Why One ‘Momentum Bar’ Could Decide The Fate Of The S&P 500 Rally

Image Source: Unsplash

Find out the hidden supply-demand signals inside the S&P 500 that could decide whether the market is gearing up for a breakout or a deeper pullback.

Watch the video from the WLGC session on 16 Sep 2025 to find out the following:

- How to spot the improving market reactions and predict a high probability breakout

- How to use the volatility to interpret supply absorption and predict a breakout.

- The key zone that the S&P 500 needs to hold to sustain the rally.

- The bearish scenario all traders must know as an early warning to escape the crash.

- And a lot more…

Video Length: 00:02:46

Market Environment

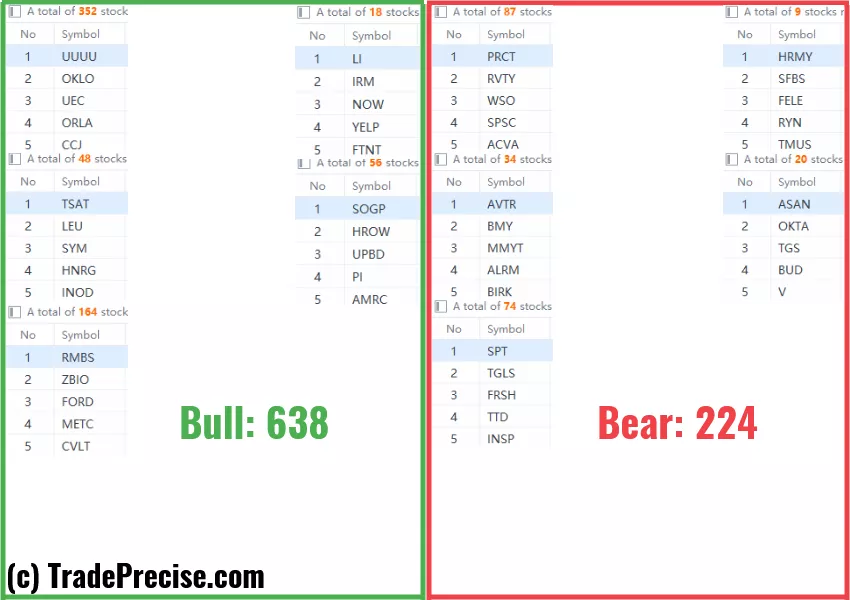

The bullish vs. bearish setup is 638 to 224 from the screenshot of my stock screener below.

3 Stocks Ready To Soar

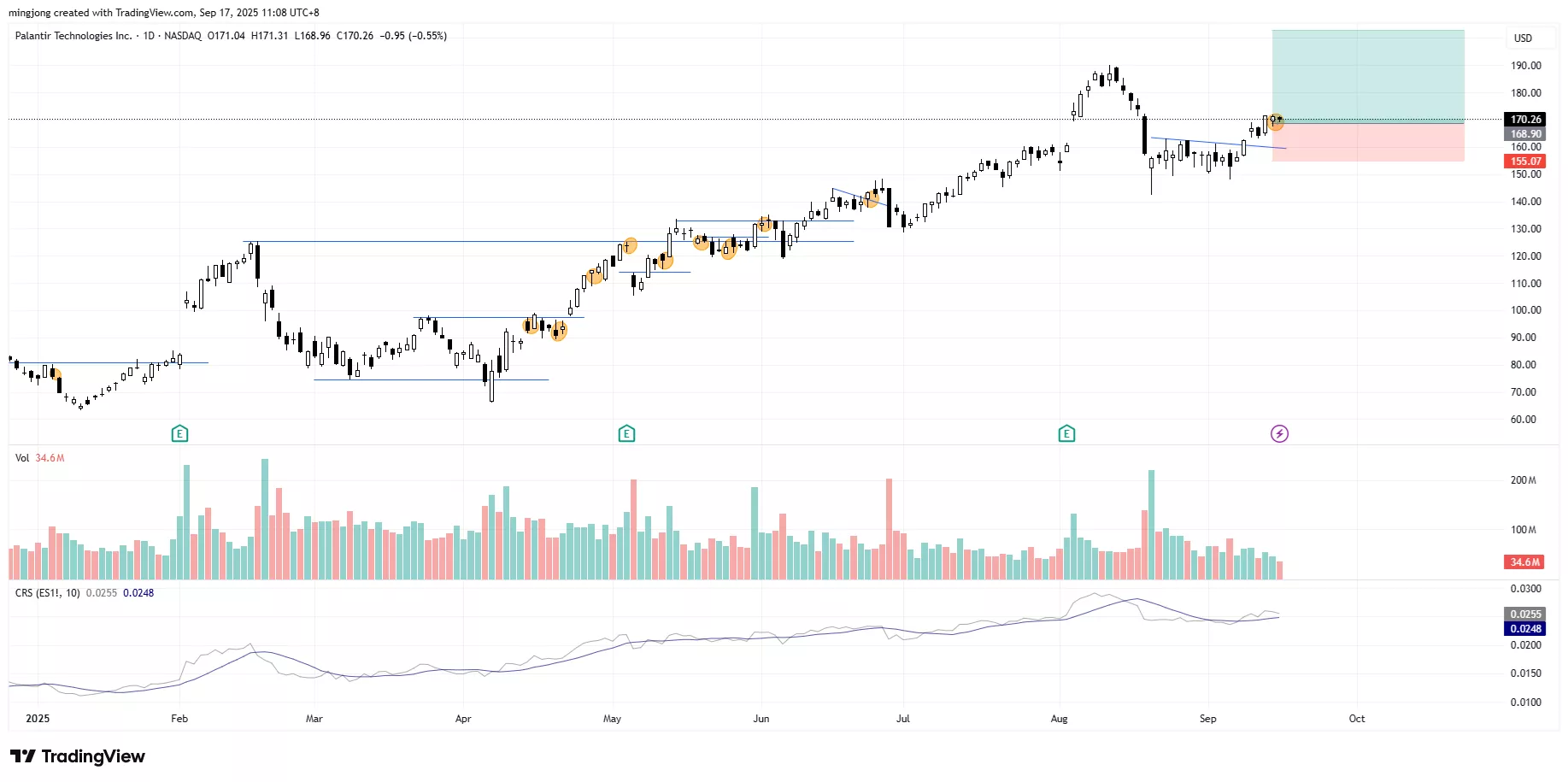

29 actionable setups such as PLTR PRM VSAT were discussed during the live session on 16 Sep 2025 before the market open (BMO).

(Click on image to enlarge)

(Click on image to enlarge)

(Click on image to enlarge)

More By This Author:

Potential Pause In Gold Futures Rally? Here's What Wyckoff Effort Vs. Results Reveals

September’s Market Curse? S&P 500 Faces Make-Or-Break Test At This Key Support

This Bullish Rotation To Russell 2000 Could Change Everything

Disclaimer: The information in this presentation is solely for educational purpose and should not be taken as investment advice.