3 Large-Cap Stocks To Buy Now And Hold Through Thick And Thin

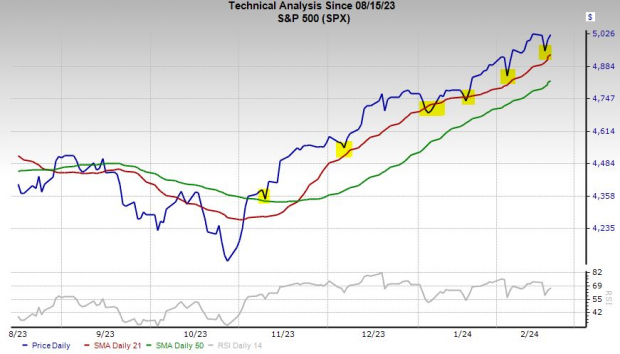

The bulls utilized the January CPI-based drop on Tuesday as an opportunity to buy up the first big dip of February. The 21-day moving average provided support again as investors clamor to buy stocks and remain heavily exposed to the market in 2024.

Some investors might be wondering how the market rebounded so quickly since Wall Street had to recalibrate its odds for when the Fed will cut rates for the second time this year.

(Click on image to enlarge)

Image Source: Zacks Investment Research

The market appears to feel that the exact timing of rate cuts and a possible delay of a few months doesn’t matter as long as the Fed does, indeed, cut at some point soon, which it is almost certain to do.

The bull case remains centered around Fed rate cuts, strong earnings growth, the AI boom, and more. And the bulls have bought up every small pullback since the market rebounded off its October lows.

Walmart (WMT) - Q4 FY24 Results on Tuesday, February 20

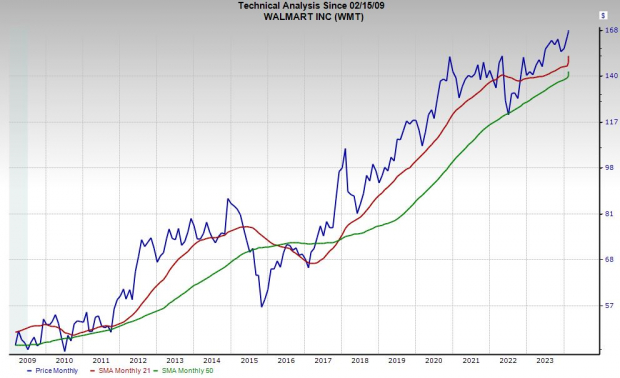

Walmart has recovered all of its losses following its post-Q3 release selloff, trading right near fresh highs heading into its earnings report. WMT is thriving in the new retail age and challenging Amazon at its own game with a subscription service dubbed Walmart+. Walmart is also growing its digital advertising business and rolling out more high-tech efforts throughout its operation.

Walmart is projected to post 5.5% same-store sales growth in the U.S. and 5.5% higher revenue to help boost its adjusted earnings by 3%, based on Zacks estimates. WMT is then set to grow its revenue by another 3% next year to reach over $666 billion and expand earnings by 8%.

(Click on image to enlarge)

Image Source: Zacks Investment Research

WMT stock has climbed 70% over the last five years vs. the retail sector’s 42%. This run includes a 9% jump in the last three months that has it trading above its 21-day moving average. Yet, it still trades 8% below its average Zacks price target and at a 10% discount to its highs at 24.1X forward 12-month earnings.

Walmart isn’t a splashy stock, but it remains a titan of the U.S. economy in good times and bad and pays a dividend.

Intuit Inc. (INTU) - Q2 FY24 Results on Thursday, February 22

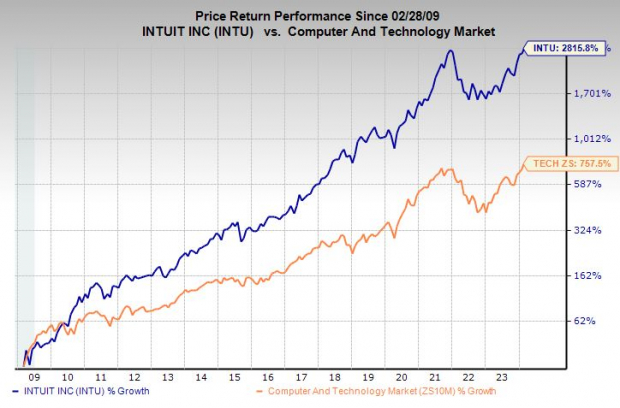

The firm behind TurboTax and other tax and accounting software utilized its pandemic boom to buy into new areas of tech and finance. Intuit’s portfolio now includes Credit Karma and Mailchimp, with various tools and software spanning from taxes and small business money management to email marketing and personal financial services.

Intuit boasts over 100 million global customers and it grew its revenue by between 11% and 32% for seven years running. Intuit’s sales are projected to climb by 12% in FY24 and another 13% in FY25 to hit $18 billion. Current Zacks estimates call for INTU to post 14% adjusted earnings growth in FY24 and FY25.

(Click on image to enlarge)

Image Source: Zacks Investment Research

Intuit shares have skyrocketed over 2,800% during the last 20 years to blow away the Zacks tech sector’s 511% and Microsoft’s 1,400%, while doubling tech over the past decade. INTU is up 62% in the last year and still trades slightly below its all-time highs. Intuit’s balance sheet is solid and 22 of the 27 brokerage recommendations Zacks has are “Strong Buys.”

Home Depot (HD) - Q4 FY23 Results on Tuesday, February 20

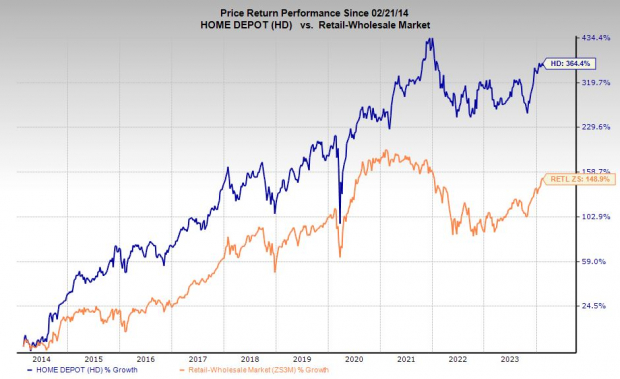

Home Depot is a dominant force in the home improvement segment that serves both do-it-yourself consumers and professionals. HD posted 20% revenue growth in FY20 and over 14% higher sales in FY21 vs. an average of around 6% in the five prior years. HD’s adjusted EPS surged by 17% and 29%, respectively.

HD grew its revenue by another 4% in 2022 to help boost its adjusted earnings by 7%, even against that impossible to compete against stretch.

Home Depot’s revenue is projected to slip by 3.5% in FY23, marking its first YoY decline since 2009, with its adjusted earnings set to dip by 10%. But Wall Street cares about what’s next and the company is projected to return to sales and earnings growth in FY24.

(Click on image to enlarge)

Image Source: Zacks Investment Research

Home Depot’s long-term outlook remains intact based on an array of tailwinds. Home Depot’s dividend yields 2.3% at the moment and it has raised its payout by 13% on an annualized basis over the past five years. HD shares have soared by over 1,600% in the last 15 years vs. its Zacks Econ Sector’s 600% and the S&P 500’s 580%. HD is up 17% in the last three months, yet it still trades 14% below its peaks.

More By This Author:

3 Top Tech Stocks to Buy Now Outside The Magnificent 7Bear Of The Day: Columbia Sportswear Company

3 Magnificent 7 Tech Stocks To Buy And Hold Forever

Disclaimer: Neither Zacks Investment Research, Inc. nor its Information Providers can guarantee the accuracy, completeness, timeliness, or correct sequencing of any of the Information on the Web ...

more