3 Top Tech Stocks To Buy Now Outside The Magnificent 7

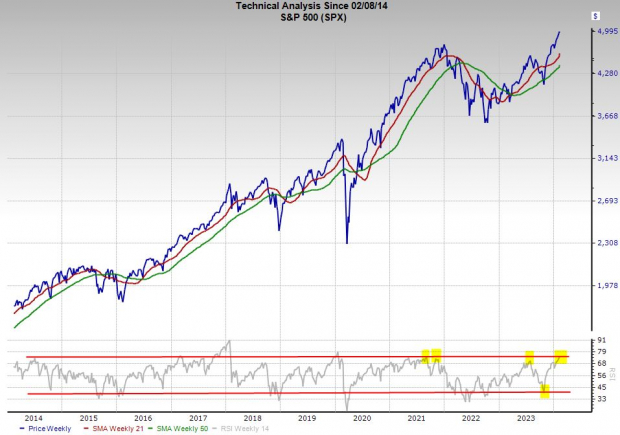

The S&P 500 touched 5,000 for the first time on Thursday with quarterly results and guidance already out from six of the Magnificent 7 tech stocks. The market has remained mostly bullish as the overall Q4 earnings picture for the S&P 500 has improved significantly over the last month. Better yet, the outlook for 2024 has remained robust and hardly signals a recession is on the horizon.

There are still tons of earnings reports to come, including from Nvidia (NVDA) and the three big tech names we dive into today. But Wall Street is now likely more concerned about upcoming guidance from Walmart, Target, and other retailers, as well as January inflation data due out on February 13 since enough large-cap tech names have already provided their all-clear signal.

(Click on image to enlarge)

Image Source: Zacks Investment Research

That said, stocks and indexes never go straight up and there will almost certainly be a pullback to key shorter-term and longer-term moving averages in the coming weeks since things are looking a bit frothy.

Investors with long-term outlooks should take advantage of any downturns and dips to scoop up their favorite stocks at slightly better prices, while also not being afraid to buy at near-term highs—because strong stocks keep breaking records over the long haul.

Arista Networks (ANET) - Q4 Financial Results on Monday, February 12

Arista Networks is a networking infrastructure provider and a leader in data-driven, client-to-cloud networking for large data centers, campus and routing environments. ANET has accumulated over 8,000+ cloud customers worldwide, including Microsoft, Meta, and other giants.

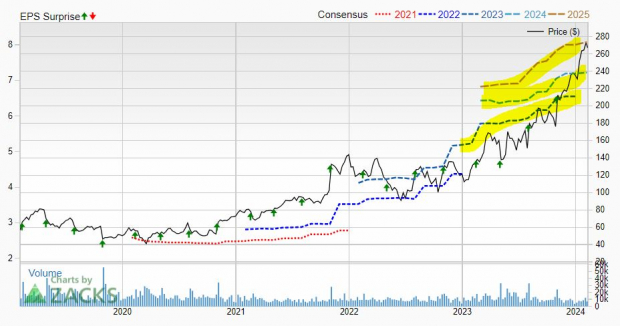

ANET is projected to grow its sales by 34% in FY23 and 12% next year to climb from $4.4 billion in FY22 to $6.5 billion in FY24. This expected top-line growth follows 23% average revenue expansion over the past five years. Arista’s adjusted EPS are projected to soar 43% in FY23 and 10% higher in FY24. ANET’s upbeat revisions help it grab a Zacks Rank #1 (Strong Buy) right now and it has topped our estimates by an average of 12% in the last four quarters.

(Click on image to enlarge)

Image Source: Zacks Investment Research

ANET stock has skyrocketed 1,900% during the last 10 years to blow away the Zacks Tech sector’s 275%. This outperformance includes a 100% surge over the past 12 months and it hit new highs on Thursday. Arista Networks might be a bit overheated right now. But Arista Networks has a sturdy balance sheet and Wall Street is high on the stock.

Cadence Design Systems (CDNS) - Q4 Financial Results on Monday, February 12

Cadence Design Systems is a titan of the electronic systems design space. The company’s modeling and computational software helps design semiconductors and other vital technologies, helping “turn design concepts into reality.” Cadence boasts Nvidia as a key customer because the GPU and AI chip powerhouse loves its simulation capabilities.

Cadence is one of two major players in this key industry that might grow in importance as chips get smaller. Investors can therefore view Cadence as both a chip and an AI investment. Cadence is projected to post 15% revenue growth in FY23 and 11% higher sales in FY24, following 15% averages sales growth in the past three years. CDNS is expected to post 20% adjusted earnings growth in FY23 and 14% higher in FY24, and its positive EPS revisions help it land a Zacks Rank #2 (Buy) heading into its Q4 release.

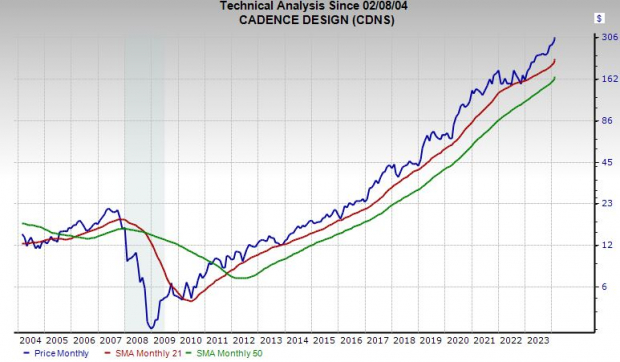

(Click on image to enlarge)

Image Source: Zacks Investment Research

Candence stock is up nearly 2,000% in the last 10 years vs tech’s 275% and 500% in the last five years. CDNS is up 13% YTD and trading at new records. The stock is far from a value play, but its valuation levels are improving and Wall Street has been paying up for the stock for years.

Shopify (SHOP) - Q4 Financial Results on Tuesday, February 13

Shopify has been at the cutting edge of e-commerce for nearly two decades, helping companies, small businesses, entrepreneurs, and others with everything from site design and sales to marketing, payments, shipping, and more. Shopify makes money from recurring subscription fees and various add-ons.

Shopify’s days of 60% growth are over, but it started to make up for slowing expansion by raising its prices in 2023 for the first time in over a decade. Shopify’s sales climbed 21% in FY22 and its revenue is projected to jump 25% higher in FY23 and another 19% in 2024 to hit $8.32 billion vs. $5.60 billion in FY22.

(Click on image to enlarge)

Image Source: Zacks Investment Research

Shopify, like all of the former growth at-all-cost tech firms, is now committed to profits. Its adjusted earnings are projected to climb from $0.04 a share last year to $0.70 in 2023 and then surge another 50% in FY24 to $1.04 a share. Shopify’s upward earnings revisions help it capture that Zacks Rank #1 (Strong Buy).

SHOP shares have skyrocketed 230% off their October 2022 lows, including a 75% run during the past year. Despite the comeback, Shopify still trades roughly 50% below its all-time highs and its 2022 stock split has it at around $88 per share. Plus, SHOP’s balance sheet is stellar.

More By This Author:

Bear Of The Day: Columbia Sportswear Company

3 Magnificent 7 Tech Stocks To Buy And Hold Forever

Bear Of The Day: Cenovus Energy Inc.

Disclaimer: Neither Zacks Investment Research, Inc. nor its Information Providers can guarantee the accuracy, completeness, timeliness, or correct sequencing of any of the Information on the Web ...

more