Bull Of The Day - Palo Alto Networks

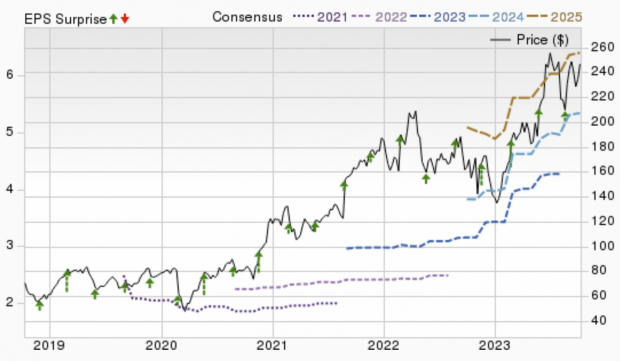

Palo Alto Networks (PANW) is a global cybersecurity company specializing in advanced firewalls and cloud-based offerings to protect enterprises from cyber threats. In addition to strong price momentum propelling the stock, PANW also enjoys a Zacks Rank #1 (Strong Buy) rating, reflecting earnings estimates that have been trending higher all year.

(Click on image to enlarge)

Image Source: Zacks Investment Research

Industry Leading Products and Growth

Palo Alto Networks continues to gain traction from consistent contract acquisitions and the growing preference for its advanced security platforms, driven by the emergence of hybrid work settings and the mission-critical demand for robust cyber security.

The company's consecutive impressive quarterly results underscore its ongoing commitment to product advancement, a transition to a subscription-centric business approach, seamless platform integration, and steady investment in sales and marketing.

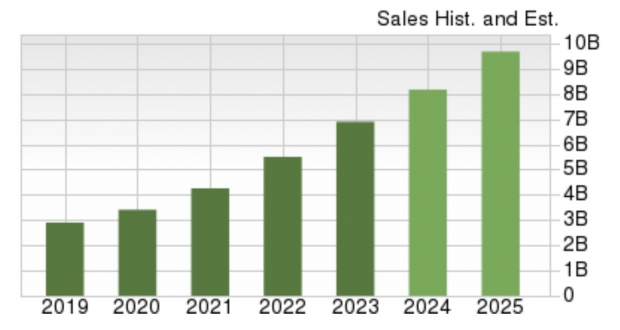

The company has grown sales at an incredible pace over the last 10 years and is expected to maintain strong continued growth. Analysts expect Palo Alto Network's revenues to expand at a CAGR of 17.5% from fiscal 2024 to 2026.

(Click on image to enlarge)

Image Source: Zacks Investment Research

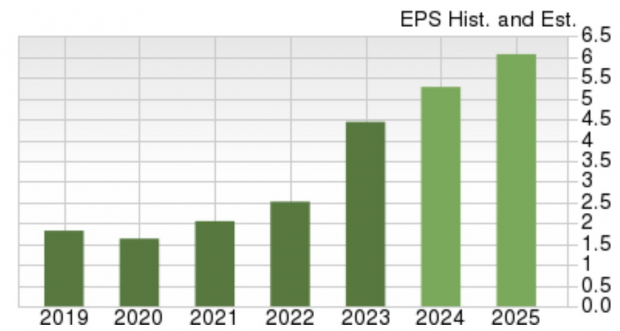

Not surprisingly, earnings are forecast to grow at a very high rate as well. Over the next 3-5 years EPS are expected to climb 28% annually. As PANW has long been a hardware focused cyber security company, the shift to cloud-based products and a subscription model has further improved the fundamentals of the business.

Gross margins for the subscription segment are estimated to be around 80% and is expected to grow even faster than the rest of the business, with a 20% CAGR through 2026.

(Click on image to enlarge)

Image Source: Zacks Investment Research

Technical Breakout

Palo Alto Networks stock has compounded at an extremely impressive 33% annually over the last ten years and has been one of the strongest stocks in the market this year, up 85% YTD.

While some traders may scoff at the idea of buying a stock that is already up so much in such a short time, momentum traders know the leading stocks often continue to be the leading stocks. And with Q4 shown to be the most bullish of the year, focusing on a leader like PANW might be a fantastic way to finish out the year.

Over the last three and a half months, PANW stock has been carving out an inverse head and shoulders chart pattern. Just this week it broke out above the key $250 level and has been moving higher since. Investors interested in the stock can look for pullbacks to get involved.

(Click on image to enlarge)

Image Source: TradingView

Bottom Line

Not only is Palo Alto Networks growing rapidly in an industry with strong secular tailwinds, but a new catalyst this year just made it even more compelling. The explosion of Generative Artificial Intelligence is going to only increase the demands of cyber security but will also improve the company’s ability to detect threats.

More By This Author:

Bull Of The Day - Amazon3 Top Stocks To Buy From A Booming Electronics Industry

Invest In These 3 Low-Beta Energy Stocks To Combat Volatility

Disclosure: Zacks.com contains statements and statistics that have been obtained from sources believed to be reliable but are not guaranteed as to accuracy or completeness. References to any specific ...

more