3 Reactions, 1 Message - This Market Setup Looks Eerily Similar To The Last 2 Analogues

Image Source: Pixabay

Find out a powerful chart setup showing the key defense level before a potential breakout to 7,000 how to take advantage of using these 2 analogues.

Watch the video from the WLGC session on 7 Oct 2025 to find out the following:

- How to use this moving average line to help confirm the trend’s strength and even predict a reversal.

- How to use the volume and magnitude to judge the current momentum.

- How to anticipate the next rally in S&P 500 based on the past 2 analogues.

- How to identify signs of strength or weakness by observing volatility during recent S&P 500 price movements?

- And a lot more…

Video Length: 00:05:25

Market Environment

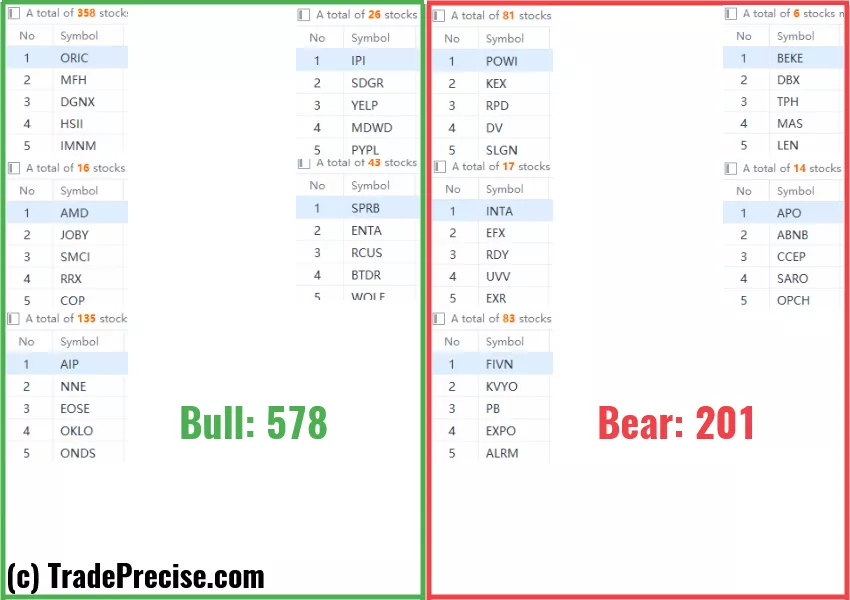

The bullish vs. bearish setup is 578 to 201 from the screenshot of my stock screener below.

(Click on image to enlarge)

3 Stocks Ready To Soar

15 actionable setups such as GLXY, RKLB, OR were discussed during the live session on 7 Oct 2025 before the market open (BMO).

(Click on image to enlarge)

(Click on image to enlarge)

(Click on image to enlarge)

More By This Author:

Gap Support Tested Twice: Is The Market Quietly Building For A Year-End Rally?

The One Signal That Could Flip It

Why One ‘Momentum Bar’ Could Decide The Fate Of The S&P 500 Rally

Disclaimer: The information in this presentation is solely for educational purpose and should not be taken as investment advice.