3 Magnificent 7 Tech Stocks To Buy And Hold Forever

The S&P 500 is trading near its new all-time highs heading into the most highly-anticipated week of corporate earnings that features reports from Microsoft, Meta, Apple, Amazon, Alphabet, and other giants.

Netflix, United Rentals, and American Airlines all surged following their financial releases, highlighting the ongoing strength of U.S. consumers and the wider economy.

Tesla was one of the standout underperformers thus far. But Wall Street might start to nibble at the EV giant sooner than later considering the oversold levels it is trading at.

There is no telling how Wall Street will react to the wave of Magnificent 7 reports next week. On top of that, there is little doubt that these big tech names and the broader market will face selling pressure and pull back down to key moving averages at some point again because that is always the case even in strong bull markets.

But the last several years have showcased how tricky the market timing game can be and why investors might want to adopt buy-and-hold mentalities. On top of that, owning some of these mega-cap tech giants is likely savvy investing even if it seems far too easy.

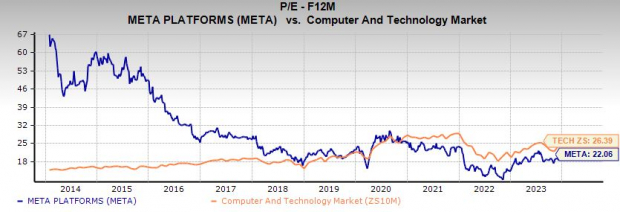

Meta Platforms, Inc. (META) shares are trading at new all-time highs ahead of its Q4 earnings release on February 1, skyrocketing 160% in the last year. Yet, Meta trades at a 16% discount to the Zacks tech sector, 10% below its 10-year median, and nearly 70% below its highs at 22.1X forward 12-month earnings.

The stock might be a little overheated, but it is still trading above all of its key short-term and longer-term moving averages.

(Click on image to enlarge)

Image Source: Zacks Investment Research

The parent company of Facebook, Instagram, and WhatsApp grew its daily active user (people) base by 7% last quarter to 3.14 billion, while its monthly active users popped 7% to 3.96 billion, reaching half of the global population.

Meta’s various apps serve different pockets of social media and digital communication, and the firm stands to benefit from ongoing ad spending in a world of smartphone addicts. Meta is also investing in its AI future and it could still be a long-term winner if the metaverse dream becomes a reality.

(Click on image to enlarge)

Image Source: Zacks Investment Research

In the here and now, Meta is poised to churn out profits as it focuses on steady expansion and efficiency. Meta is projected to grow its adjusted earnings by 46% in FY23 and another 23% in FY24 on the back of 15% and 14%, respective revenue growth. Meta’s positive earnings revisions activity helps it land a Zacks Rank #2 (Buy) right now.

Amazon (AMZN) is focused on efficiency and profitability these days and is set to report on February 1. AMZN is attempting to improve AWS cloud computing margins by rolling out more in-house chips, while also working with Nvidia.

On the e-commerce front, Amazon is boosting profitability through a different fulfillment network structure. AMZN is also growing its digital advertising unit and attempting to attract more Prime subscribers via different streaming offerings and other perks.

(Click on image to enlarge)

Image Source: Zacks Investment Research

Amazon’s earnings outlook has improved to help it land a Zacks Rank #2 (Buy) right now. Zacks estimates call for the company to grow its adjusted earnings by 280% in FY23 from $0.71 per share to $2.70 and then expand another 36% in FY24. Meanwhile, AMZN is poised to grow its revenue by 11% and 12%, respectively during this stretch to climb from $514 billion last year to $637 billion in 2024.

(Click on image to enlarge)

Image Source: Zacks Investment Research

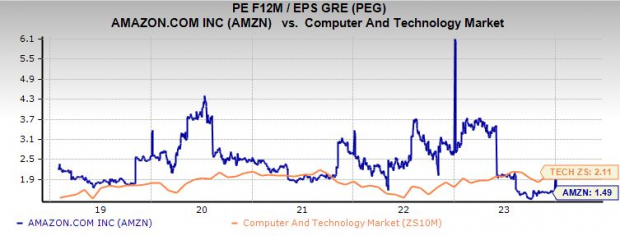

Amazon stock has soared 785% in the last decade to blow away the Zacks Tech sector’s 280%. Despite this run, Amazon is down 2% in the last three years vs. the Zacks Tech sector’s 27% climb and it trades around 15% below its all-time highs.

Amazon’s forward earnings multiple remains rather high. But its focus on bottom-line growth has it looking lightyears better than it was. Amazon’s PEG ratio might also suggest its P/E ratio will continue to come down.

Apple (AAPL), like all of the stocks on the list today doesn’t need an introduction and it reports earnings (Q1 FY24) on February 1.

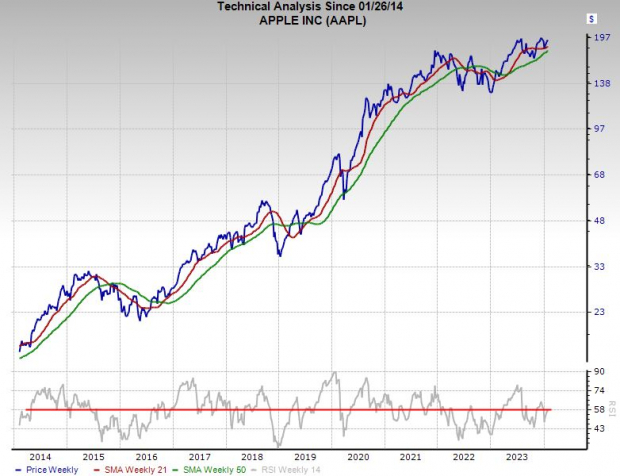

AAPL stock closed out 2023 on a downbeat note after hitting all-time highs as Wall Street worried about slowing growth in China, a saturated high-end smartphone market, possible legal setbacks, and more. Apple’s revenue did fall by 2.8% last year, but that is rather common given its somewhat cyclical iPhone-heavy business. And the stock is already bouncing back.

(Click on image to enlarge)

Image Source: Zacks Investment Research

Even in a 'down year' Apple sold $200 billion worth of iPhones in FY23 vs. $142 billion in FY19. Plus, CEO Tim Cook has helped turn its iPhones, Macs, and more, which have amassed an installed base of “over 2 billion active devices,” into a separate growth engine via services-focused subscriptions.

The biggest growth segment at the company includes the App Store, streaming TV, and more. AAPL has nearly doubled the number of paid subscriptions it had three years ago to over 1 billion.

(Click on image to enlarge)

Image Source: Zacks Investment Research

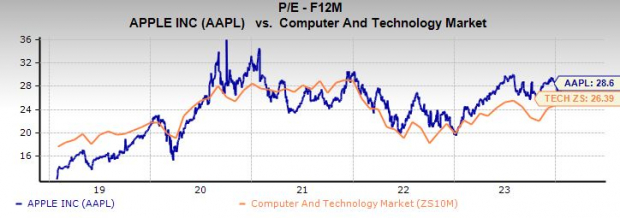

Apple’s revenue is projected to climb by 3% in FY23 and then jump 6% higher in FY25 to boost its adjusted earnings by 8% and 9%, respectively. Apple trades above all of its key short-term and long-term moving averages and it is trading near neutral RSI levels.

Meanwhile, Apple trades at a roughly 20% discount to its five-year highs at 28.6X forward 12-month earnings and not too far above its median and Tech.

More By This Author:

Bear Of The Day: Cenovus Energy Inc.3 Great Stocks From Key Industries To Buy And Hold

Bull of the Day: Casey's General Stores, Inc.

Disclaimer: Neither Zacks Investment Research, Inc. nor its Information Providers can guarantee the accuracy, completeness, timeliness, or correct sequencing of any of the Information on the Web ...

more