionally, stiff competition in the food industry, and complications in the supply chain have put stress on both sales and earnings growth, giving the stock a Zacks Rank #5 (Strong Sell) rating.

(Click on image to enlarge)

Image Source: Zacks Investment Research

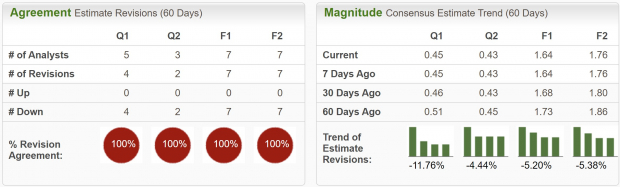

Falling Earnings Estimates

Hormel Foods is a multinational food products company headquartered in Austin, Minnesota. Well known for its meat and food brands, Hormel's product portfolio includes brands like SPAM, Skippy, and Jennie-O.

The most recent earnings report from HRL was rather disappointing. Both the top and bottom line missed analysts estimates, and although EPS were unchanged YoY, sales fell 2.3% YoY.

Continued supply chain issues have created an environment of increased complexity and higher costs. Analysts expect FY23 sales to be down -4% YoY and with higher costs cutting into margins, earnings are projected to fall nearly -10% YoY.

Analysts have unanimously downgraded earnings estimates, with the current quarter being lowered by -11.7%, FY23 by 5.2%, and FY24 decreased by -5.4%.

(Click on image to enlarge)

Image Source: Zacks Investment Research

Valuation

Hormel Foods is trading at a one year forward earnings multiple of 22.4x, which is above the market average. Additionally, although it is below its 10-year median of 23.3x, the valuation still seems a bit too rich for a company with so many headwinds.

(Click on image to enlarge)

Image Source: Zacks Investment Research

Bottom Line

With rapidly shifting food preferences from consumers, and stiff competition Hormel Foods is dealing with a challenging road ahead. Both issues are likely to cause further margin compression as they will have to compete either on price, or promotional outreach.

By no means do I think Hormel Foods is going to go the way of the dodo bird, but at this point it is definitely a stock I think investors should avoid. Until it reaches deep value territory or earnings estimates begin to trend higher, look for opportunities elsewhere.

More By This Author:

Bull Of The Day - Palo Alto NetworksBull Of The Day - Amazon

3 Top Stocks To Buy From A Booming Electronics Industry

Disclosure: Zacks.com contains statements and statistics that have been obtained from sources believed to be reliable but are not guaranteed as to accuracy or completeness. References to any specific ...

more